Greetings,

Our updated Elliott Wave analysis of COLES GROUP LIMITED (ASX:COL) indicates further bullish potential. The current wave structure suggests that wave 3‑grey is extending upward. Short-term action shows wave ii))‑navy nearing completion as a classic Zigzag formation. Once this wave finalizes, wave iii))‑navy is expected to resume the primary uptrend.

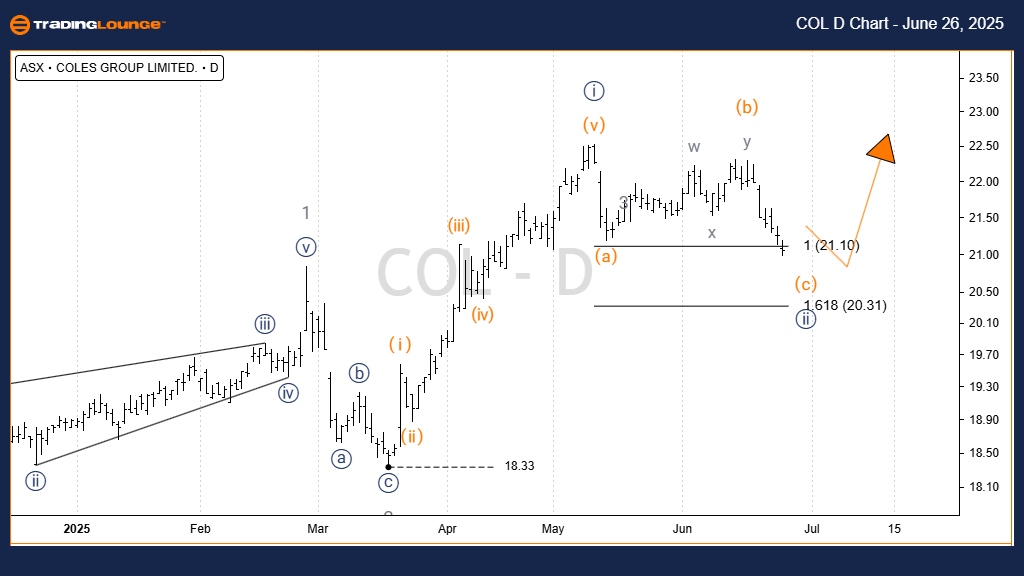

COLES GROUP LIMITED – COL Elliott Wave Technical Analysis – Daily Chart (1D, Semilog Scale)

ASX: COLES GROUP LIMITED – COL Elliott Wave Technical Analysis

Function: Major trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ii))‑navy within Wave 3‑grey

Analysis Details:

Since reaching a low of 18.33 AUD, wave 3‑grey has been progressing, divided into i)), ii)), and iii))‑navy subwaves. Currently, wave ii))‑navy is forming a Zigzag labeled a)b)c)‑orange, and it appears close to completion. Wave c)‑orange is projected to reach between 21.10 and 20.31 AUD before the corrective wave finishes. Once complete, expect wave iii))‑navy to continue the bullish impulse.

Key Support (Invalidation Point): 18.33 AUD

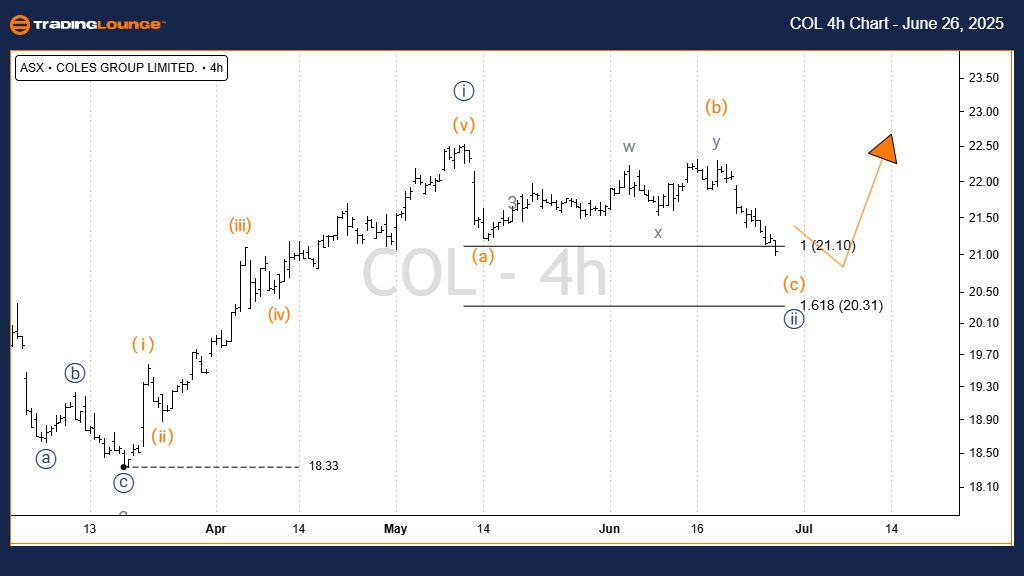

COLES GROUP LIMITED – COL Elliott Wave Technical Analysis – 4‑Hour Chart

Function: Major trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave c)‑orange of Wave ii))‑navy

Analysis Details:

The 4-hour chart highlights wave ii))‑navy targeting the 21.10–20.31 AUD range. After this correction, wave iii))‑navy is expected to initiate, potentially driving prices toward 30.00 AUD.

Key Support (Invalidation Point): 18.33 AUD

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: MINERAL RESOURCES LIMITED – MIN Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our Elliott Wave forecast for COLES GROUP LIMITED (ASX:COL) delivers a professional perspective on the stock’s current and potential trend direction. With clearly defined price targets and wave structure validation, our analysis supports technical traders and investors aiming to capitalize on medium- to long-term movements. For enhanced trading confidence, our charts specify critical validation/invalidation levels aligned with Elliott Wave principles.