LLY Elliott Wave Analysis Trading Lounge Daily Chart, 31 January 24

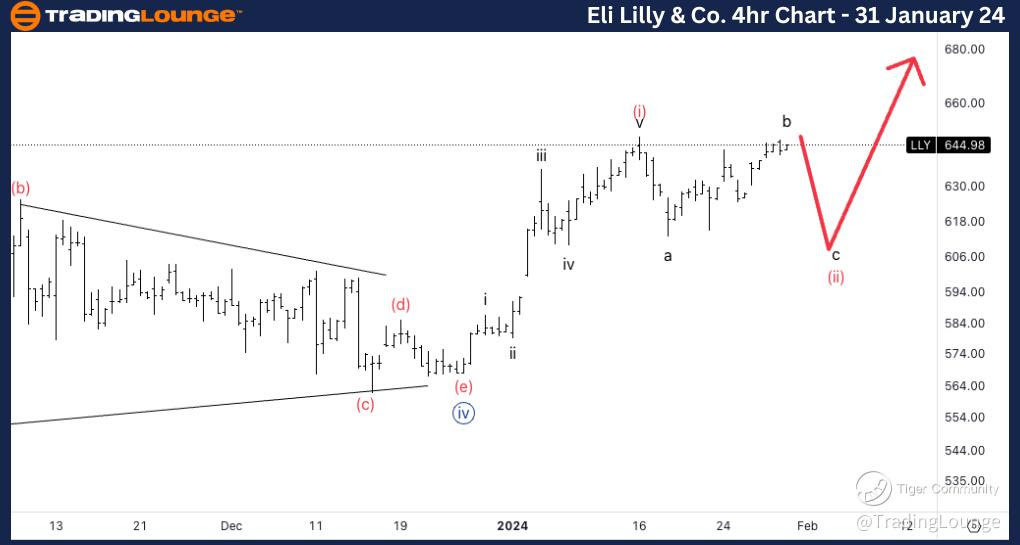

Eli Lilly & Co., (LLY) Daily Chart

LLY Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Wave {v} of 3

POSITION: Minuette wave (i) of {v}.

DIRECTION: Upside into wave {v}.

DETAILS: Looking for further upside into wave {v} as we seem to have successfully broken the previous Elliott Wave triangle in wave {iv} and we seem to be finding support on 600$.

Welcome to our Elliott Wave Analysis for Eli Lilly & Co. (LLY) as of January 31, 2024, presented by the Trading Lounge. We'll delve into the daily and 4-hour charts to provide insights into potential trading opportunities.

LLY Elliott Wave Technical Analysis - Daily Chart:

In our daily chart analysis for LLY, the current Elliott Wave structure indicates a promising trend characterized by an impulse mode. The specific wave under consideration is Wave {v} of 3, situated within the Minuette wave (i) of {v}. The prevailing direction is on the upside into wave {v}. The analysis suggests further upside potential as we observe a successful break of the previous Elliott Wave triangle in wave {iv}, with apparent support identified around the $600 mark.

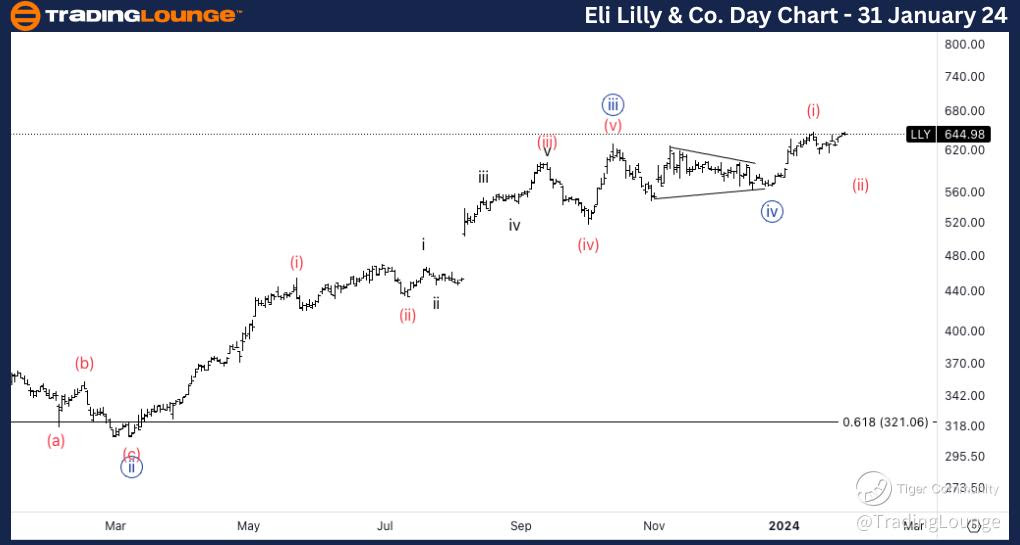

LLY Elliott Wave Analysis - 4H Chart:

Zooming in on the 4-hour chart, the Elliott Wave analysis for LLY reveals a correctional phase. The identified structure is Wave (ii) of {v}, with the current position denoted as Wave b of (ii). The anticipated direction is downside into wave c of (ii). We are ideally looking for another downward leg into wave c of (ii) before anticipating a potential upside resumption.

For traders and investors, this analysis provides valuable insights into potential entry and exit points based on Elliott Wave patterns. Stay tuned for further updates as the market dynamics evolve, and remember, successful trading requires a comprehensive understanding of the Elliott Wave principles.

If you are considering Eli Lilly & Co. as part of your portfolio, keep a close eye on these Elliott Wave patterns for informed decision-making. The Trading Lounge remains committed to providing timely and insightful technical analysis to enhance your trading strategies.

Technical Analyst: Alessio Barretta

Source: Tradinglounge.com, Learn From the Experts Join TradingLounge Here

Previous: The Coca-Cola Company (KO)

LLY Elliott Wave Analysis Trading Lounge 4Hr Chart, 31 January 24

Eli Lilly & Co.,( LLY) 4Hr Chart

LLY Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Correction

STRUCTURE: Wave (ii) of {v}.

POSITION: Wave b of (ii).

DIRECTION: Downside into wave c of (ii).

DETAILS: Ideally looking for one more leg down into wave c of (ii) to then look for upside resumption.