ASX: NEM – NEWMONT CORPORATION Elliott Wave Analysis

Hello,

This updated Elliott Wave analysis of Newmont Corporation (ASX:NEM) reviews the current wave structure based on the Australian Stock Exchange listing. Our latest evaluation indicates that ASX:NEM is moving through wave three of a larger trend. This report delivers precise price targets and a key invalidation level, essential for traders applying Elliott Wave principles to forecast market shifts.

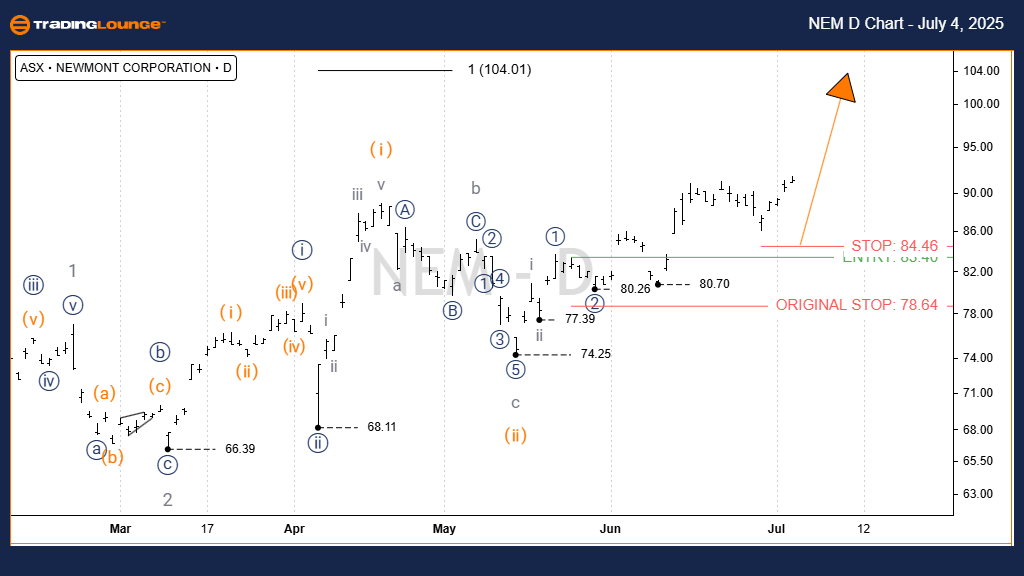

Newmont Corporation (ASX:NEM) 1D Chart (Semilog Scale) – Technical Overview

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Wave Position: Wave iii) - orange of Wave iii)) - navy of Wave 3 - grey

Key Observations:

- The low at 74.25 likely marks the end of wave ii) - orange, forming a completed zigzag correction (a, b, c - grey).

- From this pivot, wave iii) - orange is gaining upward momentum, with the primary upside target set at 100.00.

Critical Invalidation Level: 74.25

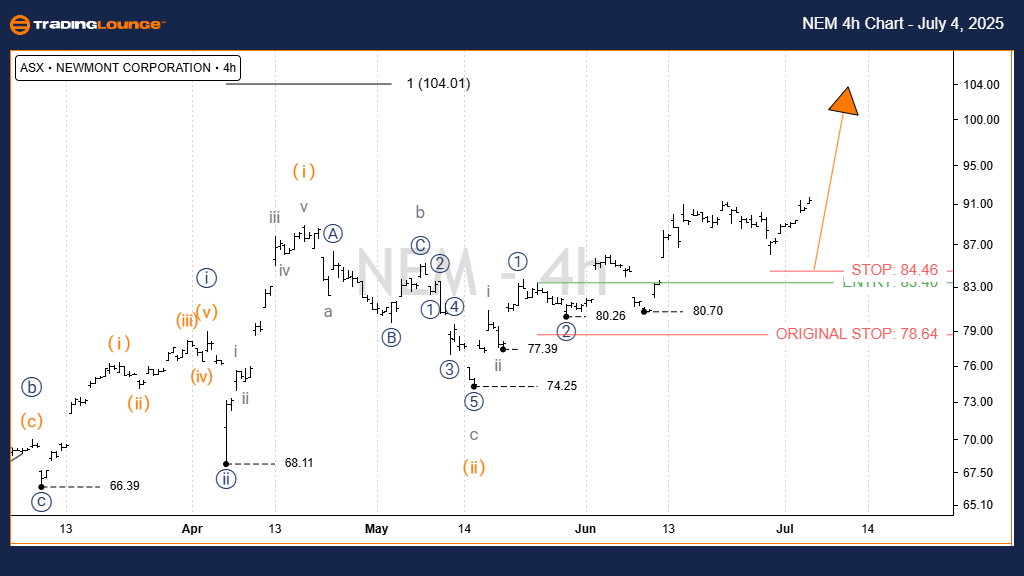

Newmont Corporation (ASX:NEM) 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Wave Position: Wave iii) - orange of Wave ((iii)) - navy of Wave 3 - grey

Technical Insights:

- The 4-hour time frame supports the upward wave continuation seen in the 1-day chart.

- Wave iii) - orange is in a sustained bullish phase, aiming for 100.00.

- On a shorter time horizon, wave iii - grey is also trending up, targeting a near-term level of 90.00.

Critical Invalidation Level: 74.25

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: COLES GROUP LIMITED – COL Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave technical analysis for ASX: NEM provides actionable insights for traders and investors following Newmont Corporation. By outlining key validation and invalidation price levels, this analysis offers a structured view of potential trend developments.

The goal is to provide a reliable, transparent perspective for anyone leveraging an Elliott Wave trading strategy in today's market.