Bovespa Index Elliott Wave Analysis – Trading Lounge Day Chart

Bovespa Index – Day Chart Analysis

Bovespa Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 4

DETAILS: Completion of Orange Wave 2 confirmed; Orange Wave 3 currently active

WAVE CANCEL INVALIDATION LEVEL: 122486

The daily chart of the Bovespa Index signals a robust bullish trend, positioning in Orange Wave 3 within the broader Navy Blue Wave 1 structure. The end of Orange Wave 2 has led to the initiation of a typically strong impulsive phase in the Elliott Wave forecast.

This stage indicates intense buying interest and reinforces the Brazil stock market’s bullish momentum. As long as the index stays above 122486, this bullish Elliott Wave interpretation remains valid. A drop below this level would require a reassessment of the current wave structure.

This analysis provides valuable insights for traders looking to capitalize on the Bovespa Index's upward trend. The following phase, Orange Wave 4, is expected to be corrective. Traders should observe the wave's progression and adjust strategies accordingly to manage risks effectively.

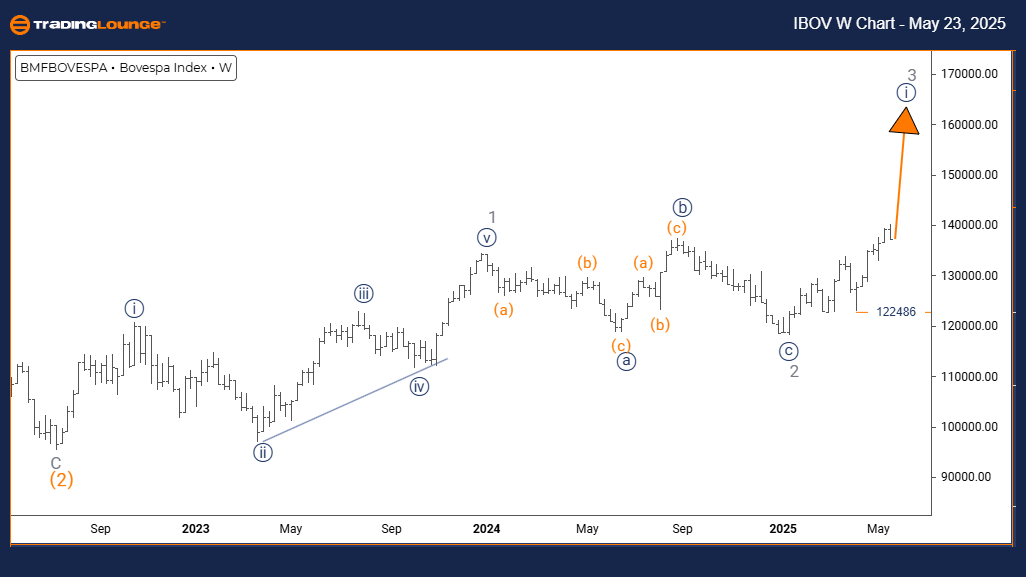

Bovespa Index Elliott Wave Analysis – TradingLounge Weekly Chart

Bovespa Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 confirmed complete; Navy Blue Wave 1 of 3 currently in progress

WAVE CANCEL INVALIDATION LEVEL: 122486

The weekly Bovespa Index chart continues to support a bullish Elliott Wave outlook. The structure identifies the development of Navy Blue Wave 1 within Gray Wave 3, following the confirmed end of Gray Wave 2.

This impulsive movement reflects a potential start to a significant long-term rally in the Brazilian equity market. The wave count remains valid as long as the price holds above 122486, supporting the current bullish perspective.

This broader wave structure suggests the Bovespa Index may be in the early stages of an extended upward cycle. Navy Blue Wave 2, anticipated to be corrective, is expected to follow. Investors should monitor for trend continuation signals and be ready to reassess if the critical support level is breached.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: CAC 40 (France) Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support