ASX: MINERAL RESOURCES LIMITED – MIN Elliott Wave Technical Analysis

Greetings,

Our updated Elliott Wave analysis for MINERAL RESOURCES LIMITED (ASX:MIN) highlights promising upside potential. A completed fourth-wave correction indicates the start of the fifth wave, which could lead to substantial price gains. This technical forecast outlines key target levels and invalidation zones for investors and traders monitoring ASX:MIN.

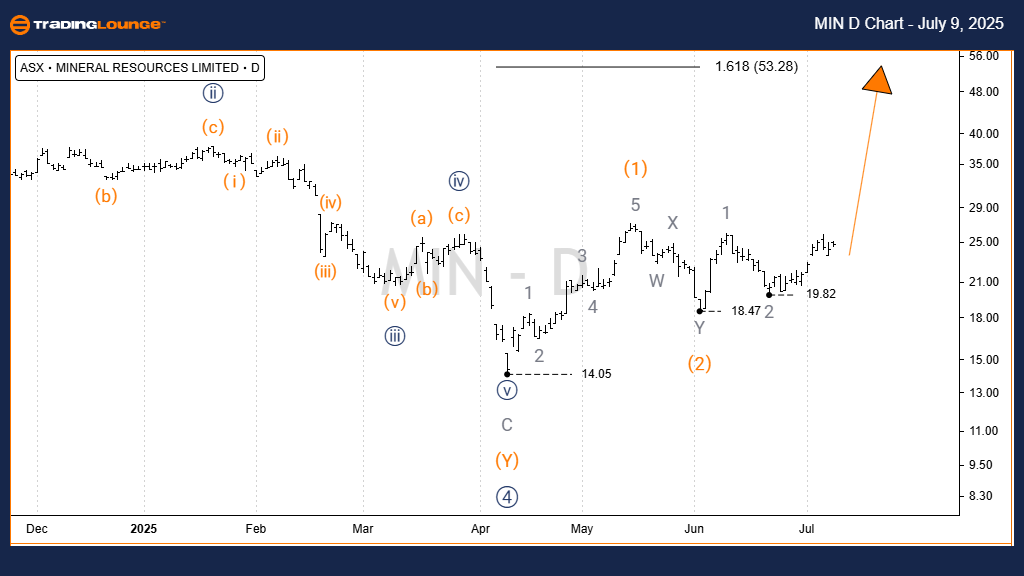

ASX: MINERAL RESOURCES LIMITED – MIN 1D Chart (Semilog Scale) Elliott Wave Forecast

Function: Primary trend (Intermediate degree, orange)

Mode: Motive wave

Structure: Impulse

Current Position: Wave 3 within Wave 5 (orange/navy)

Key Insights:

The corrective phase bottomed at $14.05, setting up a motive wave rally.

Short-term and medium-term targets range between $50.00 to $80.00.

The bullish Elliott Wave setup remains valid as long as prices stay above $14.05.

A brief pullback below $18.47 suggests a potential extension of wave 2 (orange) but does not invalidate the uptrend scenario.

Critical Invalidation Level: $14.05

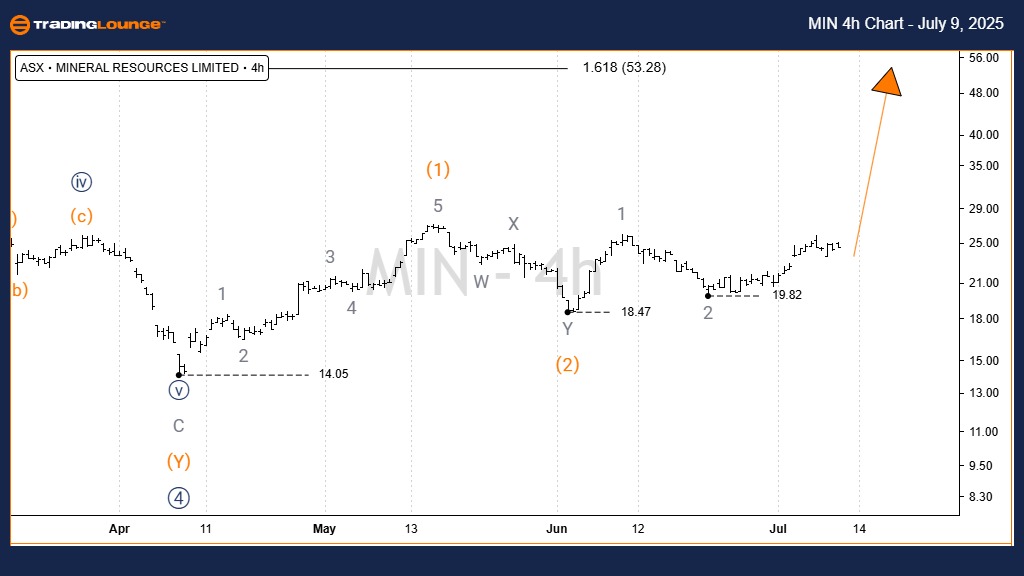

ASX: MINERAL RESOURCES LIMITED – MIN 4‑Hour Chart Wave Analysis

Function: Intermediate trend continuation

Mode: Motive wave

Structure: Impulse

Current Position: Wave 3 (orange)

Detailed Breakdown:

From the $14.05 low, wave 1 (orange) concluded in a classic five-wave formation.

A complex Double Zigzag correction ended at $18.47, marking wave 2 (orange).

Current movement signals the beginning of wave 3 (orange), aiming for the $53.28 resistance.

Pullbacks below $18.47 align with a prolonged wave 2 and do not undermine the bullish structure.

Holding above $14.05 remains essential to confirm this upward trend.

Key Invalidation Zone: $14.05 (Maintaining this level is critical)

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: UNIBAIL‑RODAMCO‑WESTFIELD – URW Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave outlook on ASX: MINERAL RESOURCES LIMITED – MIN blends both macro and micro wave structures, providing a reliable technical foundation for decision-making. With clearly marked validation and invalidation points, our analysis enhances investor confidence. The ongoing motive wave progress offers a strong opportunity to align with the prevailing trend.