ASX: MIN Elliott Wave Forecast – Bullish Wave 5 Setup Emerging

ASX-listed MINERAL RESOURCES LIMITED (ASX: MIN) is under our latest Elliott Wave radar. Technical patterns suggest that the major Wave 4 correction has concluded, positioning the stock for a potential Wave 5 advance. This report identifies target levels and critical invalidation markers.

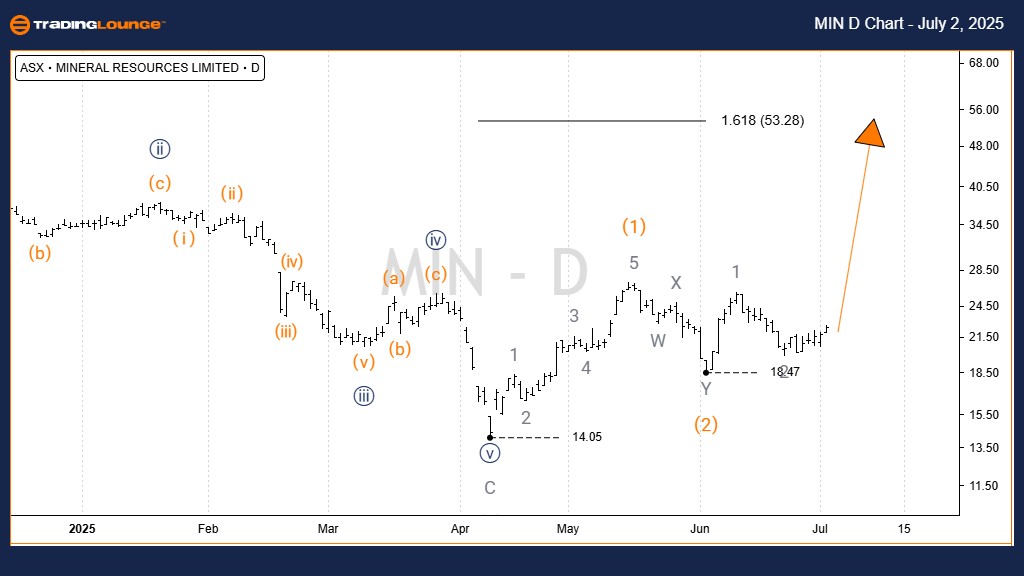

MINERAL RESOURCES LIMITED - MIN 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 (Orange) of Wave 5 (Navy)

The correction found a solid base at $14.05, indicating that a fresh impulse wave is likely underway. The bullish trajectory projects a target zone between $50.00 and $80.00. To maintain this outlook, the price must stay above the $14.05 level. A drop below $18.47 does not break the bullish structure but implies a deeper Wave 2 retracement, after which Wave 3 (Orange) may unfold upwards.

Invalidation Point: $14.05

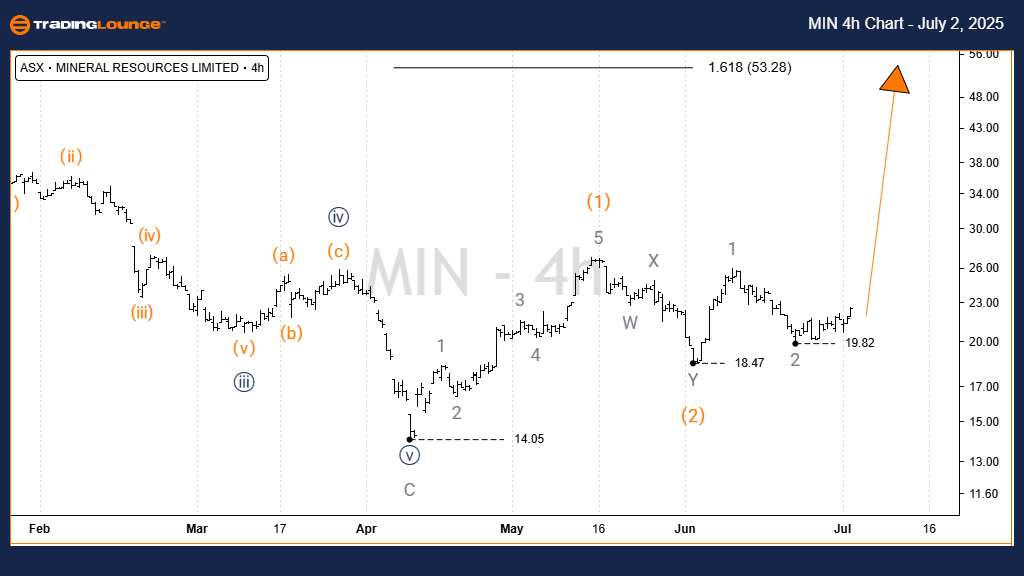

MINERAL RESOURCES LIMITED - MIN 4-Hour Chart Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 (Orange)

The 4-hour timeframe confirms that Wave 1 (Orange) ended with a clear five-wave move down to $14.05. A Double Zigzag correction completed Wave 2 (Orange) at $18.47, preparing for a potential rise toward $53.28 as Wave 3 begins. While any dip below $18.47 signals a lengthier correction phase, it does not invalidate the broader bullish pattern.

Invalidation Point: $14.05

Technical Analyst: Hua (Shane) Cuong, Certified Elliott Wave Analyst – Master Level (CEWA-M).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NORTHERN STAR RESOURCES LTD – NST Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This updated Elliott Wave forecast for MINERAL RESOURCES LIMITED (ASX: MIN) highlights bullish technical potential, key trend levels, and price zones to monitor. Our analysis supports traders with clear, theory-based targets and critical support levels, helping to validate or adjust trading strategies based on evolving price action.