ASX: MINERAL RESOURCES LIMITED (MIN) Elliott Wave Technical Analysis - TradingLounge

Greetings,

Today's Elliott Wave analysis presents an updated outlook on MINERAL RESOURCES LIMITED (ASX: MIN), a stock listed on the Australian Stock Exchange (ASX).

This analysis highlights the significant bullish potential in ASX:MIN, offering valuable insights on optimal entry points, bullish confirmations, and critical price levels. These details assist traders in effectively tracking the uptrend based on this forecast.

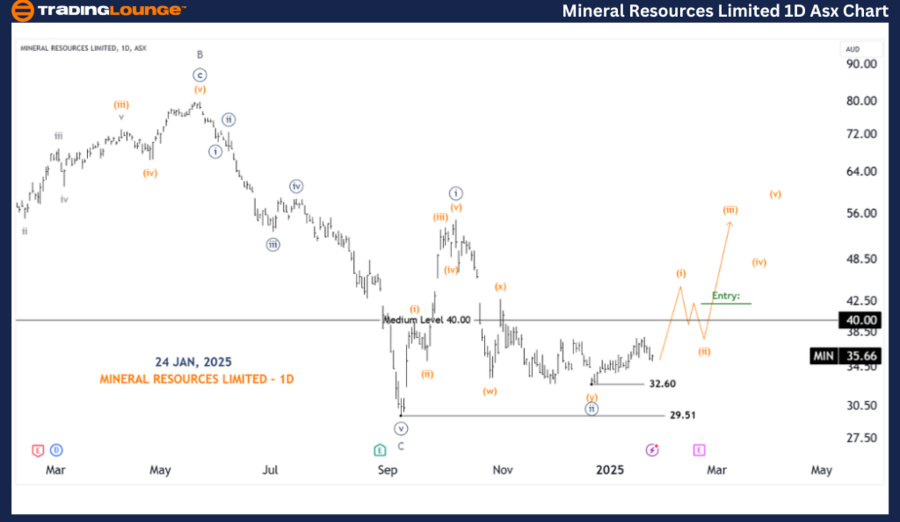

ASX: MINERAL RESOURCES LIMITED (MIN) 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minuette degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy

Details:

- Wave ((ii)) - navy completed a sharp correction with a deep retracement, forming a Double Zigzag pattern.

- Wave ((iii)) - navy is expected to push significantly higher.

- Once wave (i),(ii) - orange completes, especially after wave (ii) moves higher again, it offers an ideal long opportunity around the key resistance level of 40.00.

Invalidation point: 32.60

Key Point: 40.00

ASX: MINERAL RESOURCES LIMITED (MIN) 4-Hour Chart Analysis

Function: Major trend (Minuette degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy

Details:

- The 4-hour chart aligns with the daily chart analysis, confirming the bullish structure.

- Wave (i) - orange of wave ((iii)) - navy is still developing.

- Traders should consider entering positions only after wave (ii) - orange completes and initiates an upward movement.

Invalidation point: 32.60

Key Point: 40.00

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: COLES GROUP LIMITED – COL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis of ASX: MINERAL RESOURCES LIMITED (MIN) provides an in-depth market outlook, helping traders make well-informed decisions. Key price levels act as confirmation and invalidation points, strengthening the reliability of the wave count. By leveraging these insights, traders can align their strategies with the evolving market trends and enhance their trading confidence.