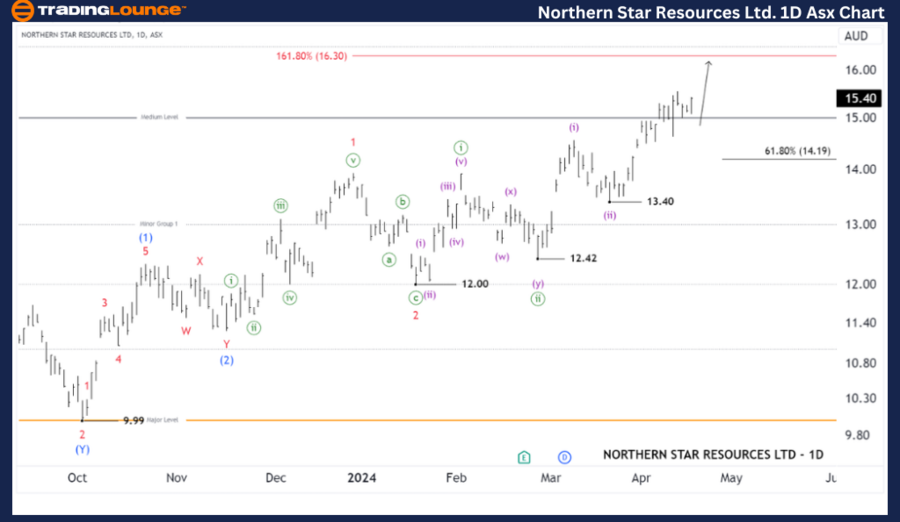

ASX: NORTHERN STAR RESOURCES LTD – NST Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with NORTHERN STAR RESOURCES LTD – NST. Our recently updated forecast for NST in the Top 50 ASX Stocks service is still active. We have identified a bullish opportunity with NST, setting up wave (iii)-purple of wave ((iii))-blue that could push much higher.

ASX: NORTHERN STAR RESOURCES LTD – NST Elliott Wave Technical Analysis

ASX: NORTHERN STAR RESOURCES LTD – NST 1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, blue)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-purple of Wave ((iii))-green of Wave 3-red of Wave (3)-blue

Recent analysis: Accurate forecast

Details: The detailed short-term outlook shows that wave (3)-blue is unfolding, subdividing into waves 1 and 2-red, which have been completed, and wave 3-red is currently unfolding to push higher. At a smaller degree, wave (iii)-purple is opening to push even higher, targeting an immediate objective around 16.30, while maintaining a price above 14.19 is an advantage and strong support for this bullish outlook.

Invalidation point: 13.40

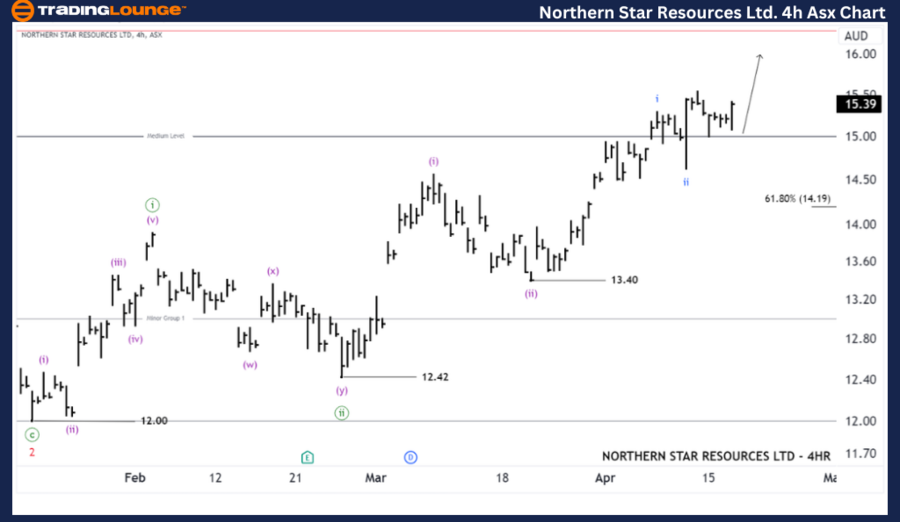

ASX: NORTHERN STAR RESOURCES LTD – NST Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: NORTHERN STAR RESOURCES LTD – NST Elliott Wave Technical Analysis

ASX: NORTHERN STAR RESOURCES LTD – NST 4-Hour Chart Analysis

Function: Major trend (Minute degree, green)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-purple of Wave ((iii))-green

Details: The shorter-term outlook indicates that the (iii)-purple wave seems to be unfolding to push higher. It is subdividing into the i-blue and ii-blue waves, with the ii-blue wave potentially just completed. The iii-blue wave might be ready to push higher as long as the price remains above the support level at 14.19, which would be advantageous from this perspective.

Invalidation point: 13.40

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: NORTHERN STAR RESOURCES LTD – NST aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: COCHLEAR LIMITED - COH Elliott Wave Technical Analysis

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE