Unlocking insights into the market dynamics of McDonald’s Corp. (MCD) through Elliott Wave Analysis reveals promising trading opportunities. This comprehensive analysis delves into both daily and 4-hour charts to provide a strategic outlook for traders.

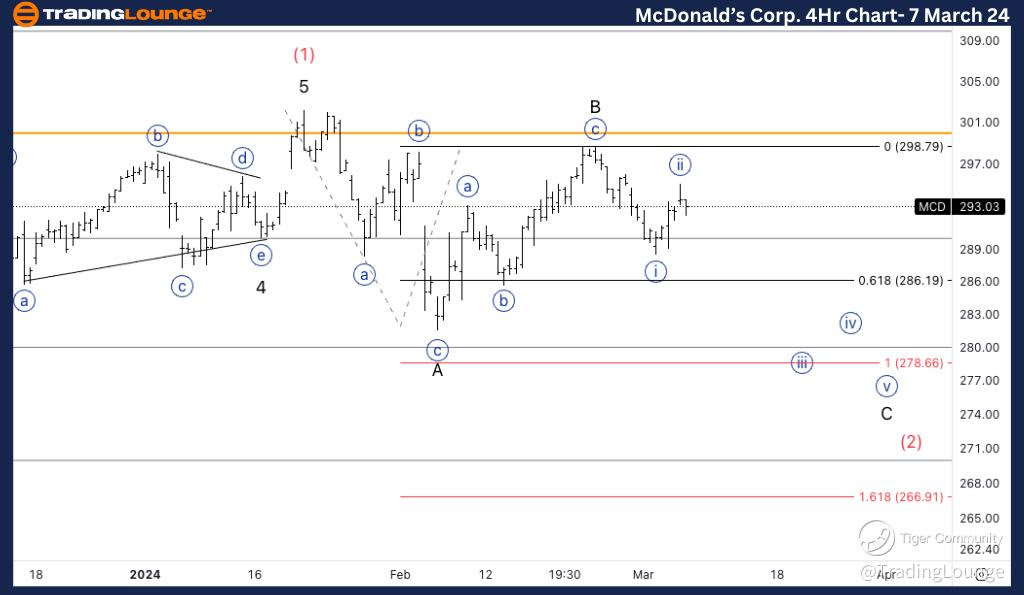

MCD Elliott Wave Analysis Trading Lounge Daily Chart

McDonald’s Corp., (MCD) Daily Chart Analysis

MCD Elliott Wave Technical Analysis

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Intermediate wave (2)

Direction: Completion of wave C of (2)

In the daily chart analysis of McDonald’s Corp. (MCD), we observe a compelling trend characterized by its impulsive nature. Currently positioned within the intermediate wave (2), the completion of wave C signals a pivotal juncture. Notably, the breach of the previous All-Time High (ATH) at $300 is indicative of bullish momentum. However, the resistance encountered at TL3 necessitates a potential pullback before the upward trajectory resumes.

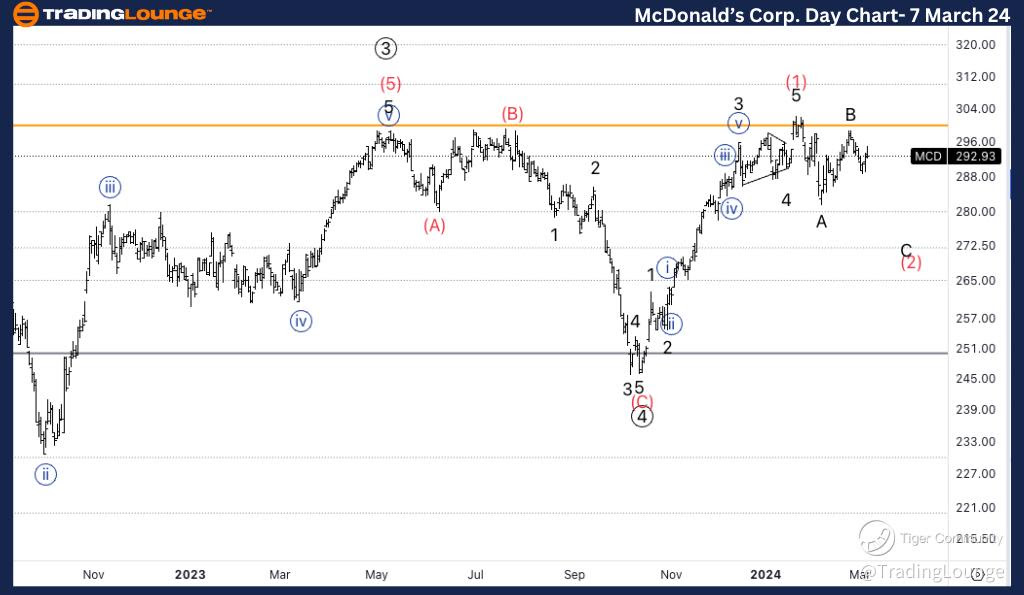

MCD Elliott Wave Analysis Trading Lounge 4Hr Chart, 7 March 24

McDonald’s Corp., (MCD) 4Hr Chart Analysis

MCD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave {ii} of C

Direction: Acceleration lower into wave {iii}

Analyzing the 4-hour chart of McDonald’s Corp. (MCD) unveils counter-trend movements typified by corrective waves. Positioned within the flat structure, wave {ii} of C showcases a potential deceleration. Anticipating acceleration lower into wave {iii} remains a key focus. However, the possibility of a sideways wave B formation cannot be discounted entirely. Notably, the equality of C versus A points towards a target slightly below $278, aligning with wave C's trajectory.

Leveraging Elliott Wave Analysis for Strategic Trading

By leveraging Elliott Wave Analysis, traders can gain valuable insights into market trends and capitalize on potential trading opportunities. The combination of motive and corrective modes, along with impulsive and flat structures, offers a nuanced understanding of market dynamics. Identifying intermediate waves and anticipating directional shifts enable traders to make informed decisions, optimizing their trading strategies for success.

Conclusion

In conclusion, McDonald’s Corp. (MCD) presents a compelling landscape for traders, as depicted through Elliott Wave Analysis. The daily chart signals bullish momentum, with potential pullbacks offering entry points for long positions. Meanwhile, the 4-hour chart highlights counter-trend movements, urging caution and strategic positioning. By embracing Elliott Wave principles, traders can navigate the complexities of the market with confidence, unlocking profitable opportunities along the way.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Coca-Cola Company (KO)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.