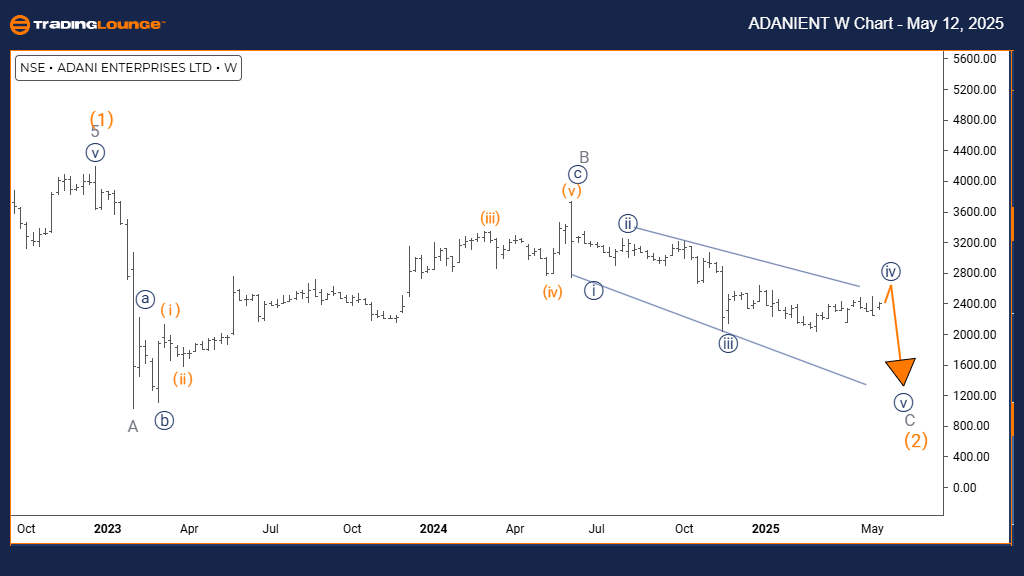

ADANI ENTERPRISES – Elliott Wave Analysis – Trading Lounge Day Chart

ADANIENT Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Navy Blue Wave 4

POSITION: Gray Wave C

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 5

DETAILS: Navy Blue Wave 3 of C is complete; Navy Blue Wave 4 of C is in progress and nearing its conclusion.

The daily Elliott Wave analysis of Adani Enterprises share price reveals a counter-trend correction, forming within a larger bearish setup. The price action currently develops as Navy Blue Wave 4 under Gray Wave C, indicating the stock is approaching the end of its corrective structure. The prior Navy Blue Wave 3 seems completed, while the market now unfolds in Wave 4, typically characterized by consolidation or mild upside before the next downward impulse.

Located within Gray Wave C, this structure signals the final segment of a broader corrective cycle. The next move is likely Navy Blue Wave 5, which may wrap up the current bearish phase. Since Wave 4 is corrective, any upward movement is expected to remain limited. Traders should stay alert for early signals of trend reversal, suggesting that Wave 5 may soon initiate. This technical analysis provides clarity on the short-term positioning of Adani stock and supports a continued bearish outlook, with potential opportunities emerging as Wave 4 concludes.

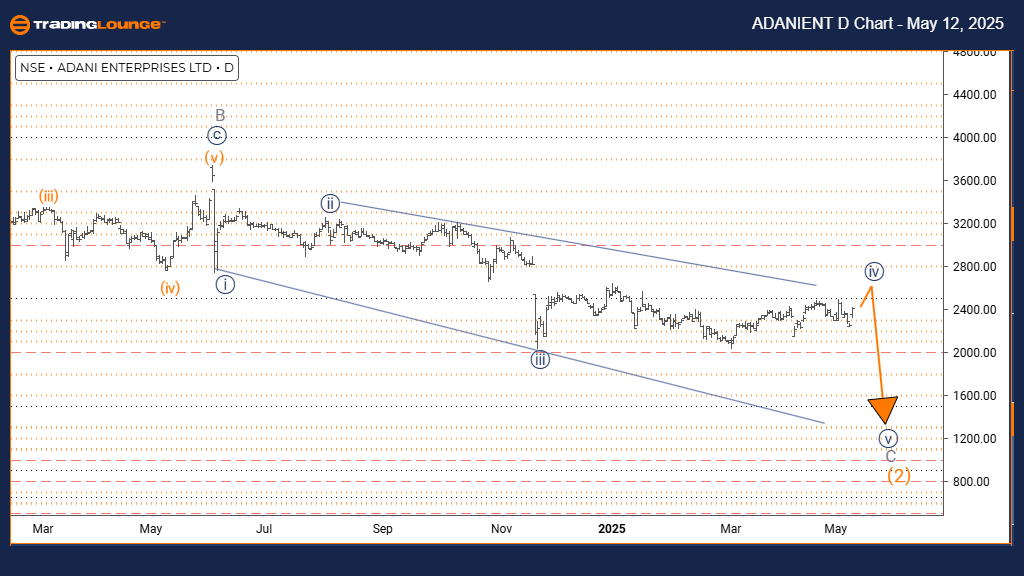

ADANI ENTERPRISES – Elliott Wave Analysis – Trading Lounge Weekly Chart

ADANIENT Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: Gray Wave C

POSITION: Orange Wave 2

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Gray Wave B is confirmed complete; Gray Wave C is actively progressing.

The weekly Elliott Wave chart for Adani Enterprises stock illustrates a counter-trend setup transitioning into an impulsive phase within a broader corrective wave. The structure reflects Gray Wave C as part of Orange Wave 2, signifying an extended corrective movement. With Gray Wave B finalized, the current active wave—Gray Wave C—is unfolding and may represent the terminal leg of the downtrend.

This impulsive nature of Gray Wave C indicates increased bearish momentum, consistent with late-stage correction dynamics. Upon its completion, Orange Wave 3 is expected to emerge, potentially marking the start of a longer-term bullish move. Confirmation that Wave B has ended reinforces this perspective. Traders should monitor price developments to catch signs of exhaustion in Wave C, which may offer attractive reversal setups.

The Adani Enterprises technical analysis signals the market nearing a potential turning point. Although downside appears limited, confirmation through price action and indicators is essential. The current pattern is critical for assessing long-term positioning and identifying high-probability entry points based on Elliott Wave principles.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ADANI GREEN Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support