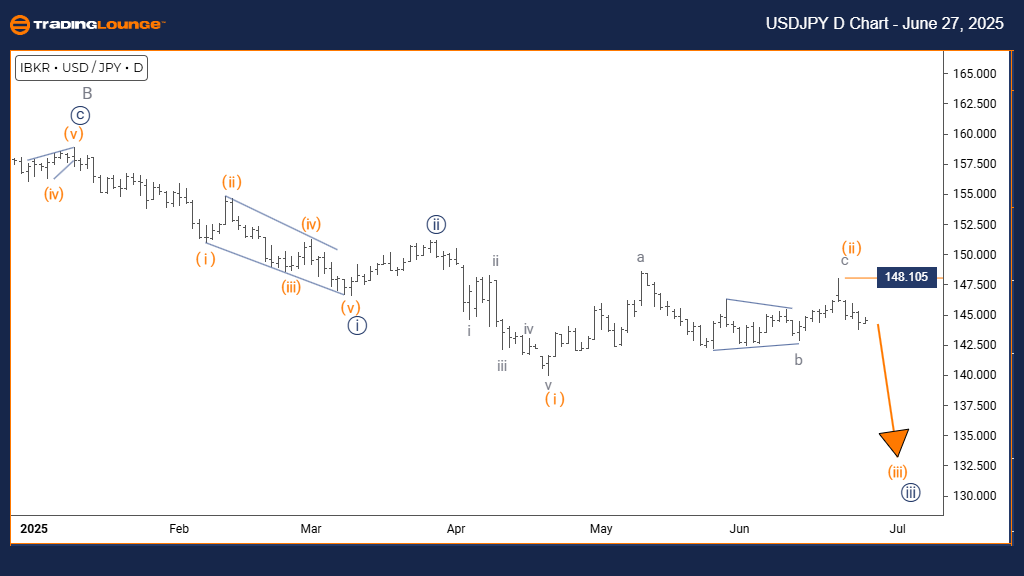

U.S. Dollar / Japanese Yen (USDJPY) Elliott Wave Analysis – Trading Lounge Daily Chart

USDJPY Elliott Wave Technical Forecast

FUNCTION: Bearish Market Structure

MODE: Impulsive Decline

STRUCTURE: Developing Orange Wave 3

POSITION: Initial Phase of Navy Blue Wave 1

DIRECTION OF NEXT SUB-WAVES: Continuation of Orange Wave 3

DETAILS: Completion of Orange Wave 2 confirmed; Orange Wave 3 in progress

WAVE INVALIDATION LEVEL: 148.105

The daily USDJPY Elliott Wave analysis signals a sustained bearish trend. The currency pair is following an impulsive decline, characteristic of strong downside momentum. Currently, the pattern is forming Orange Wave 3, situated within a larger Navy Blue Wave 1 context—indicating the early stage of a broader downward cycle.

Orange Wave 2 appears concluded, with Orange Wave 3 now active. As the most dynamic part of an Elliott Wave bearish sequence, Wave 3 typically generates significant price declines. Traders should expect accelerated downward movement if the structure maintains its integrity.

The critical level to monitor remains at 148.105. A break above this threshold would invalidate the existing wave count and demand a structural review. While USDJPY stays below this level, bearish momentum is likely to persist.

Current technical indicators reinforce the bearish USDJPY outlook. With institutional selling pressure evident, the continuation of Orange Wave 3 aligns with forecasts of stronger downside movement in the ongoing Navy Blue Wave 1 development.

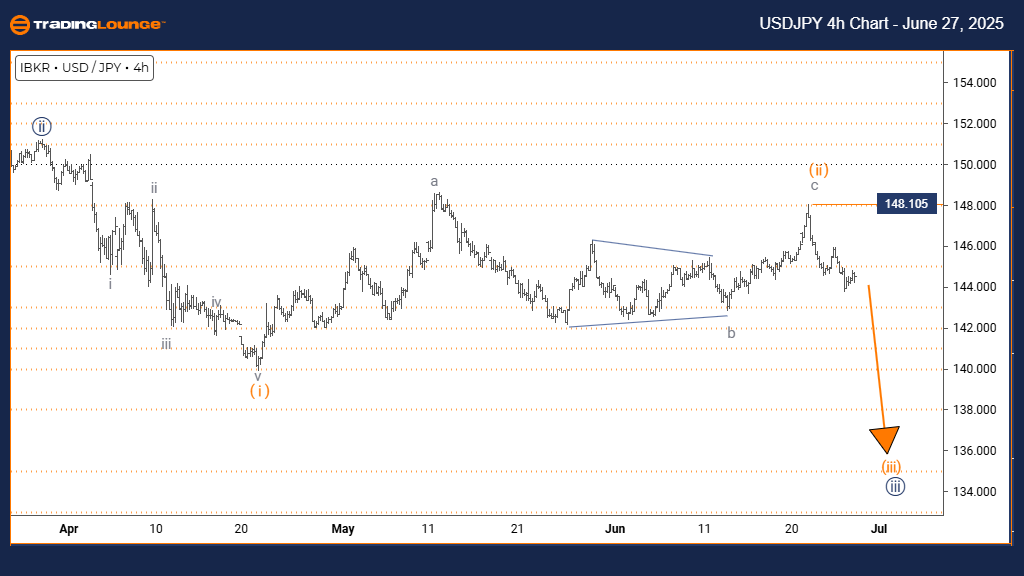

U.S. Dollar / Japanese Yen (USDJPY) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

USDJPY Elliott Wave Technical Forecast

FUNCTION: Bearish Trend Continuation

MODE: Impulsive Price Action

STRUCTURE: Orange Wave 3 Formation

POSITION: Within Navy Blue Wave 1

DIRECTION OF NEXT SUB-WAVES: Orange Wave 3 Ongoing

DETAILS: Orange Wave 2 completed; Orange Wave 3 initiated

WAVE INVALIDATION LEVEL: 148.105

The 4-hour USDJPY Elliott Wave forecast continues to emphasize bearish conditions. The pair is actively moving through Orange Wave 3, a strong impulsive leg within the broader Navy Blue Wave 1 trend. This setup signals robust downward movement consistent with Wave 3 characteristics.

With the conclusion of Orange Wave 2, the transition to Wave 3 has started. Elliott Wave theory suggests that Wave 3 often results in sharp price drops with limited corrective activity. As this structure develops, traders should closely monitor its progression for trend confirmation.

The 148.105 level remains a key invalidation point. Any sustained move above this line will negate the current bearish wave count. As long as the price holds beneath it, the bearish structure remains in play.

Technical momentum indicators support the likelihood of deeper declines in USDJPY. With Orange Wave 3 extending, the market setup favors continued selling pressure and additional downside over the short term.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support