ASX: SCENTRE GROUP – SCG Elliott Wave Technical Analysis

Greetings, Our Elliott Wave analysis for today highlights an updated view of the Australian Stock Exchange (ASX), specifically analyzing SCENTRE GROUP – SCG.

We project upside potential for ASX: SCG in the near term. The short-term outlook emphasizes monitoring for a pullback within the second wave to pinpoint high-quality long-trade setups. This analysis equips traders with insights on when to stay out, when to enter positions, and how to approach trading systematically and intuitively.

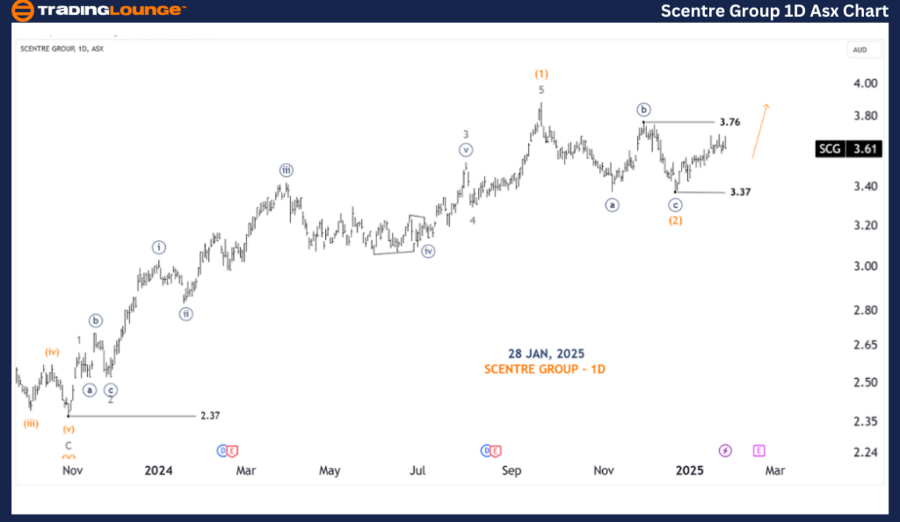

ASX: SCENTRE GROUP – SCG Elliott Wave Analysis TradingLounge (1D Chart)

SCG 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave (3) - orange

Details:

Wave (2) - orange likely ended as a Zigzag near the low of 3.37, setting the stage for the development of Wave (3) - orange, which is identified as an Extended Wave.

Currently, Wave 1 - grey is forming within Wave (3) - orange.

Invalidation Point: 3.37

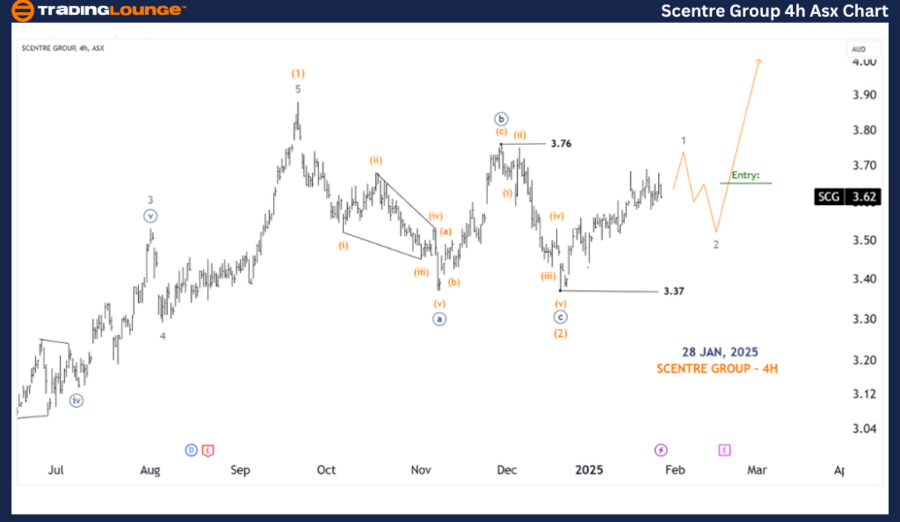

ASX: SCENTRE GROUP – SCG Elliott Wave Analysis (4-Hour Chart)

ASX: SCENTRE GROUP TradingLounge 4-Hour Chart Analysis

Function: Major Trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave 1 - grey of Wave (3) - orange

Details: The short-term outlook suggests that Wave 1 - grey of Wave (3) - orange is nearing its completion.

A pullback in Wave 2 - grey is anticipated shortly, presenting a significant opportunity to identify Long Trade Setups.

Invalidation Point: 3.37

Key Point: Focus on Wave b of Wave 2 - grey

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: MINERAL RESOURCES LIMITED (MIN) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our analysis of ASX: SCENTRE GROUP – SCG emphasizes short-term and contextual trends, offering actionable insights into the current market movements. The forecast provides specific price levels to validate or invalidate the wave count, boosting confidence in the outlook. With these key elements, traders can adopt an informed and professional approach to navigating market trends effectively.