ASX: WESTPAC BANKING CORPORATION (WBC) Elliott Wave Technical Analysis – TradingLounge

Greetings, Traders!

This Elliott Wave analysis offers an updated outlook on WESTPAC BANKING CORPORATION (WBC) listed on the Australian Stock Exchange (ASX).

Our latest evaluation indicates that ASX: WBC may have completed a Triangle pattern, signaling a potential upward price movement. This report highlights key price levels to help traders assess the validity of this scenario, potential invalidation levels, and a bullish confirmation signal.

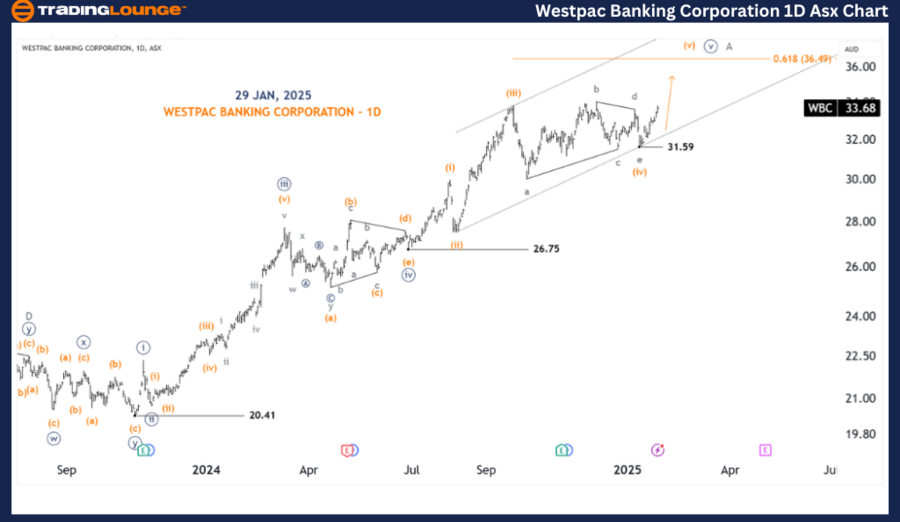

ASX: WESTPAC BANKING CORPORATION (WBC) – 1D Chart (Semilog Scale)

Market Function: Major Trend (Minute degree, navy)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave (v) - orange of Wave ((v)) - navy

Technical Analysis:

The Triangle pattern appears complete, with Wave 4 forming a recent low at 31.59.

The subsequent Wave (v) - orange is now unfolding upwards.

Price targets suggest a potential move towards 36.49, with an extension possibility to the upper edge of the trend channel.

Key Trading Levels:

✅ Bullish Confirmation: Price sustains above 31.59

❌ Invalidation Level: 31.59

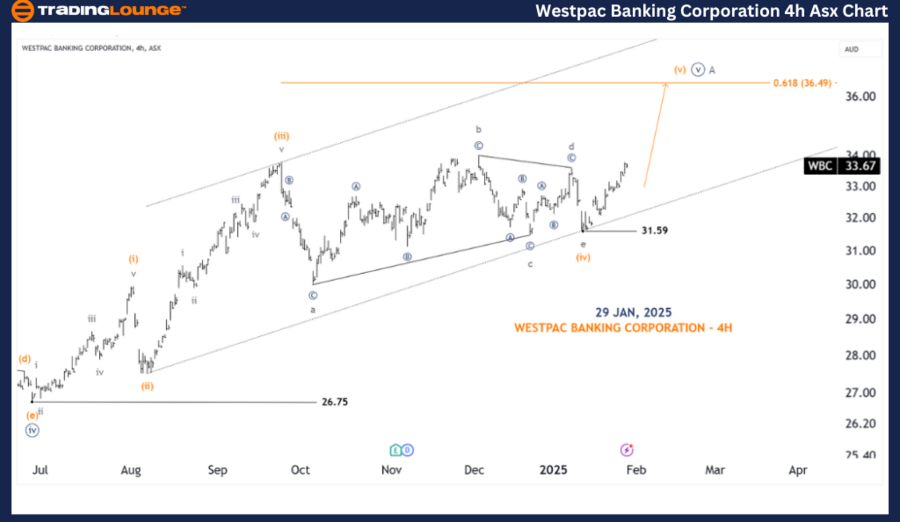

ASX: WESTPAC BANKING CORPORATION (WBC) – 4H Chart Analysis

Market Function: Major Trend (Minor degree, grey)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave (v) - orange

Technical Analysis:

The Triangle formation appears completed, with the price breaking above the wave d - grey level.

In the short term, price is expected to move towards the 0.618 Fibonacci retracement level of Wave (v) to Wave (i).

Key Trading Levels:

✅ Short-Term Target: 0.618 Fibonacci ratio

❌ Invalidation Level: 31.59

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SCENTRE GROUP – SCG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our Elliott Wave analysis of ASX: WBC provides traders with key market insights to refine their trading strategies. By pinpointing critical price levels, we enhance confidence in the current wave count and potential bullish movements.

This professional technical analysis helps traders navigate market trends with precision and clarity, ensuring well-informed entry and exit decisions.