Greetings,

Our latest Elliott Wave analysis focuses on MINERAL RESOURCES LIMITED (ASX:MIN). Based on the current technical structure, we identify significant upside potential as a major Wave 4 correction appears to have concluded. We now anticipate a transition into Wave 5, which will highlight key target zones and invalidation levels to watch.

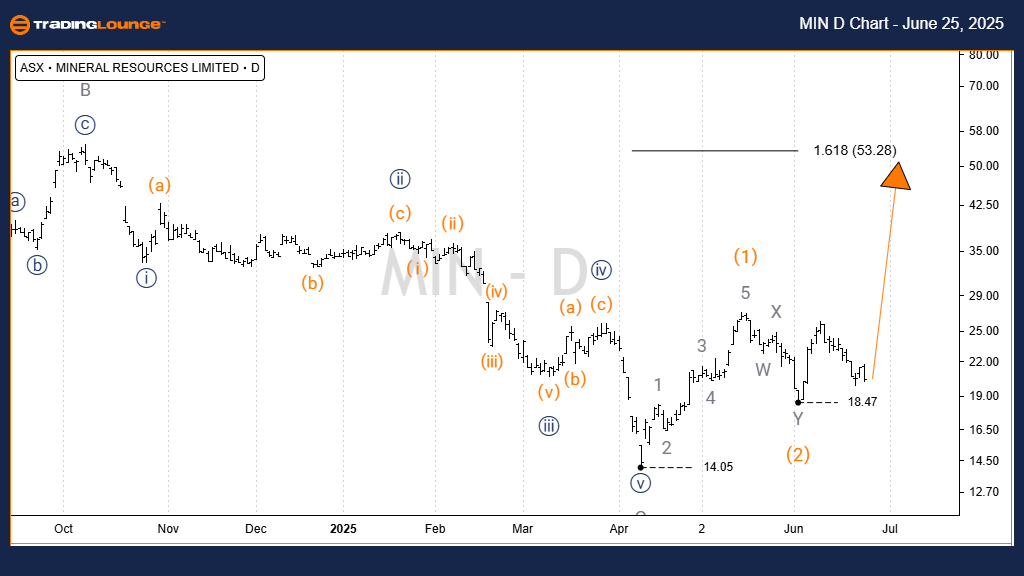

ASX: Mineral Resources Limited (MIN) Elliott Wave Analysis - Tradinglounge (1D Chart)

ASX: MINERAL RESOURCES LIMITED 1D Chart Technical Analysis

ASX: MINERAL RESOURCES LIMITED (MIN) Elliott Wave Technical Analysis

Function: Major Trend (Intermediate Degree – Orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 to Wave 5 (Orange to Navy)

Technical Breakdown:

- The recent low at $14.05 likely marks the completion of a large corrective structure.

- A Motive wave is now expected to drive prices higher.

- Upside targets range between $50.00 and $80.00, assuming the price remains above $14.05, sustaining the bullish view.

- A brief move below $18.47 aligns with a prolonged Wave 2 (Orange) but does not invalidate the bullish setup.

- The continuation of Wave 3 (Orange) is anticipated if upward momentum resumes.

Key Invalidation Level: $14.05

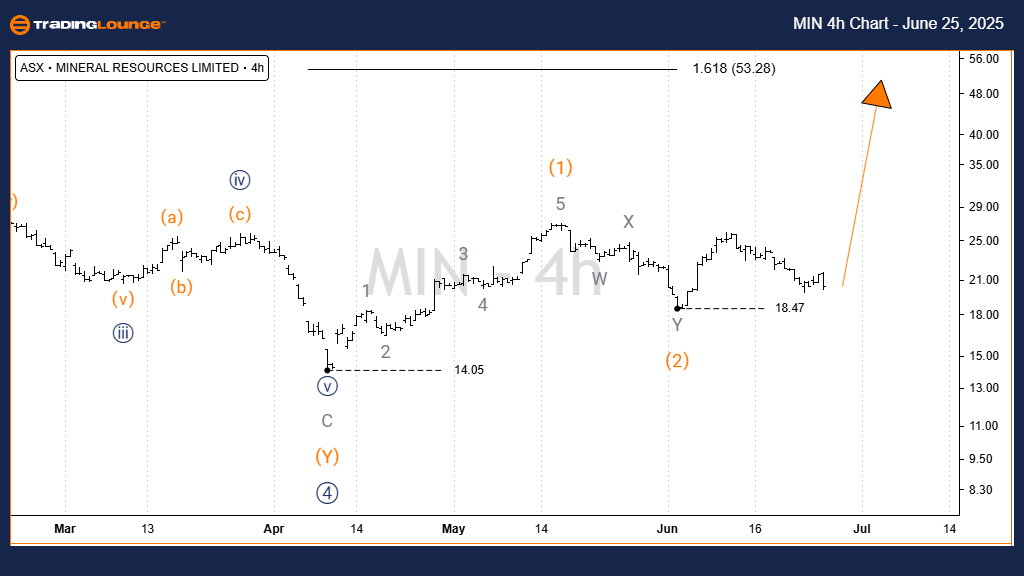

ASX: MINERAL RESOURCES LIMITED – MIN – Elliott Wave Technical Analysis (4‑Hour Chart)

Function: Major Trend (Intermediate Degree – Orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 (Orange)

Technical Breakdown:

- Following the $14.05 low, Wave 1 (Orange) completed a five-wave advance.

- Wave 2 (Orange) ended with a Double Zigzag correction at $18.47.

- Current price action suggests Wave 3 (Orange) is underway, with the structure pointing toward the $53.28 target.

- The bullish scenario remains valid above $18.47, with the critical invalidation level at $14.05.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NST Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave forecast for ASX:MIN integrates the broader trend with a near-term view. With clearly defined support and resistance levels, traders can monitor potential entry zones and risk parameters. Our analysis emphasizes wave count validation, contributing to a confident bullish outlook supported by structured technical reasoning.