Soybeans Commodity Elliott Wave Analysis

Soybeans Elliott Wave Technical Analysis

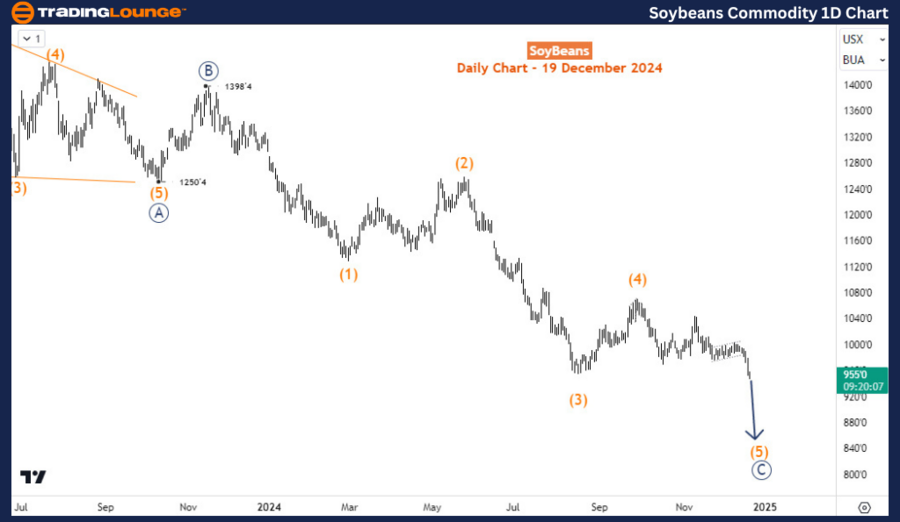

Soybeans broke to the downside on December 17, marking a continuation of the bearish trend initiated in June 2022 when prices peaked above $1,785. The current price hovers around $950, with the potential to fall further toward $800 in the coming days or weeks.

Soybeans Commodity Daily Chart Analysis

The daily chart highlights that the bearish cycle from June 2022 is a corrective structure rather than an impulsive one. Wave ((A)) was completed in October 2023 at $1,250, followed by a bounce to $1,398 for wave ((B)) in November 2023. The ongoing wave ((C)) is unfolding with an incomplete impulsive structure and is now in its final wave – wave (5). This bearish correction since June 2022 retraces the prior bullish impulse wave that began in May 2019 and culminated in June 2022.

Further analysis on the H4 chart provides insights into the progression of wave (5) and its potential targets.

Soybeans Commodity H4 Chart Analysis

Wave (5) of the bearish cycle has progressed through waves 1 and 2 and is currently in wave 3. Wave 3 remains incomplete and is currently in wave (iii) of ((iii)) of 3. This indicates that further downside is likely before wave (5) concludes. Additionally, there is a possibility of an alternative scenario, where an ending diagonal structure could complete wave (5) instead of an impulse. Regardless of the pattern, the short-term outlook favors further declines, making selling opportunities on bounces a strategic approach for traders.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WTI Crude Oil Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support