MCD Elliott Wave Analysis: McDonald's Corp. (MCD)

In this Elliott Wave analysis of McDonald's Corp. (MCD), we examine its price movement and wave structure using Elliott Wave Theory to identify potential trading opportunities. Both the daily and 1-hour charts are reviewed to offer traders a comprehensive perspective.

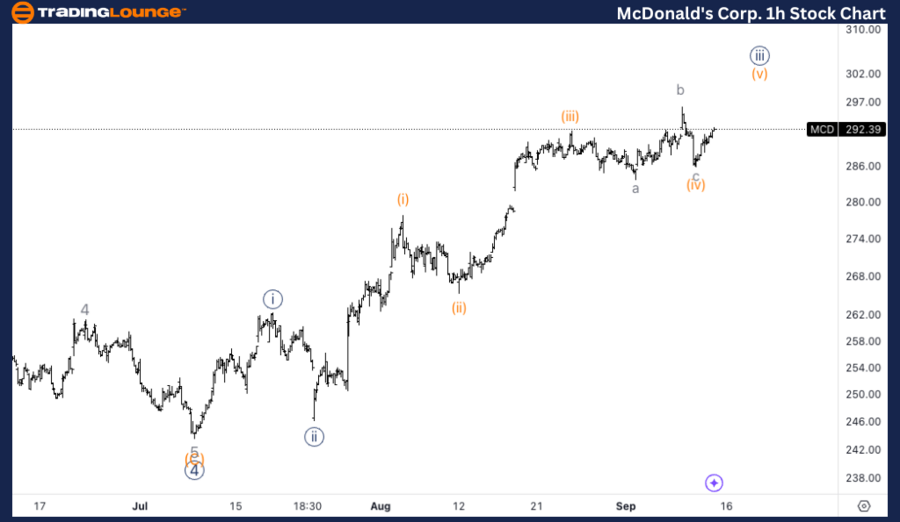

TradingLounge McDonald's Corp. Stock Elliott Wave Analysis – Daily Chart

McDonald's Corp. (MCD) Daily Chart Analysis

MCD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 1

Direction: Upside into wave 1

Details: The current price action is moving towards completing a five-wave structure within wave 1, with the stock approaching the key TradingLevel3 at $300.

MCD Stock Technical Analysis – Daily Chart Overview

In the daily chart, McDonald's is displaying a strong impulsive trend, advancing within Wave {iii} of 1. This wave signifies robust upward momentum, with the stock nearing the critical resistance level at $300, recognized as TradingLevel3 (TL3). A five-wave structure within this wave 1 is expected to complete as the price approaches this key level, indicating a significant trading opportunity for upside potential.

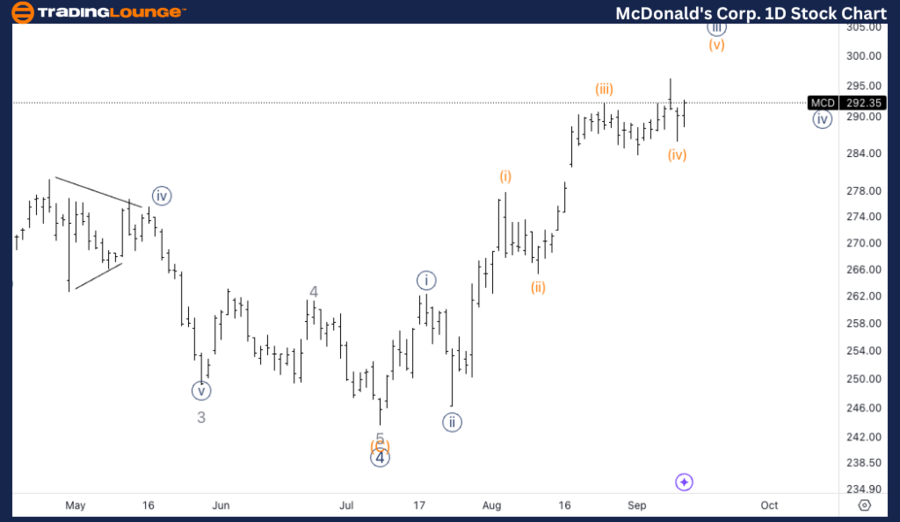

MCD Elliott Wave Analysis – 1H Chart

McDonald's Corp. (MCD) 1H Chart

McDonald's Corp MCD Stock Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave i of (v)

Direction: Upside into wave (v)

Details: The price action suggests an upward move into Wave (v) after a flat correction in Wave (iv), with support found near $280, at the end of MinorGroup2.

MCD Elliott Wave Technical Analysis – 1H Chart Overview

On the 1-hour chart, McDonald's seems to be progressing within Wave i of (v), which likely signals the beginning of the final leg in this impulsive sequence. The recent Wave (iv) formed a flat correction, and the stock found crucial support near $280, aligning with the end of MinorGroup2. This suggests further upward movement is expected in the next wave as the stock continues to build momentum.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Deere & Co. (DE) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support