USDCAD Elliott Wave Analysis – Trading Lounge Day Chart

U.S. Dollar / Canadian Dollar (USDCAD) Day Chart

USDCAD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Gray wave 5

Position: Orange wave A

Next Higher Degree Direction: Orange wave B

Details: Gray wave 4 has completed, and gray wave 5 is now active.

Wave Cancellation Invalidation Level: 1.35657

The USD/CAD daily chart shows a counter-trend movement, revealed by Elliott Wave technical analysis. This movement is impulsive in nature, indicating a strong directional momentum in the market. The focus is on gray wave 5, which follows the completion of gray wave 4. Gray wave 5 is currently underway.

At this stage, the market is positioned within orange wave A, part of a larger wave sequence. Following the completion of orange wave A, the next expected move is orange wave B, which belongs to a higher wave degree. This implies that after the completion of gray wave 5's impulsive phase, the market could enter a corrective phase, indicated by orange wave B.

The wave cancellation invalidation level is marked at 1.35657. If the price reaches or exceeds this level, the current wave analysis will become invalid, requiring a new evaluation of the market structure. It is crucial for traders to closely monitor this level to ensure the accuracy of the current wave pattern.

Key Takeaways:

- Gray wave 5 is active after the completion of gray wave 4.

- The market is currently in orange wave A, with orange wave B anticipated next.

- The wave cancellation invalidation level is 1.35657, a critical level for maintaining or reassessing the current wave analysis.

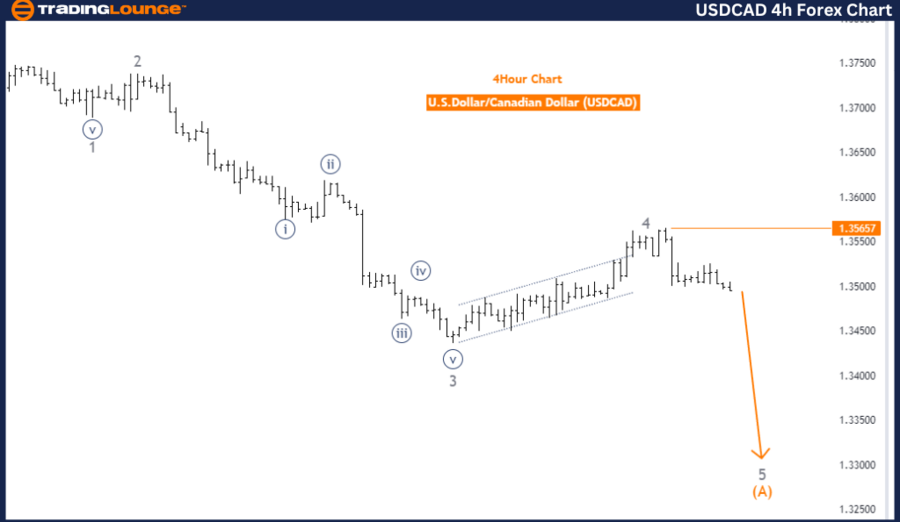

U.S. Dollar / Canadian Dollar (USDCAD) 4-Hour Chart Analysis

USDCAD Elliott Wave Technical Analysis

-

Function: Counter Trend

-

Mode: Impulsive

-

Structure: Gray wave 5

-

Position: Orange wave A

-

Next Higher Degree Direction: Orange wave B

-

Details: Gray wave 4 has completed, and gray wave 5 is currently progressing.

- Wave Cancellation Invalidation Level: 1.35657

The USD/CAD 4-hour chart also reveals a counter-trend movement through Elliott Wave technical analysis. This movement, classified as impulsive, suggests strong market momentum in a specific direction.

The analysis highlights gray wave 5, which follows gray wave 4's completion. Now, the market is progressing through gray wave 5. The current wave position is within orange wave A, which is part of the broader wave cycle. Once orange wave A is complete, the next expected movement is orange wave B, signaling a shift into a corrective phase.

The analysis sets a wave cancellation invalidation level at 1.35657. Breaching this level would invalidate the current wave analysis, requiring a reassessment of the trend and wave structure.

Key Takeaways:

- Gray wave 5 is progressing after gray wave 4's completion.

- The market is currently in orange wave A, with orange wave B anticipated to follow.

- Traders should monitor the invalidation level at 1.35657 to confirm or adjust the current wave structure.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: British Pound/U.S. Dollar (GBPUSD) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support