Pepsico Inc., Elliott Wave Technical Analysis

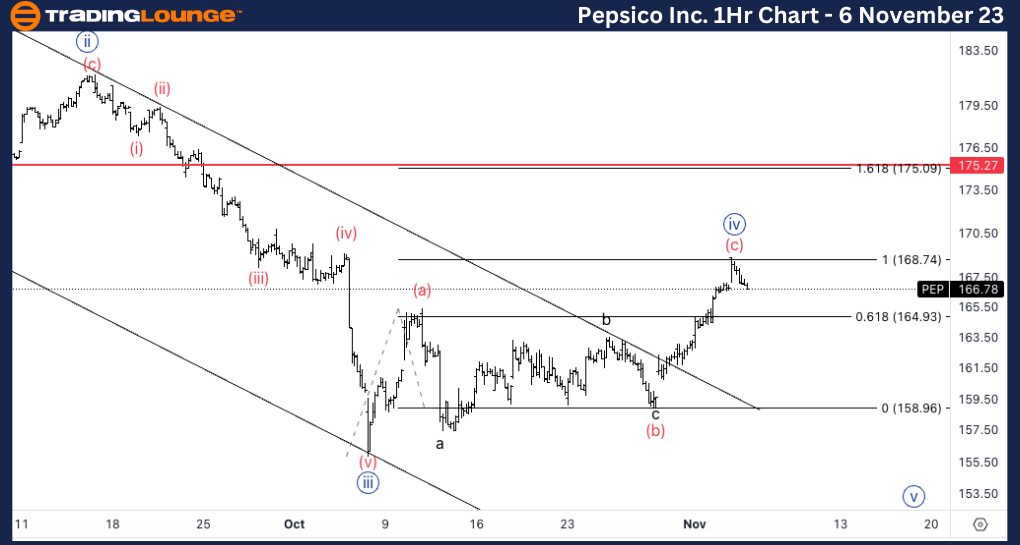

Pepsico Inc.,(PEP:NASDAQ): 4h Chart, 6 November 23

PEP Stock Market Analysis: We have been looking for downside into wave {v} as we seem to have an incomplete bearish move. We have gone past 38.2% retracement of wave {iii}. Invalidation stands at 175$.

PEP Elliott Wave Count: Wave {iv} of 3.

PEP Technical Indicators: In between averages.

PEP Trading Strategy: Looking for downside into wave {v} with a stop at 175$.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

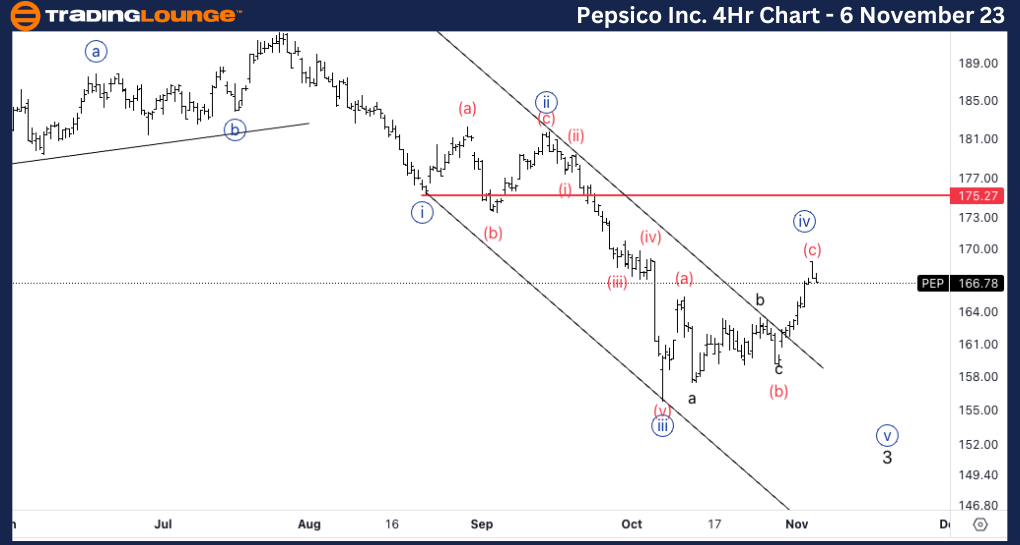

Pepsico Inc., PEP: 1-hour Chart, 6 November 23

Pepsico Inc., Elliott Wave Technical Analysis

PEP Stock Market Analysis: We have reached equality of wave (c) vs. (a) which usually act as resistance, therefore we can start looking for downside from where we stand.

PEP Elliott Wave count: Wave (c) of {iv}.

PEP Technical Indicators: Above all averages.

PEP Trading Strategy: Looking for shorts into wave {v}.