WTI Crudeoil Elliott Wave Forecast

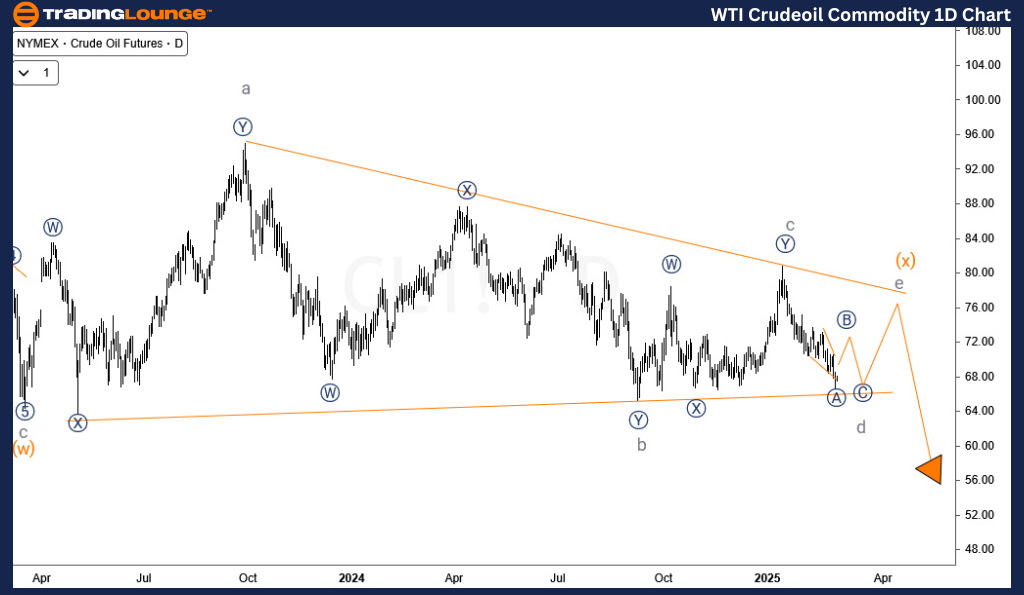

WTI crude oil continues to extend its decline from January 2025, reaching the lower boundary of the sideways price formation that has been developing since March 2023. However, the structure appears incomplete, suggesting that this lower boundary could act as a strong support zone. If so, this may trigger a corrective bounce, retracing part of the losses incurred since the January 2025 downturn.

WTI Daily Chart Analysis

From a long-term perspective, the decline in WTI from March 2022 is serving as a correction to the strong impulse rally that began at the lows of the Covid crash in April 2020. This corrective phase has taken the form of a double zigzag pattern. In this structure, wave (w) of the supercycle degree concluded in March 2023, followed by wave (x), which has evolved into a sideways triangle formation.

The triangle consists of five corrective sub-waves, where the January 2023 pullback represents cycle degree wave d within supercycle degree wave (x). Given this setup, a final upward movement is expected before a significant sell-off resumes, aligning with broader Elliott Wave projections.

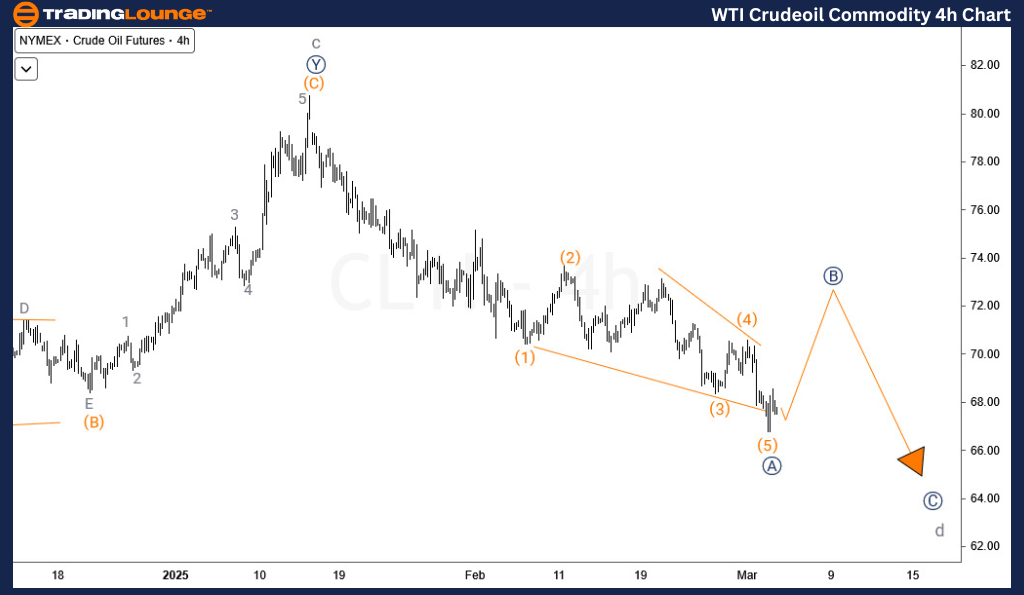

WTI H4 Chart Analysis

The H4 timeframe illustrates that WTI has completed a diagonal structure for wave ((A)) of d, indicating a potential bounce for wave ((B)) before another downward leg develops. However, an alternative scenario suggests that wave d may have already been finalized, which could lead to a stronger bullish reversal than initially anticipated. Traders should monitor price action closely to confirm whether the corrective rally gains momentum or if further declines remain on the horizon.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Soybean Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support