COLES GROUP LIMITED – COL Elliott Wave Technical Analysis – TradingLounge

Market Update:

Elliott Wave analysis for COLES GROUP LIMITED (ASX: COL) indicates continued bullish potential. The broader trend, defined as wave 3-grey, remains in an extended phase. In the short term, its corrective phase—wave ii-navy—appears to be concluding as a classic zigzag pattern. Upon finalization of wave ii-navy, wave iii-navy is expected to resume, propelling the stock in the direction of the dominant trend.

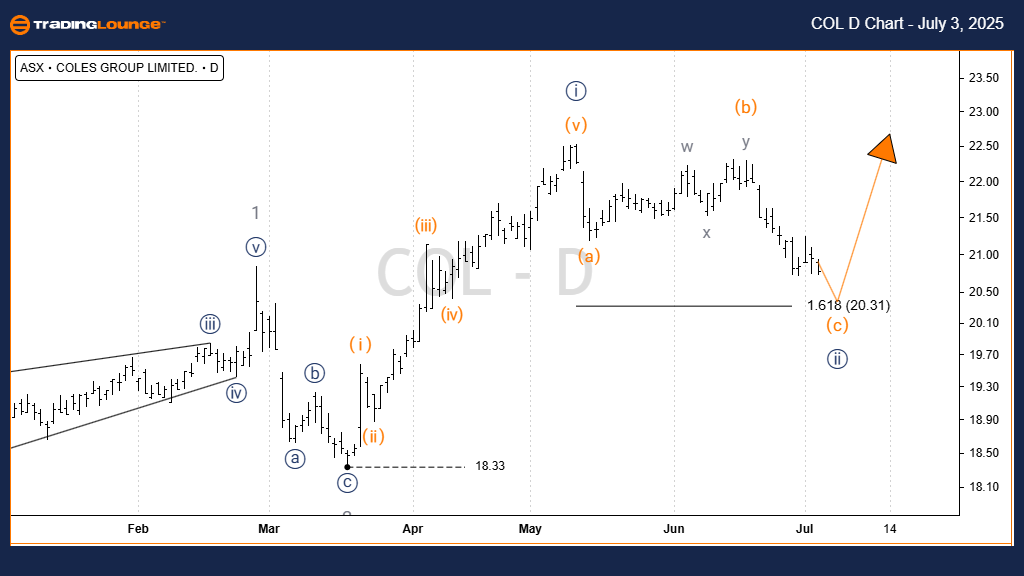

COLES GROUP LIMITED – COL 1D Chart (Semilog Scale) Analysis:

Function: Major trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ii-navy of Wave 3-grey

Details:

- From the 18.33 low, Wave 3-grey is unfolding into i-navy → ii-navy → iii-navy.

- Current structure shows wave ii-navy nearing completion within an a-b-c orange zigzag.

- Expected target range: ~21.10–20.31.

- Upon breakout, look for wave iii-navy to move upward in line with the main trend.

Invalidation point: 18.33

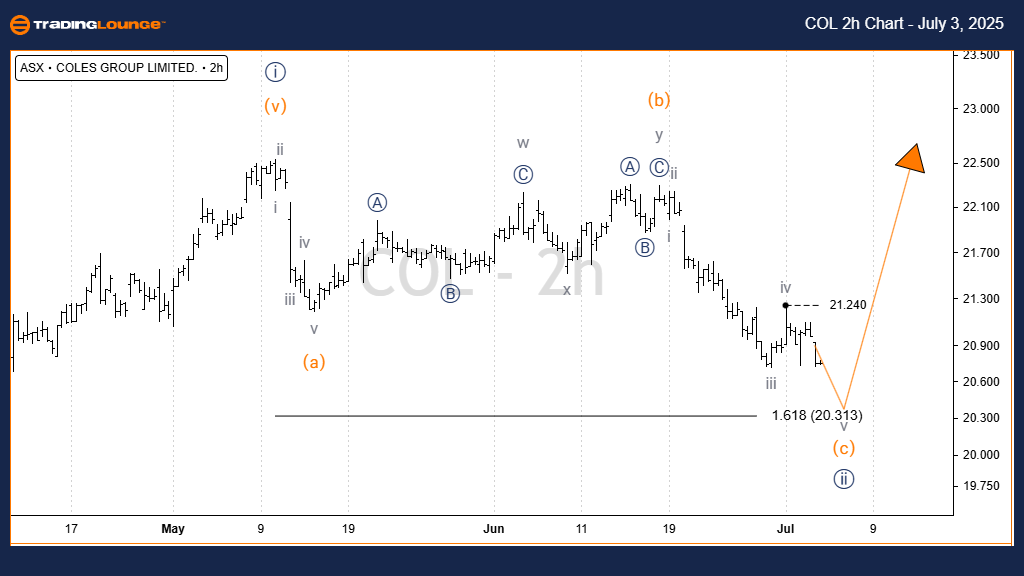

COLES GROUP LIMITED – COL Elliott Wave Technical Analysis – TradingLounge (2‑Hour Chart)

2‑Hour Chart Analysis:

Function: Major trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave v-grey of Wave c-orange of Wave ii-navy

Details:

- Wave ii-navy remains active with a projected zone of ~21.10–20.31.

- A potential bullish reversal is forecasted upon completion, as wave iii-navy aims for the ~$30.00 level.

- A move above 21.240 validates the early development of wave iii-navy.

Invalidation point: 18.33

Key reference level: 21.240

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: MINERAL RESOURCES LIMITED - MIN Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This technical review offers a detailed Elliott Wave outlook for COLES GROUP LIMITED (COL), focusing on both short-term movement and broader market context. Clear target zones and invalidation points enhance clarity and precision in our forecast. These insights provide traders and investors with reliable, data-driven perspectives on the ASX market structure and trend behavior.