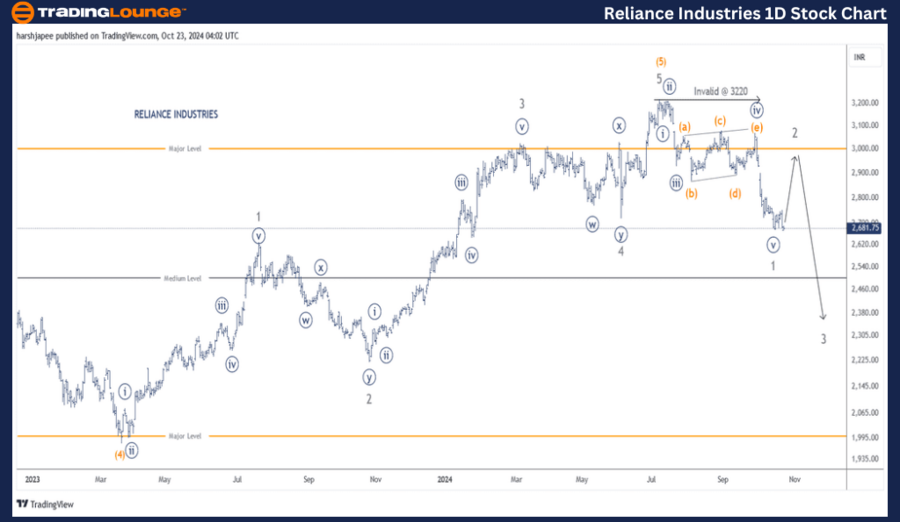

TradingLounge – RELIANCE Elliott Wave Analysis (1D Chart)

Reliance Industries Daily Chart Technical Analysis

RELIANCE Elliott Wave Technical Analysis

Function: Corrective Lower (Intermediate degree, orange)

Mode: Corrective

Structure: Zigzag

Position: Minor Wave 1 (Grey)

Details: Minor Wave 1 (Grey) is potentially still unfolding, with prices breaking below the 2650 mark. A counter-trend rally is expected to unfold as Minor Wave 2 (Grey) soon, likely pushing towards the 2900-2950 zone, before prices turn lower again.

Invalidation Point: 3220

Reliance Industries Potential Elliott Wave Counts

The daily chart for Reliance Industries shows that a progressive rally has likely terminated around the 3220 high, marked as Intermediate Wave (5) Orange. The decline towards 2650 has unfolded impulsively, suggesting more downside ahead.

Additionally, the price has broken below 2720, which corresponds to the previous Wave 4 (Grey) of a lower degree. Ideally, a pullback is expected before the downtrend resumes. In March 2023, Intermediate Wave (4) had concluded around the 1980 level.

Since then, a five-wave rally reached the 3220 high, identified as Intermediate Wave (5). The subsequent drop to the 2650 level indicates the termination of Minor Wave 1 (Grey). If these Elliott Wave counts remain valid, a rally in Wave 2 is expected to unfold soon.

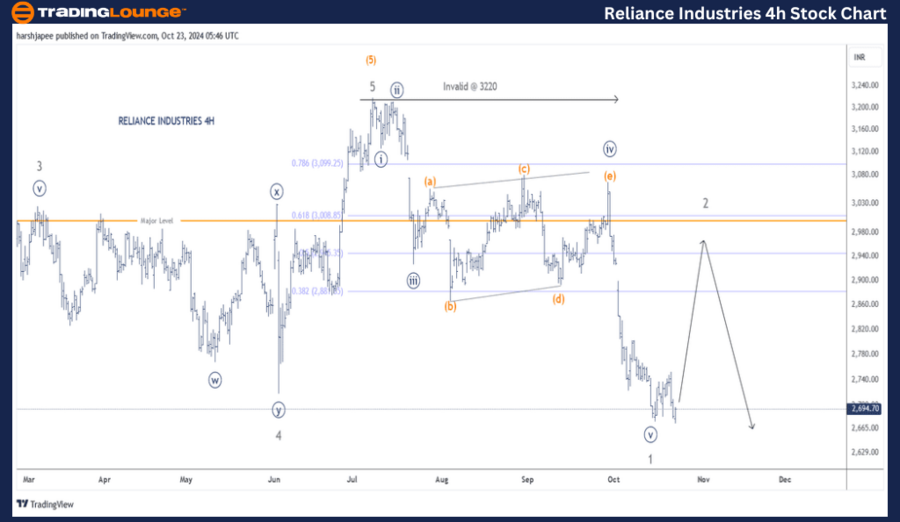

Reliance Industries Elliott Wave Analysis - TradingLounge (4H Chart)

RELIANCE Stock Technical Analysis

Function: Corrective Lower (Intermediate degree, orange)

Mode: Corrective

Structure: Zigzag

Position: Minor Wave 1 (Grey)

Details: Minor Wave 1 (Grey) appears to still be unfolding, with prices breaking below the 2650 mark. A counter-trend rally is expected to develop in Minor Wave 2 (Grey), potentially heading towards the 2900-2950 zone, before the downtrend resumes with Minor Wave 3 (Grey).

Invalidation Point: 3220

Reliance Industries 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4-hour chart for Reliance Industries highlights the sub-waves within Minor Wave 3 (Grey) of the larger degree uptrend. The stock rallied up to the 3220 level, terminating Wave 5 (Grey) before possibly reversing the trend. Bears have carved out an impulsive move lower at the Minute degree around 2650, ending Minor Wave 1 (Grey). If this count is correct, expect Wave 2 to unfold as an expanded flat, potentially reaching 2900 in the near term.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HINDUSTAN UNILEVER Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Reliance Industries appears to have turned lower after printing a high of 3220 in July 2024. The stock has completed Minor Wave 1 lower around the 2650 mark and is likely unfolding Minor Wave 2 now.