ASX: BHP GROUP LIMITED - BHP Elliott Wave Analysis

Our latest Elliott Wave analysis for BHP GROUP LIMITED (ASX:BHP) highlights a potential bullish movement in the stock price. Based on the completed wave 2-orange, which seems to have formed a classic Zigzag pattern, there is a strong indication that wave 3-orange has started to develop. This analysis covers our projected target price range and critical support levels that validate the bullish scenario.

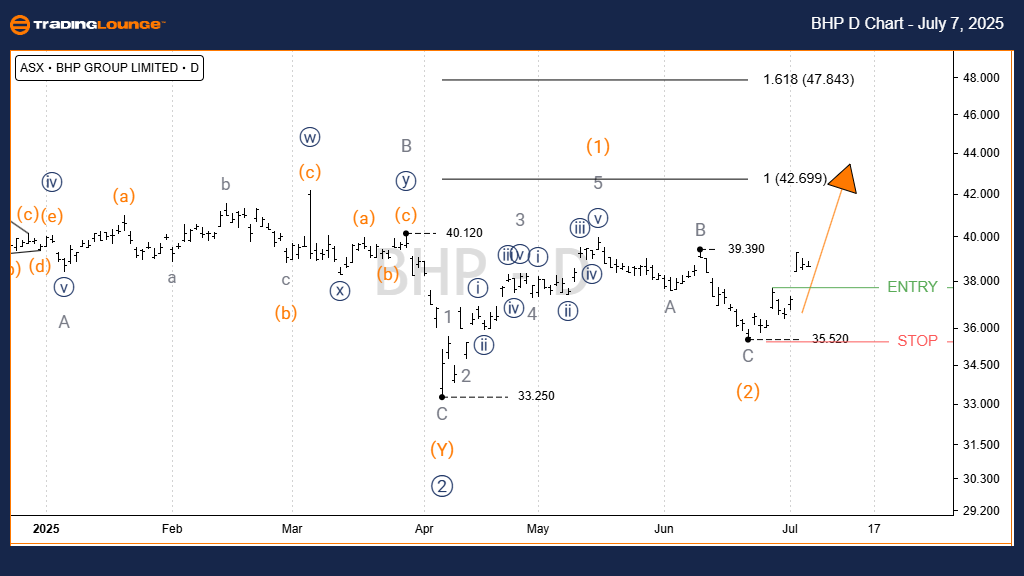

ASX: BHP GROUP LIMITED - BHP Daily Chart (1D, Semilog Scale) Overview

Wave Function: Intermediate Trend (Orange Degree)

Wave Mode: Motive

Structure Type: Impulse

Wave Position: Wave 3-orange

Technical Breakdown:

Wave 1-orange began from the low of 33.25 and formed a complete five-wave impulsive structure. Subsequently, wave 2-orange is likely completed as a grey ABC Zigzag correction. This technical progression reinforces the possibility of wave 3-orange advancing next, with price targets estimated between 42.70 and 47.84. The bullish scenario remains intact as long as BHP stays above the key support level of 35.52.

Critical Invalidation Level: 35.52

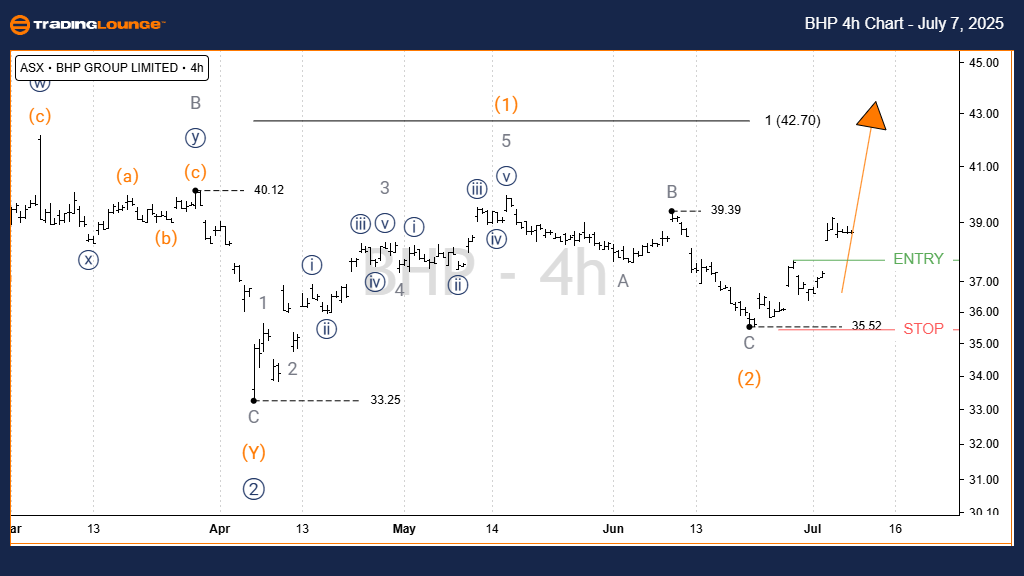

ASX: BHP GROUP LIMITED - Elliott Wave Analysis on 4-Hour Chart

TradingLounge 4-Hour Chart Review

Analyzing the 4-hour timeframe, the structure remains aligned with the daily chart analysis. A potential long position becomes more favorable if BHP breaks above the entry confirmation zone, signaling the continuation of wave 3-orange in the upward direction.

Wave Function: Intermediate Trend (Orange Degree)

Wave Mode: Motive

Structure Type: Impulse

Wave Position: Wave 3-orange

Critical Invalidation Level: 35.52

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Newmont Corporation Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave technical analysis of BHP GROUP LIMITED (ASX:BHP) integrates both short-term and long-term chart patterns. We have defined key support and resistance zones that validate or challenge the ongoing bullish wave structure. These levels help traders and investors align with a technically backed and objective market strategy.