ASX: WOODSIDE ENERGY GROUP LTD (WDS) - Elliott Wave Technical Analysis

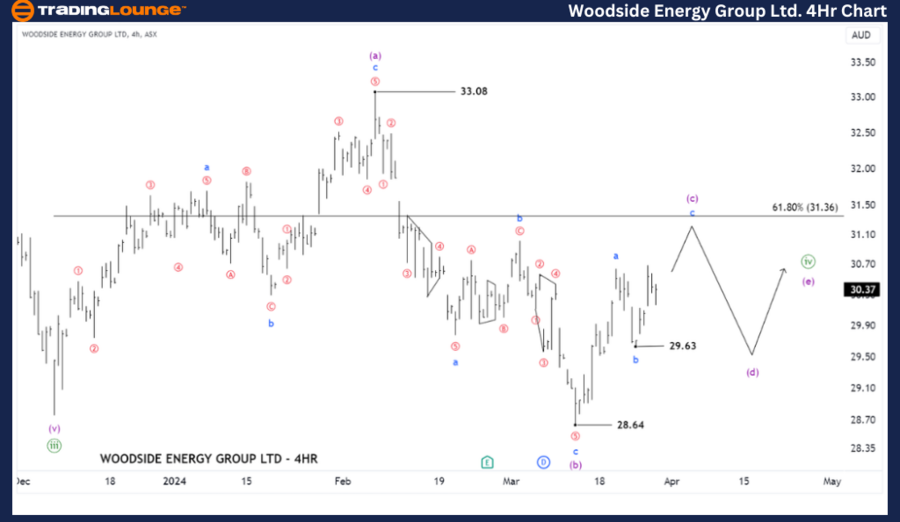

ASX: WOODSIDE ENERGY GROUP LTD - WDS Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with WOODSIDE ENERGY GROUP LTD - WDS. We ascertain that wave ((iv))-green is evolving as a Triangle Correction, and its wave (c)-purple may continue to rise a bit further. And after the entire Triangle Correction concludes with wave ((iv)), wave ((v))-green will return to push lower.

ASX: WOODSIDE ENERGY GROUP LTD - WDS Elliott Wave Technical Analysis

ASX: WOODSIDE ENERGY GROUP LTD - WDS 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minute degree, green)

Mode: Motive

Structure: Impulse

Position: Wave ((iv))-green

Details: The short-term outlook suggests that wave ((iv))-green has been initiated, with expectations of it forming a corrective Triangle pattern. Therefore, it can be inferred that wave ((iv)) will likely continue to move sideways for some time before wave ((v))-green resumes to push lower.

Invalidation point: 33.08

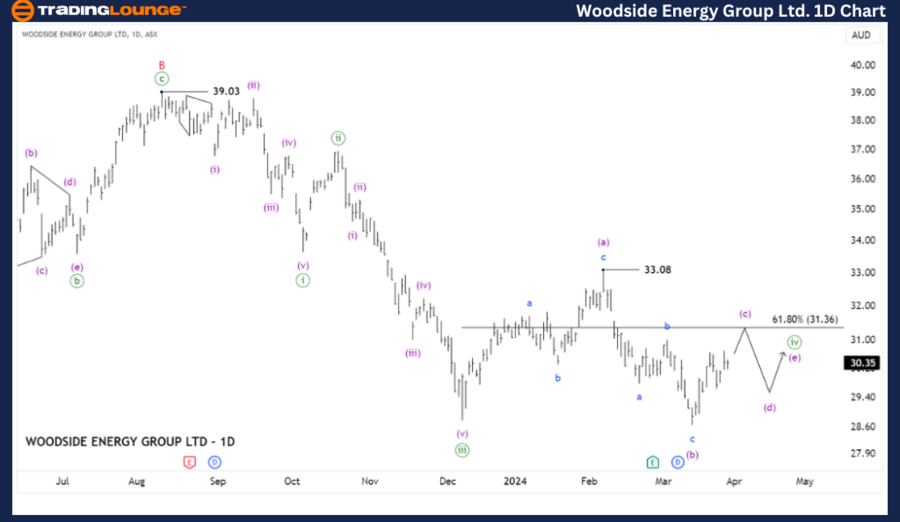

ASX: WOODSIDE ENERGY GROUP LTD - WDS Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: WOODSIDE ENERGY GROUP LTD - WDS Elliott Wave Technical Analysis

ASX: WOODSIDE ENERGY GROUP LTD - WDS 4-Hour Chart Analysis

Function: Counter trend (Minuette degree, purple)

Mode: Corrective

Structure: Triangle

Position: Wave (c)-purple

Details: The shorter-term outlook further describes the detailed subdivisions of wave ((iv))-green as a Triangle Correction. Waves (a) and (b)-purple have been completed, and now wave (c)-purple is unfolding. Typically, wave (c) exhibits a common retracement ratio compared to wave (a) within a Triangle Correction, and the target for this ratio is around 31.36. Therefore, we can expect wave (c) to rise to test that resistance level.

Invalidation point: 33.08

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: FORTESCUE LTD – FMG aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: FORTESCUE LTD – FMG

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.