ASX: UNIBAIL‑RODAMCO‑WESTFIELD – URW Elliott Wave Technical Analysis | TradingLounge

Our latest Elliott Wave update for UNIBAIL‑RODAMCO‑WESTFIELD (ASX: URW) highlights the medium-term bullish potential of URW stock. Based on our current wave analysis, URW appears to be in the early stages of a fifth wave, suggesting upward momentum. However, short-term indicators do not support immediate buying opportunities. This technical review outlines the reasoning in detail.

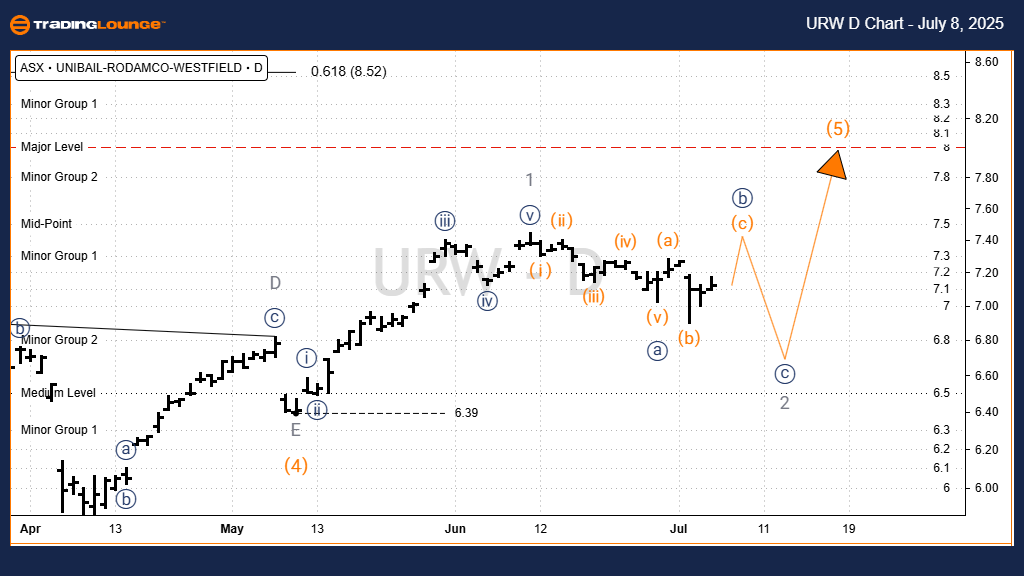

ASX: UNIBAIL‑RODAMCO‑WESTFIELD – URW 1D Chart Analysis (Semilog Scale)

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave 2-grey within Wave 5-orange

Key Insights:

Wave 4-orange concluded at a low of 6.39, forming a contracting triangle pattern labeled A, B, C, D, E-grey.

Currently, Wave 5-orange is progressing higher, aiming for the next significant resistance near 8.52.

Wave 5-orange remains active, suggesting further upside potential.

Critical Invalidation Level: 6.39

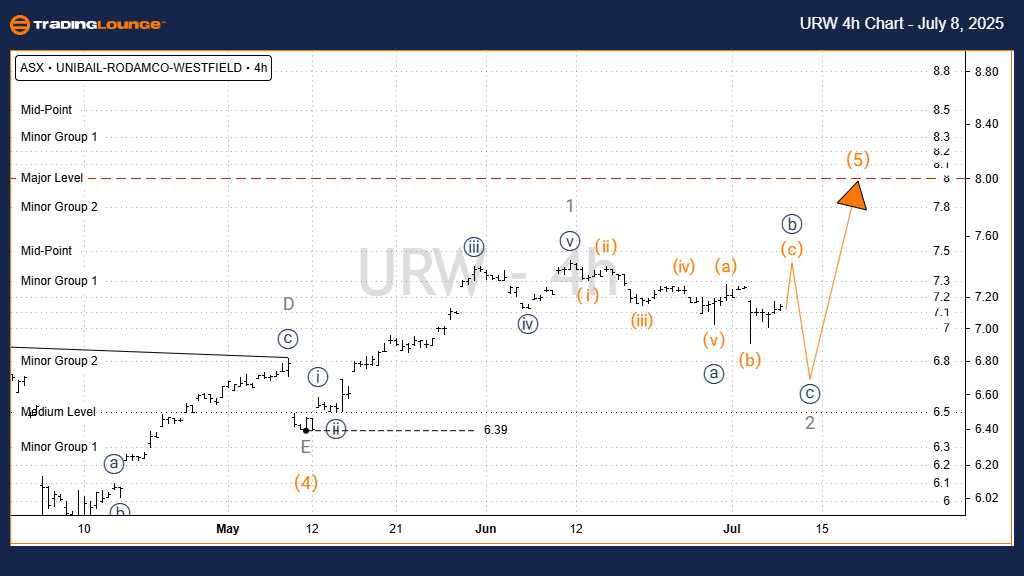

ASX: UNIBAIL‑RODAMCO‑WESTFIELD – URW 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave c-orange of Wave b-navy of Wave 2-grey

Key Insights:

Wave 1-grey is complete as a classic five-wave structure.

Wave 2-grey is unfolding as a corrective zigzag, marked a-b-c-navy.

Within this, Wave B-navy shows traits of an expanded flat and may be followed by a downward move in Wave c-navy.

Critical Invalidation Level: 6.39

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: BHP GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our comprehensive Elliott Wave outlook on ASX: URW (UNIBAIL‑RODAMCO‑WESTFIELD) delivers a professional view of current market momentum and possible price action scenarios. With key validation and invalidation levels identified, this forecast aims to strengthen decision-making for traders. Monitoring these wave structures enables better alignment with potential medium-term gains while recognizing near-term risks.