Elliott Wave Analysis for JP Morgan & Chase Co. (JPM): Daily and 1-Hour Charts

This detailed Elliott Wave analysis examines the daily and 1-hour charts of JP Morgan & Chase Co. (JPM). By leveraging Elliott Wave Theory, we aim to provide insights into the current market trends and predict potential price movements.

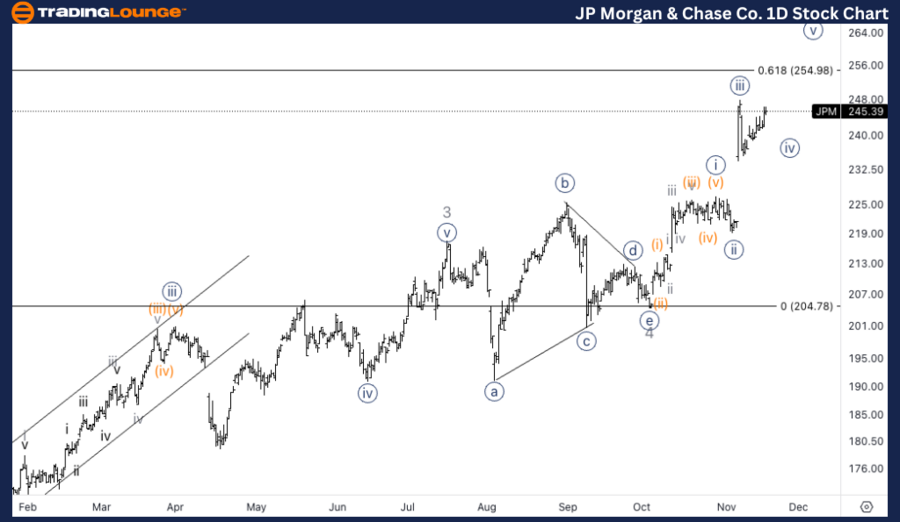

JPM Elliott Wave Analysis - TradingLounge Daily Chart

JP Morgan & Chase Co. (JPM) Daily Chart Analysis

JPM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 5

Direction: Upside in 5 of (5)

Details: JPM is currently trading above TradingLevel2 at $200, indicating strong bullish momentum within Minor wave 5. The next key target is TradingLevel3 at $300, which could act as a critical resistance level.

JPM Elliott Wave Technical Analysis – Daily Chart

On the daily chart, JP Morgan & Chase Co. (JPM) is advancing within Minor wave 5 of the larger wave (5). The breakout above TradingLevel2 at $200 reflects a robust uptrend. The next technical and psychological resistance level to monitor is $300, which could pose a challenge for further upside momentum.

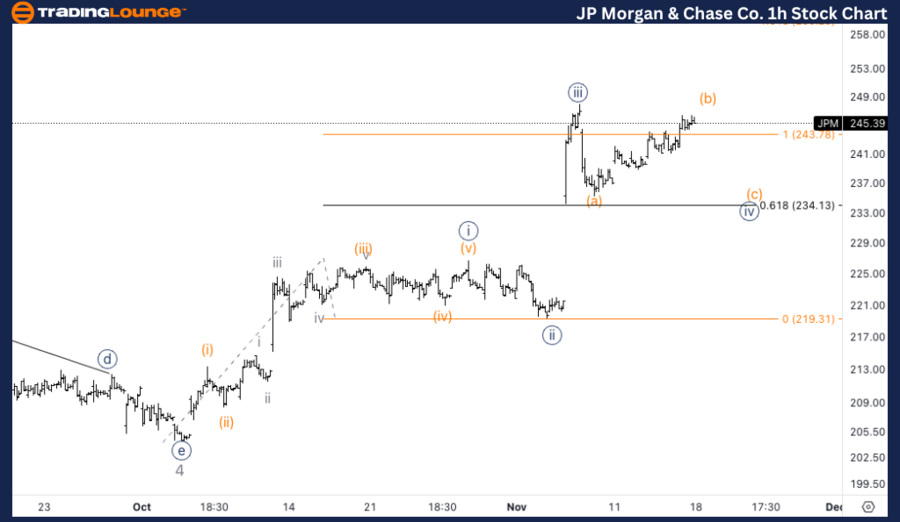

JPM Elliott Wave Analysis - TradingLounge 1-Hour Chart

JP Morgan & Chase Co. (JPM) 1H Chart Analysis

JPM Stock Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iv} of 5

Direction: Bottom in wave {iv}

Details: JPM is anticipated to complete a corrective phase within wave {iv}. A sharp decline, identified as potential wave (a), was followed by a corrective rally in wave (b). A further downside move in wave (c) of {iv} is expected, with MinorGroup1 likely to act as strong support.

JPM Technical Analysis – 1H Chart

On the 1-hour chart, JPM appears to be completing wave {iv} within Minor wave 5. The initial decline (wave (a)) has been followed by a corrective bounce (wave (b)). A final move lower in wave (c) is anticipated to complete wave {iv}. MinorGroup1 is expected to hold as a support zone, potentially marking the end of wave {iv} before the bullish trend resumes in wave {v}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Berkshire Hathaway Inc. Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support