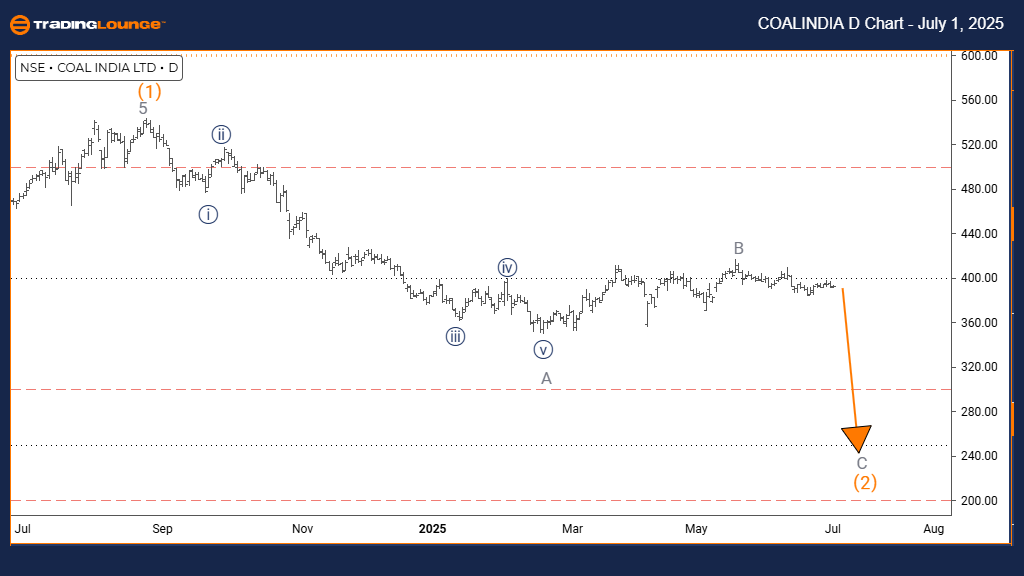

COAL INDIA Elliott Wave Analysis – TradingLounge Daily Chart

COAL INDIA Elliott Wave Technical Overview

Function: Counter-Trend

Mode: Impulsive

Structure: Gray Wave C

Position: Orange Wave 4

Direction (Lower Degrees): Gray Wave C (Started)

Details: Completion of Gray Wave B followed by initiation of Gray Wave C

Daily Chart Summary

The daily Elliott Wave analysis of COAL INDIA stock reflects a counter-trend scenario. Price action currently follows an impulsive wave pattern, suggesting a strong move against the broader market trend. The identified wave, Gray Wave C, is unfolding within the corrective structure of Orange Wave 4, signaling a potential nearing of the correction's conclusion.

Wave B to C Transition

The completed Gray Wave B phase has initiated Gray Wave C, marking a decisive segment in the counter-trend. Gray Wave C typically represents the final wave within a correction, characterized by increased momentum in the opposite direction of the primary trend. This movement continues within the framework of Orange Wave 4.

Technical Outlook

At present, COAL INDIA appears to be progressing through the final stage of a corrective move. With the impulsive nature of Gray Wave C gaining traction and Gray Wave B completed, downward price momentum is likely. Traders should closely monitor for reversal signs, as this phase often precedes the end of the Orange Wave 4 correction.

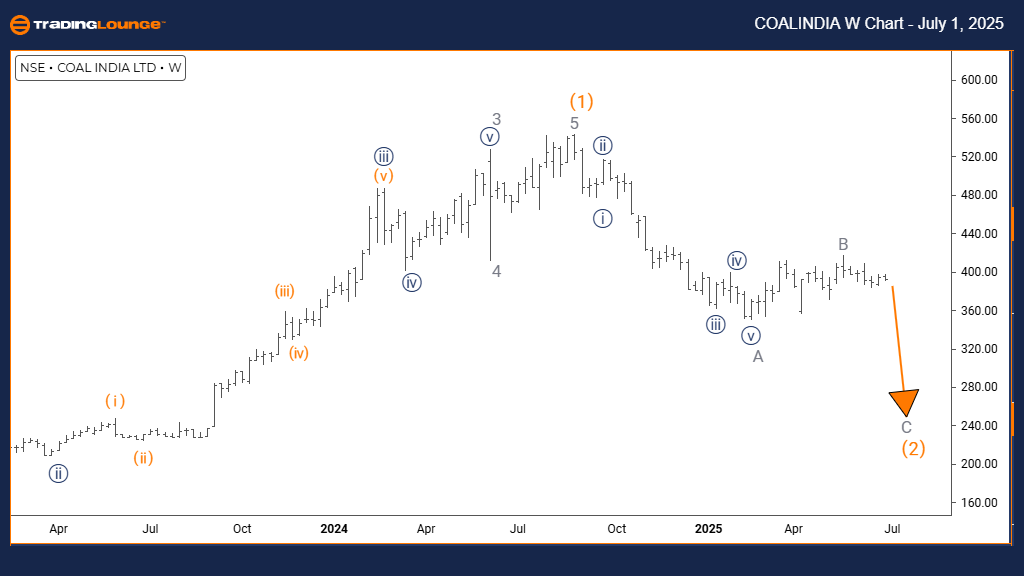

COAL INDIA Elliott Wave Analysis – TradingLounge Weekly Chart

COAL INDIA Elliott Wave Technical Overview

Function: Counter-Trend

Mode: Impulsive

Structure: Gray Wave C

Position: Orange Wave 4

Direction (Lower Degrees): Gray Wave C (Started)

Details: Gray Wave B is complete, and Gray Wave C is actively developing

Weekly Chart Summary

The weekly Elliott Wave analysis of COAL INDIA reveals a strong counter-trend impulse. Price movement is advancing against the prevailing trend, structured as Gray Wave C within the larger Orange Wave 4 corrective phase. This pattern suggests that the stock may be approaching the end of its ongoing correction.

Wave B to C Shift

With Gray Wave B appearing to be finalized, the market has transitioned into Gray Wave C. This wave is significant as it usually culminates the corrective trend, pushing with considerable momentum opposite to the dominant price direction. The current progression remains nested within the Orange Wave 4 formation.

Technical Outlook

COAL INDIA seems to be advancing through the latter phase of its counter-trend cycle. The presence of Gray Wave C, along with a completed Wave B, supports expectations of continued impulsive selling. Market participants should be alert to trend-reversal indicators as Gray Wave C might wrap up the larger correction seen in Orange Wave 4.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ADANI PORTS & SEZ Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support