Welcome to our latest Elliott Wave analysis for Salesforce Inc. (CRM). This analysis offers insights into CRM's price movements using Elliott Wave Theory, helping traders identify potential opportunities based on the current trend. We will explore both the daily and 1-hour charts for a thorough understanding of CRM's market behavior.

CRM Elliott Wave Analysis – Trading Lounge Daily Chart

Salesforce Inc. (CRM) Daily Chart Analysis

CRM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 3

Direction: Upside into wave 3

Details: We are observing the possibility that a multi-year correction has concluded, and CRM is now resuming its upward movement. As CRM approaches the $265 level, it is crucial to find support here to sustain the upward trend.

CRM Elliott Wave Technical Analysis – Daily Chart

CRM appears to be resuming its uptrend after what seems to be the completion of a multi-year correction. As CRM advances within Minor wave 3, the price must find support near the $265 mark to maintain this upward momentum. Successfully establishing support at this level would confirm the bullish outlook, indicating that the uptrend remains intact and CRM could continue to rise.

CRM Elliott Wave Analysis – Trading Lounge 1H Chart

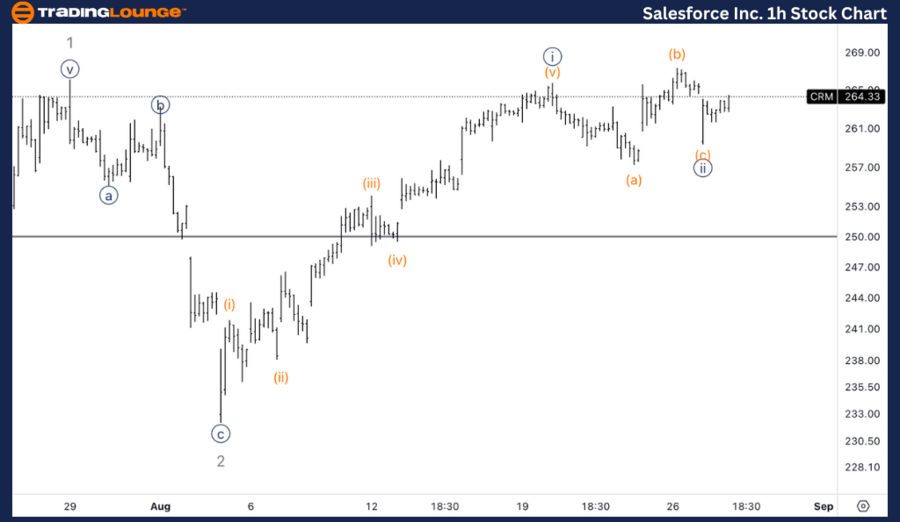

Salesforce Inc. (CRM) 1H Chart Analysis

CRM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {ii} of 3

Direction: Bottom in wave {ii}

Details: We are looking for a bottom in wave {ii} following a three-wave corrective move after breaking the previous high, which marked the top of wave {i}.

CRM Stock Technical Analysis – 1H Chart

The 1-hour chart suggests that CRM may have completed a corrective wave {ii} within Minor wave 3. This correction appears to have taken the form of a three-wave pattern, typical of corrective phases. After breaking the previous high, which marked the top of wave {i}, CRM now seems ready to resume its upward movement. A confirmed bottom in wave {ii} would indicate that the next phase higher in wave {iii} is likely to begin.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Apple inc. Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support