Are you ready to harness the power of Elliott Wave Analysis to optimize your BTCUSD trading strategy? Dive into the comprehensive insights provided by TradingLounge's daily and 4-hour charts to stay ahead in the dynamic cryptocurrency market.

Elliott Wave Analysis on BTCUSD - February 29, 24

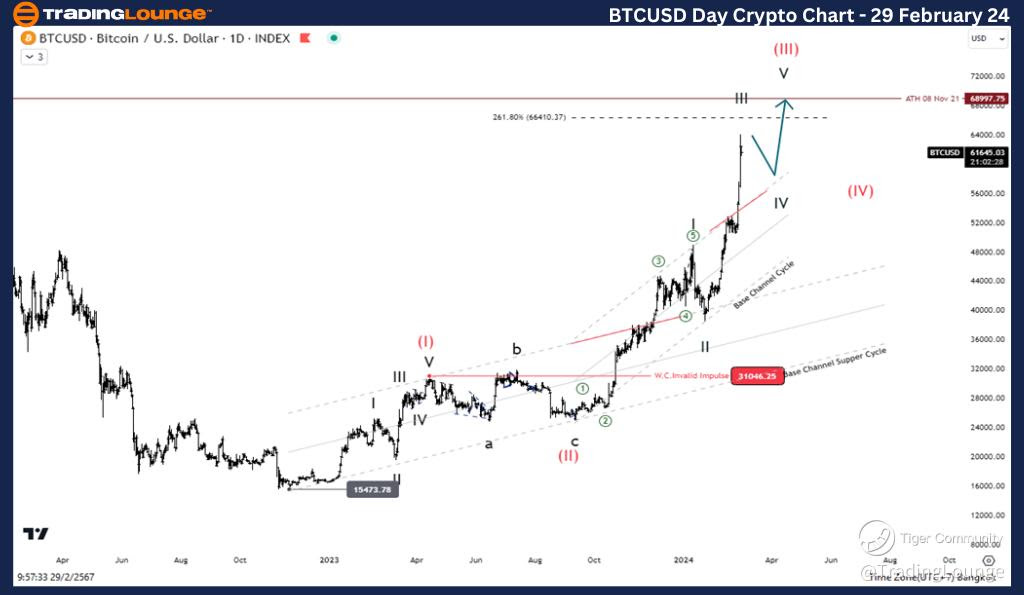

Bitcoin/ U.S. dollar(BTCUSD) Daily Chart Analysis

BTCUSD Elliott Wave Technical Analysis:

BTCUSD Trading Strategy: Identifying a wave (III) characterized by an extended impulse suggests an upward trajectory, potentially testing the 66410.307 level. The overall trend indicates an upward movement, presenting opportunities for further growth.

BTCUSD Technical Indicators: With the price positioned above the MA200, signaling an uptrend, and Wave Oscillators reflecting bullish momentum, the outlook remains favorable for BTCUSD trading.

Elliott Wave Analysis on BTCUSD 4-Hour Chart - February 29, 24

BTCUSD Elliott Wave Technical Analysis:

Bitcoin/ U.S. dollar(BTCUSD) Trading Strategy: Echoing the insights from the daily chart, wave (III) indicates an extended impulse, reinforcing the potential for an upward movement toward the 66410.307 level. The overall uptrend persists, suggesting continued growth opportunities.

Bitcoin/ U.S. dollar(BTCUSD) Technical Indicators: Consistent with the daily analysis, the price remains above the MA200, affirming the uptrend, while Wave Oscillators maintain bullish momentum, supporting favorable trading conditions for BTCUSD.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Uniswap/ U.S. dollar(UNIUSD)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

Key Takeaways for BTCUSD Traders:

-

Utilize Elliott Wave Analysis: Leverage the predictive power of Elliott Wave theory to identify market trends and anticipate price movements accurately.

-

Stay Informed with Daily and 4-Hour Charts: Regularly monitor both daily and shorter-term charts to capture nuanced market dynamics and adjust your trading strategy accordingly.

-

Confirm Trends with Technical Indicators: Supplement Elliott Wave analysis with technical indicators like MA200 and Wave Oscillators to validate trends and assess market momentum.

-

Implement Risk Management: Mitigate potential losses by employing effective risk management strategies, such as setting stop-loss orders and adhering to disciplined trading practices.

-

Stay Adaptive: Remain flexible in your approach and adapt to changing market conditions to capitalize on emerging opportunities and minimize risks effectively.

By integrating Elliott Wave Analysis with technical indicators and prudent risk management, traders can enhance their profitability and navigate the complexities of the BTCUSD market with confidence. Embrace the power of data-driven insights to optimize your trading performance and achieve your financial goals in the ever-evolving cryptocurrency landscape.