This analysis focuses on the current trend structure of Salesforce Inc., (CRM) utilizing the Elliott Wave Theory on both the daily and 1-hour charts. Below is a breakdown of the stock's position and potential future movements.

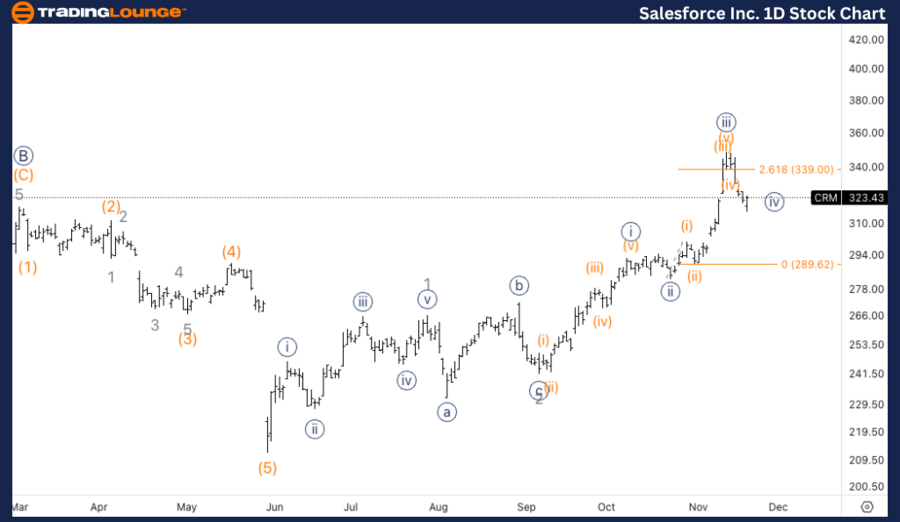

CRM Elliott Wave Analysis – Salesforce Inc. (CRM) Daily Chart

CRM Elliott Wave Technical Analysis – Daily Chart

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor Wave 3

Direction: Upside within Wave 3

Details: Salesforce Inc. (CRM) is advancing in an impulsive Minor wave 3, holding above the critical support level, Trading Level 3 (TL3), at $300. This upward momentum aligns with the Elliott Wave Theory's characteristics of wave 3, which typically exhibit strong bullish activity. Investors can expect a continuation of this upward trend, targeting higher highs as the structure remains intact.

CRM Elliott Wave Technical Analysis – Daily Chart

On the daily chart, Salesforce (CRM) is advancing within Minor wave 3, building momentum as it holds above Trading Level 3 at $300. This suggests bullish continuation, with the possibility of setting new highs in line with the ongoing impulsive structure. The trend remains upward, and the focus is on further gains as wave 3 typically exhibits strong momentum.

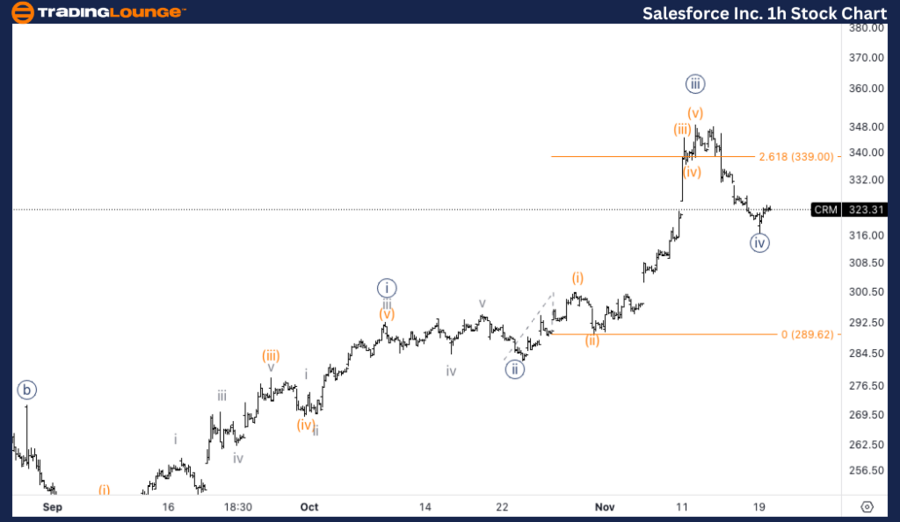

CRM Elliott Wave Technical Analysis – 1-Hour Chart

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iv} of 3

Direction: Bottoming in Wave {iv}

Details: On the 1-hour chart, CRM is completing wave {iv} of Minor wave 3. This corrective wave could manifest either as a sharp decline or a sideways consolidation. Traders should monitor closely for signs of a confirmed bottom, which will signal the beginning of wave {v}. This next phase may bring renewed bullish momentum, aligning with the broader uptrend visible in the daily chart.

CRM Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, CRM is likely near the end of wave {iv} of Minor wave 3. This wave could take the form of either a sharp correction or sideways consolidation, providing a base for the next leg higher in wave {v}. Traders should watch for signs of a confirmed bottom and renewed upside momentum, particularly as the structure of wave {iv} unfolds in the coming sessions.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Walt Disney Co. (DIS) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support