Iron Ore Elliott Wave Technical Analysis

Iron Ore Elliott Wave Analysis

The SGX TSI Iron Ore Index plays a pivotal role as a benchmark for iron ore market participants, including traders, miners, and steelmakers. It is heavily relied upon for contract settlements and risk management. This index, derived from real-time spot market transactions, is recognized for accurately reflecting market conditions.

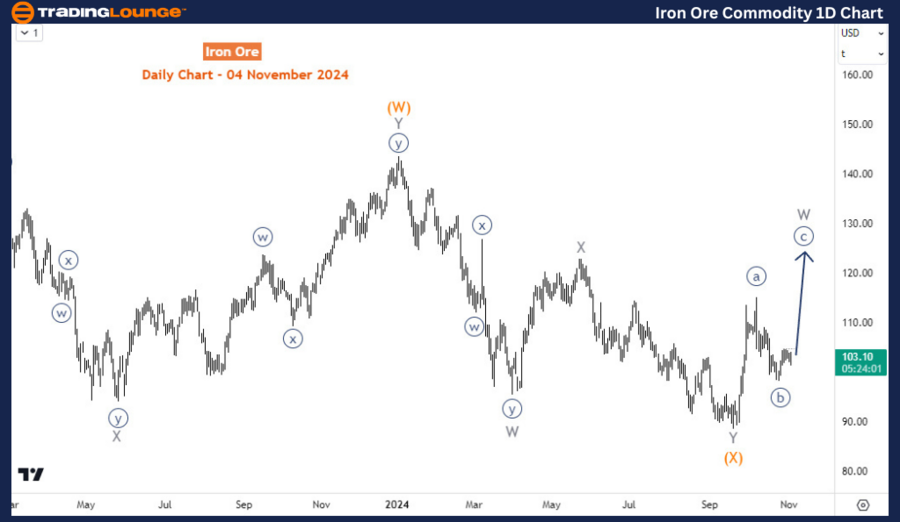

In May 2021, the index reached an all-time high of roughly $233 per dry metric ton, driven largely by China’s strong demand and supply-side disruptions. However, this peak led to a substantial correction, causing the index to plummet over 68% to $73 by October 2022. A notable rebound followed, lifting the index to $143.5 by December 2023. In 2024, though, this recovery lost momentum, with the index experiencing another decline of nearly 50% before showing renewed signs of growth in September.

Elliott Wave Perspective

From an Elliott wave analysis, the daily chart illustrates a multi-phase correction beginning from the peak in May 2021. The initial drop completed wave ((W)) of the primary degree, reaching its lowest point at $73.6 in October 2022. This was followed by a bullish zigzag pattern, which concluded in January 2024, before resuming a corrective downtrend. This downward movement appears corrective rather than impulsive, hinting at potential for further upside as the second phase develops, with an anticipated higher target in wave (Y) of X (circled).

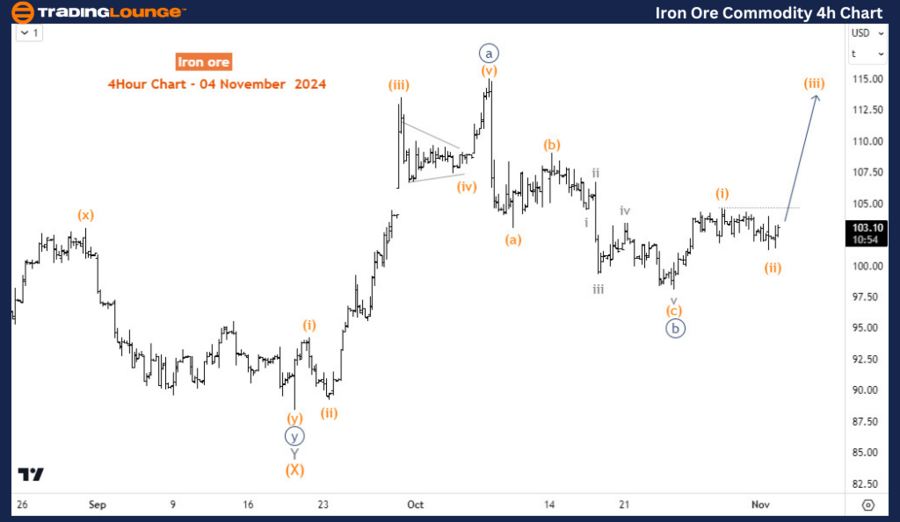

Iron Ore Elliott Wave Analysis: H4 chart

On the H4 chart, we see a closer view of the recovery from September's low, forming a 5-wave impulse structure. Currently, the index is undergoing a 3-wave corrective pullback, labeled as waves ((a)) of ((b)) of W of ((Y)). As long as this pullback stays above the September low, the outlook remains positive for a continuation of the upward trend.

Summary and Trading Outlook

In summary, the SGX TSI Iron Ore Index has experienced a complex correction, but the Elliott wave structure supports a medium-term bullish continuation. Traders might consider a completed pullback as a potential entry signal for wave (Y), with targets set above recent lows.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Natural Gas Commodity Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support