Elliott Wave Analysis of The Walt Disney Co. (DIS)

In this Elliott Wave analysis, we’ll evaluate the trend structure of The Walt Disney Co. (DIS) using daily and 1-hour charts to determine the current wave position and potential price targets.

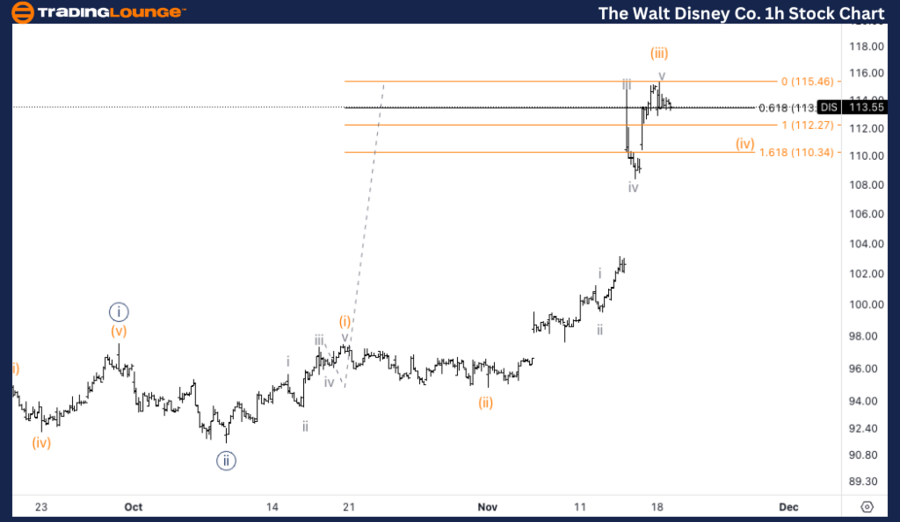

DIS Elliott Wave Analysis: TradingLounge Daily Chart

The Walt Disney Co. (DIS) Daily Chart

DIS Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 1

Direction: Upside in wave 1

Details: The longer-term count poses challenges due to uncertainties about whether the extended correction is fully complete. With prices now trading above TradingLevel1 at $100, confidence in the bullish scenario is growing, suggesting a potential for further upward movement.

DIS Elliott Wave Technical Analysis – Daily Chart

On the daily chart, Disney (DIS) is advancing in wave {iii} of 1, part of a larger impulsive structure. The longer-term Elliott Wave count remains somewhat unclear due to the complex correction the stock has experienced. However, breaking above TradingLevel1 at $100 has strengthened the case for an upside breakout. This suggests the correction might have concluded, with DIS positioned for further gains in this impulsive structure.

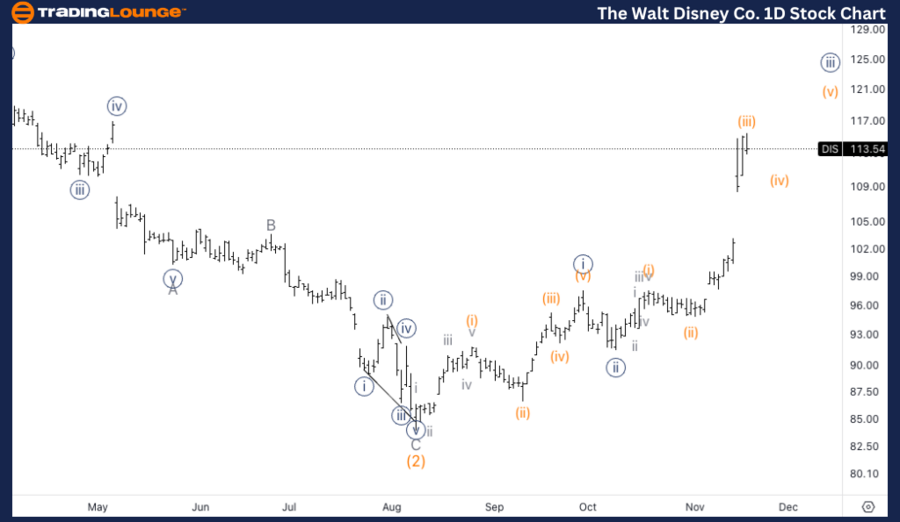

DIS Elliott Wave Analysis: TradingLounge 1-Hour Chart

The Walt Disney Co. (DIS) 1H Chart

DIS Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iii) of {iii}

Direction: Pullback in wave (iv)

Details: After a sharp rally, it appears wave (iii) of {iii} has reached a top. A corrective wave (iv) is now expected, which could find support near the previous wave iv of one lesser degree, as well as near equality with wave (2), around the $112 level.

DIS Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, wave (iii) of {iii} appears to have peaked following a strong acceleration. The next anticipated move is a corrective wave (iv). This pullback is likely to find support near the prior wave iv of one lesser degree and around $112, aligning with equality to the earlier wave (2). This consolidation should set the stage for a final upward thrust in wave (v).

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JP Morgan & Chase Co Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support