Welcome to the Elliott Wave Analysis for Deere & Co. (DE). This analysis provides a detailed view of DE's price action using Elliott Wave Theory, guiding traders in making informed market decisions. We will break down both the daily and 1-hour charts to offer a thorough perspective.

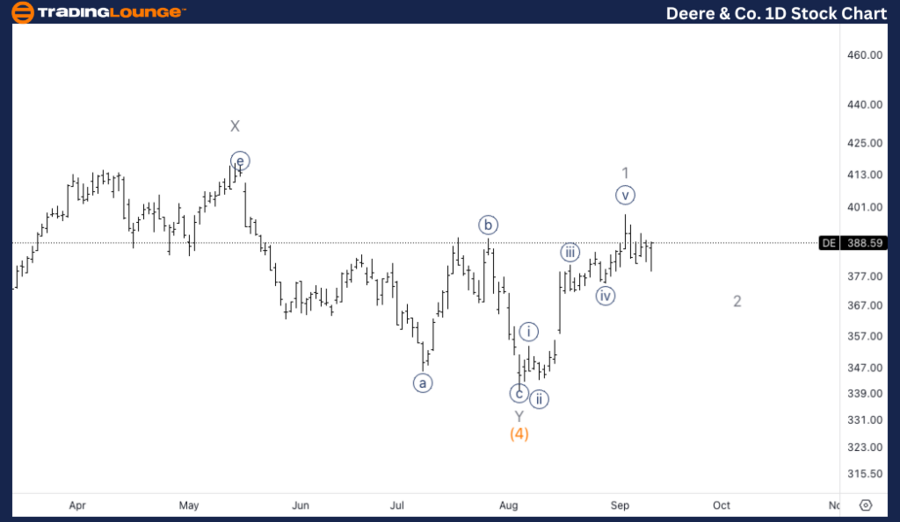

Deere & Co. (DE) Daily Chart Elliott Wave Analysis

DE Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 2 of (5)

Direction: Upside in 3

Details: We are monitoring the potential bottom of an extended Wave (4) as DE hovers near the $400 support level. A further upward move is anticipated to confirm the ongoing bullish sentiment.

DE Elliott Wave Technical Analysis – Daily Chart

On the daily chart, Deere & Co. demonstrates an impulsive trend, with DE positioned in Wave 2 of Intermediate Wave (5). A bottom formation in Wave (4) is possible around the crucial $400 support zone. This area is key for validating the anticipated upward movement.

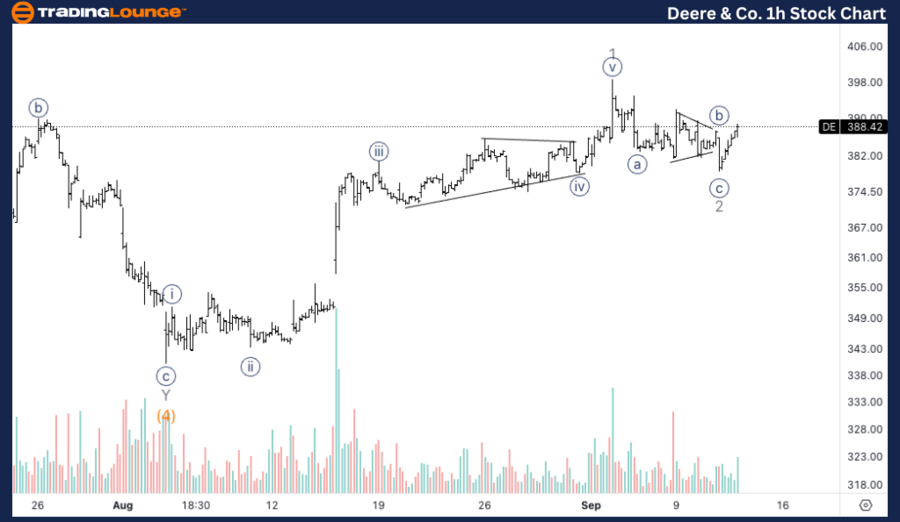

DE Elliott Wave Analysis Trading Lounge 1H Chart

Deere & Co. (DE) 1H Chart

DE Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 3

Direction: Upside in Wave {iii}

Details: On this shorter time frame, we are analyzing the completion of Wave 2, with DE showing signs of moving higher. A clear three-wave corrective structure in Wave 2 is visible, and the increasing volume on the rise supports the expectation of further gains in Wave {iii}.

DE Elliott Wave Technical Analysis – 1H Chart

In the 1-hour chart, Deere & Co. is progressing through Wave {i} of 3, signaling the start of an impulsive upward phase. The corrective Wave 2 appears to have concluded, with the chart showcasing a distinct three-wave pattern. Rising trading volume during this upward shift enhances the likelihood that DE has entered Wave {iii}, typically the strongest and most powerful phase of an impulsive wave.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Palo Alto Networks Inc. Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support