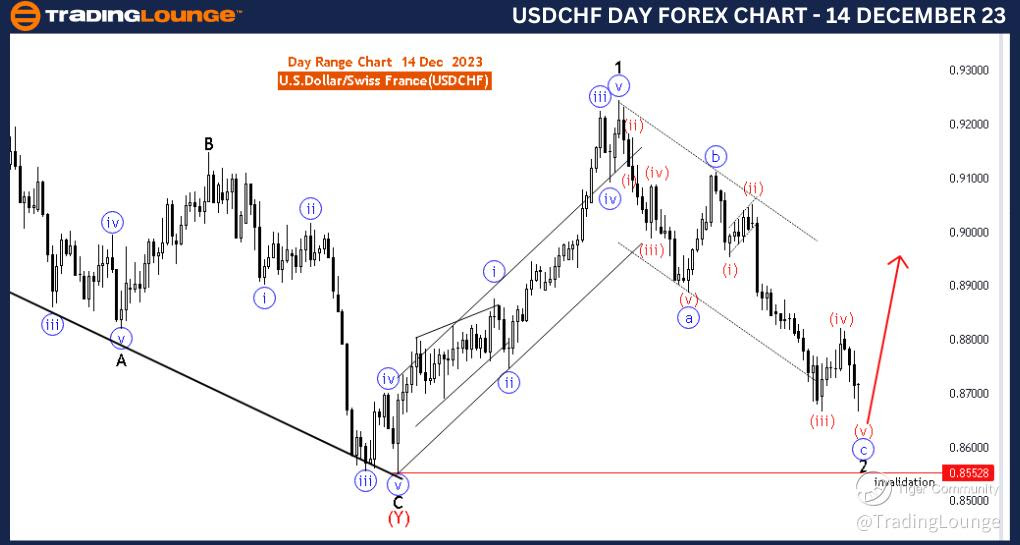

USDCHF Elliott Wave Analysis Trading Lounge 4 Hour Chart, 14 December 23

U.S.Dollar/Swiss Franc(USDCHF) 4 Hour Chart

USDCHF Elliott Wave Technical Analysis

Function: Counter Trend

Mode: impulsive as blue wave C

Structure: Red wave 5 of blue wave C

Position: Black wave 2

Direction Next Higher Degrees: Black wave 3

Details: red wave 5 blue wave C is in play and looking near to end. Wave Cancel invalid level: 0.85528

The "USDCHF Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 14 December 23, provides a comprehensive analysis of the U.S. Dollar/Swiss Franc (USDCHF) currency pair, focusing on the 4-hour timeframe and utilizing Elliott Wave principles to discern potential market movements.

The identified "Function" is "Counter Trend," signaling that the analysis aims to recognize potential reversals or corrections against the prevailing market trend. This is valuable information for traders looking to capitalize on counter trend opportunities.

The described "Mode" is "impulsive as blue wave C," suggesting that the current phase is marked by strong and decisive price movements, particularly within the context of a corrective wave labeled as "blue wave C." Recognizing the impulsive nature provides insights into the strength of the corrective movement.

The primary "Structure" involves "Red wave 5 of blue wave C," specifying the position of the current wave within the broader Elliott Wave framework. Understanding the hierarchical structure assists traders in assessing the potential magnitude and direction of the ongoing price movement.

The specified "Position" is labeled as "Black wave 2," indicating the current wave's position within the larger Elliott Wave structure. This information is crucial for traders to understand the context of the market movement and make informed decisions.

In terms of "Direction Next Higher Degrees," the projection is "Black wave 3," suggesting the anticipated next impulsive wave within the broader Elliott Wave structure. Traders can use this information to anticipate potential future market movements in the upward direction.

The "Details" section highlights that "red wave 5 blue wave C is in play and looking near to end." This suggests that the ongoing impulsive wave within the corrective structure is approaching completion. Traders can use this information to prepare for potential shifts in market dynamics.

The "Wave Cancel invalid level" is identified as "0.85528." This level serves as a critical point at which the current wave count would be invalidated, prompting a reassessment of the prevailing market conditions.

In summary, the USDCHF Elliott Wave Analysis for the 4-hour chart on 14 December 23, suggests a counter trend impulsive phase labeled as "Red wave 5 of blue wave C," with insights into the internal wave structure and the anticipated next impulsive wave, "Black wave 3." The completion of red wave 5 indicates the potential end of the current impulsive movement within the corrective structure. Traders should be attentive to the specified invalidation level for a comprehensive analysis of market conditions.

Technical Analyst : Malik Awais

Source : Tradinglounge.com get trial here!

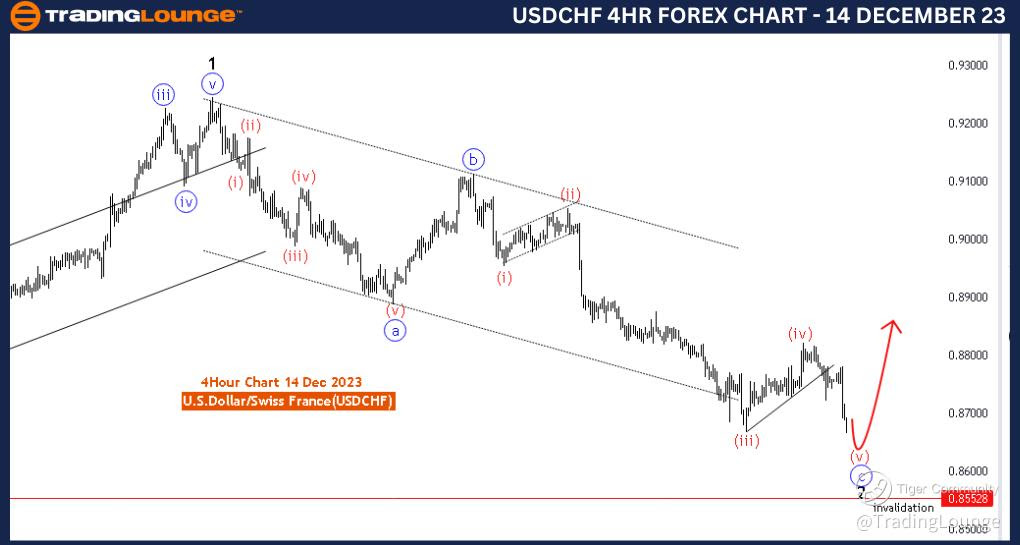

USDCHF Elliott Wave Analysis TradingLounge Day Chart, 14 December 23

U.S.Dollar/Swiss Franc(USDCHF) Day Chart

USDCHF Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Red wave 5 of blue wave C

Position: Black wave 2

Direction Next Higher Degrees: Black wave 3

Details: red wave 5 blue wave C is in play and looking near to end . After that a new uptrend will start . Wave Cancel invalid level: 0.85528

The "USDCHF Elliott Wave Analysis Trading Lounge Day Chart" dated 14 December 23, provides a detailed analysis of the U.S. Dollar/Swiss Franc (USDCHF) currency pair, focusing on the daily timeframe and utilizing Elliott Wave principles for technical analysis.

The identified "Function" is "Counter Trend," indicating that the analysis is oriented towards identifying potential reversals or corrections against the prevailing trend. This information is valuable for traders seeking opportunities in counter trend movements.

The specified "Mode" is "Corrective," suggesting that the current phase is characterized by corrective price actions. Corrective phases are typically characterized by price movements against the primary trend and often involve consolidation or retracement.

The primary "Structure" involves "Red wave 5 of blue wave C," signifying the position of the current wave within the broader Elliott Wave framework. Understanding the structure is essential for traders to anticipate potential price movements and formulate appropriate strategies.

The described "Position" is labeled as "Black wave 2," providing information about the current wave's placement within the larger Elliott Wave structure. This context aids traders in comprehending the ongoing market dynamics and making informed decisions.

In terms of "Direction Next Higher Degrees," the projection is "Black wave 3," indicating the expected next impulsive wave within the broader Elliott Wave structure. This information assists traders in anticipating potential future market movements in the upward direction.

The "Details" section highlights that "red wave 5 of blue wave C is in play and looking near to end." This suggests that the ongoing corrective wave is approaching completion, and after that,

a new uptrend is anticipated. Traders can use this information to prepare for potential shifts in market dynamics.

The "Wave Cancel invalid level" is identified as "0.85528." This level serves as a critical point at which the current wave count would be invalidated, prompting a reassessment of the prevailing market conditions.

In summary, the USDCHF Elliott Wave Analysis for the daily chart on 14 December 23, suggests a corrective phase labeled as "Red wave 5 of blue wave C," with insights into the anticipated next impulsive wave, "Black wave 3." The completion of red wave 5 indicates the potential end of the current corrective movement, with an expectation of a new uptrend. Traders should closely monitor the specified invalidation level for a comprehensive analysis of market conditions.

Technical Analyst : Malik Awais

Source : Tradinglounge.com get trial here!