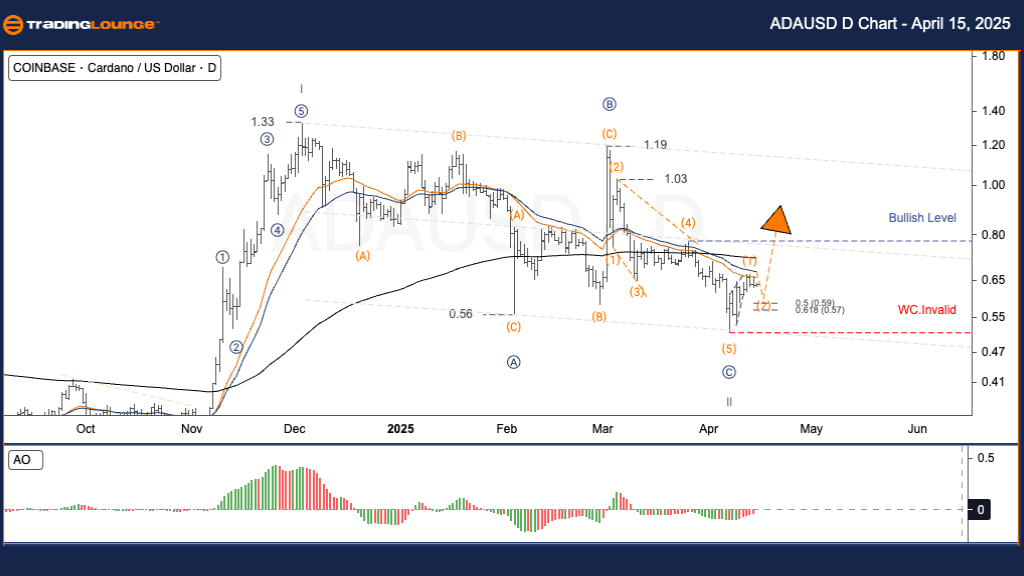

Cardano / U.S. Dollar (ADAUSD) Elliott Wave Analysis - TradingLounge Daily Chart

ADAUSD Elliott Wave Technical Analysis – Bullish Reversal in Sight

Function: Counter-Trend

Mode: Corrective

Structure: Flat

Position: Wave ((C))

Next Higher Degree Direction: Wave II

Invalidation Level: N/A

Cardano (ADAUSD) Trading Strategy – Daily Chart Outlook:

Cardano has been undergoing a large ABC corrective structure within Wave II since late 2024. Current Elliott Wave analysis identifies a potential trend reversal as ADA forms a solid base near the $0.514 mark, marking the end of Wave ((C)). This “Bottom Confirmed” pattern signals the beginning of Wave III, a bullish impulse wave.

- Wave I: Completed at $1.33

- Wave II: Extended over 4 months forming a Flat correction

- Wave C: Terminated at $0.514

Trading Strategies

Strategy Overview – Swing Trading Opportunity:

✅ Swing traders should monitor the $0.59–$0.57 range for long entries. A breakout above $0.769 resistance confirms bullish momentum.

Risk Management:

Invalidation Level: A decline below $0.514 invalidates the bullish count and calls for re-evaluation.

Cardano / U.S. Dollar (ADAUSD) Elliott Wave Analysis - TradingLounge H4 Chart

ADAUSD Elliott Wave Technical Analysis – Short-Term Reversal Setup

Function: Counter-Trend

Mode: Corrective

Structure: Flat

Position: Wave ((C))

Next Higher Degree Direction: Wave II

Invalidation Level: N/A

Cardano (ADAUSD) Trading Strategy – H4 Chart Insight:

On the 4-hour timeframe, Cardano maintains its corrective structure, but the completion of Wave ((C)) at $0.514 supports a bullish reversal. ADA now enters a setup phase for a potential rally under Wave III as momentum shifts.

- Wave I: Peaked at $1.33

- Wave II: Developed over 4 months in a classic Flat correction

- Wave C: Completed at $0.514

Trading Strategies

Strategy Overview – Swing Trade Setups:

✅ Price zone between $0.59–$0.57 presents entry potential for swing traders. A confirmed break above $0.769 adds strength to the upward move.

Risk Management:

Invalidation Level: A move below $0.514 negates the current bullish count and signals structural change.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

Previous: NEOUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support