ASX: UNIBAIL RODAMCO WESTFIELD – URW Elliott Wave Analysis TradingLounge

Greetings! This updated Elliott Wave analysis explores the trends of the Australian Stock Exchange (ASX), focusing on UNIBAIL RODAMCO WESTFIELD (ASX: URW). Our insights indicate that ASX: URW is positioned to continue its upward trajectory.

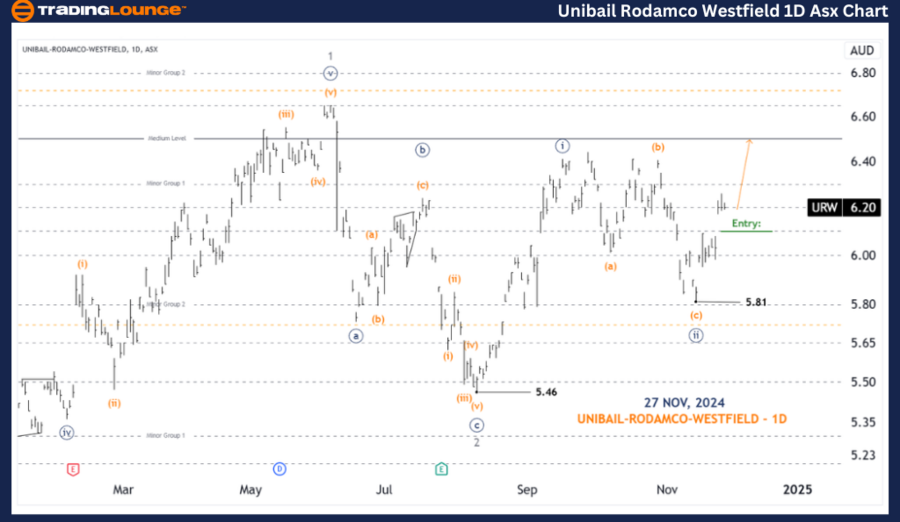

ASX: UNIBAIL RODAMCO WESTFIELD – URW 1D Chart (Semilog Scale) Analysis

URW Elliott Wave Technical Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 3-grey

Details:

Wave ((iii))-navy is progressing upward, targeting the next resistance at 6.50. A further price increase would confirm this wave structure, reinforcing our bullish outlook.

Invalidation point: 5.81

ASX: UNIBAIL RODAMCO WESTFIELD – URW 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave iii-grey of Wave ((iii))-navy

Details:

Wave ((ii))-navy concluded as a Flat correction marked as (a)(b)(c)-orange, with a low at 5.81. Wave ((iii))-navy is now extending upward, with its subwaves i-grey and ii-grey completed. This suggests that wave iii-grey is set to advance further, potentially supporting higher price levels.

Invalidation point: 5.81

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SANTOS LIMITED - STO Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: UNIBAIL-RODAMCO-WESTFIELD (URW) highlights both contextual trends and short-term projections, aiming to guide readers in recognizing actionable trading opportunities. Validation and invalidation levels are clearly defined, with 6.50 as a key target for upward movement and 5.81 acting as a critical invalidation point. This structured approach ensures an objective and professional view of the market, empowering traders to align their strategies effectively.