GBPUSD Elliott Wave Analysis Trading Lounge Day Chart

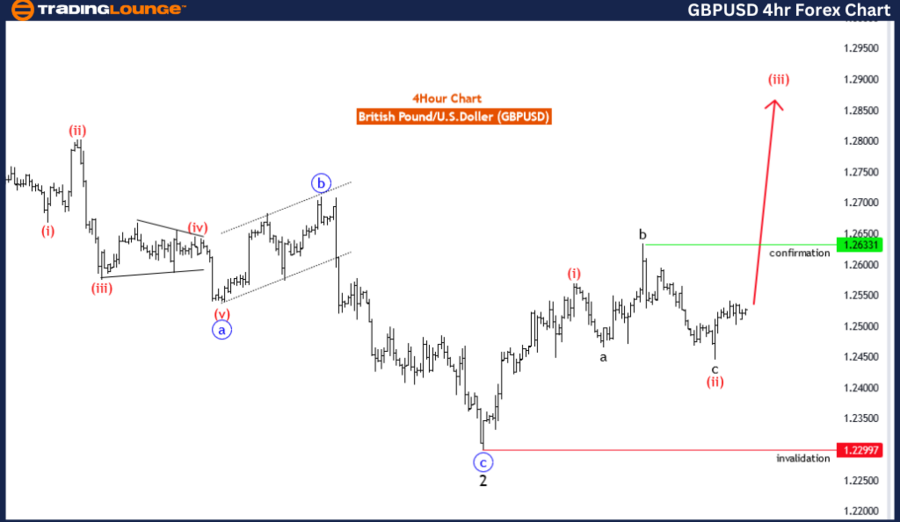

British Pound/U.S.Dollar(GBPUSD) Day Chart

GBPUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: impulsive

STRUCTURE: red wave 3

POSITION: Blue Wave 1

DIRECTION NEXT LOWER DEGREES: red wave 4

DETAILS: red wave 2 looking completed at 1.2459. Now red wave 3 is in play.

Wave Cancel invalid level: 1.22997

The daily chart for the British Pound versus the U.S. Dollar (GBP/USD) reveals a trend-following Elliott Wave pattern, providing insights into the directional movement of the market.

Function:

The function of the chart is defined as "Trend," indicating that the GBP/USD pair is currently exhibiting a strong directional movement. This suggests that the market is likely experiencing a sustained movement in one direction over a period of time.

Mode:

The mode identified is "impulsive," which signifies that the market is exhibiting strong momentum in its movement. Impulsive waves are characteristic of Elliott Wave theory and typically represent phases of robust directional movement within a broader trend.

Structure:

The structure highlighted in the analysis is "red wave 3," indicating that the market is currently in the midst of a significant and forceful upward movement. Red waves typically denote larger-degree waves within the Elliott Wave sequence, with red wave 3 often being the most powerful and extended phase.

Position:

The position on the chart is identified as "blue wave 1," suggesting that the first wave of the broader impulsive pattern has commenced. This indicates the initiation of a new phase of upward price movement within the larger trend.

Direction for Next Lower Degrees:

The direction for the next lower degrees is indicated as "red wave 4," implying that after the completion of the current impulsive wave (red wave 3), a corrective phase (red wave 4) is expected to follow. Corrective waves typically involve temporary price retracements or consolidations before the trend resumes.

Details:

The analysis notes that "red wave 2" has likely completed its retracement, with the market now in the early stages of "red wave 3." The wave cancellation or invalidation level is set at 1.22997, indicating a critical threshold. A breach of this level could potentially invalidate the current wave count, suggesting a shift in the market dynamics.

In summary, the daily chart for GBP/USD indicates a strong impulsive trend, with the market currently in the early stages of "red wave 3." The completion of "red wave 2" suggests that a new upward leg is underway, with a wave cancellation level providing a crucial reference point for assessing the validity of the current wave count.

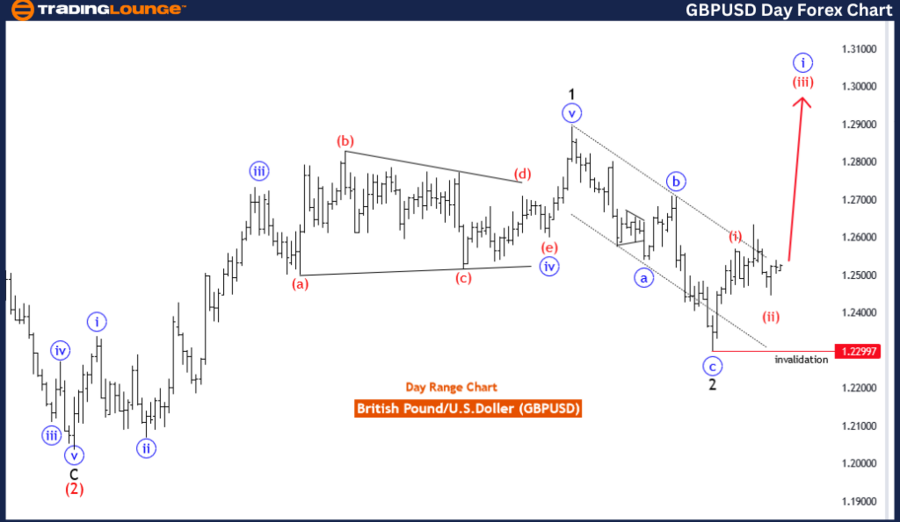

GBPUSD Elliott Wave Analysis Trading Lounge 4-Hour Chart,

British Pound/U.S.Dollar(GBPUSD) 4 Hour Chart Analysis

GBPUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: impulsive

STRUCTURE: red wave 3

POSITION: Blue Wave 1

DIRECTION NEXT LOWER DEGREES: red wave 4

DETAILS: red wave 2 looking completed at 1.2459. Now red wave 3 is in play. Wave Cancel invalid level: 1.22997

The 4-hour chart for the British Pound versus the U.S. Dollar (GBP/USD) reveals a trend-following Elliott Wave pattern, providing insights into the directional movement of the market.

Function:

The function of the chart is defined as "Trend," indicating that the GBP/USD pair is currently exhibiting a strong directional movement. This suggests that the market is likely experiencing a sustained movement in one direction over a period of time.

Mode:

The mode identified is "impulsive," which signifies that the market is exhibiting strong momentum in its movement. Impulsive waves are characteristic of Elliott Wave theory and typically represent phases of robust directional movement within a broader trend.

Structure:

The structure highlighted in the analysis is "red wave 3," indicating that the market is currently in the midst of a significant and forceful upward movement. Red waves typically denote larger-degree waves within the Elliott Wave sequence, with red wave 3 often being the most powerful and extended phase.

Position:

The position on the chart is identified as "blue wave 1," suggesting that the first wave of the broader impulsive pattern has commenced. This indicates the initiation of a new phase of upward price movement within the larger trend.

Direction for Next Lower Degrees:

The direction for the next lower degrees is indicated as "red wave 4," implying that after the completion of the current impulsive wave (red wave 3), a corrective phase (red wave 4) is expected to follow. Corrective waves typically involve temporary price retracements or consolidations before the trend resumes.

Details:

The analysis notes that "red wave 2" has likely completed its retracement, with the market now in the early stages of "red wave 3." The wave cancellation or invalidation level is set at 1.22997, indicating a critical threshold. A breach of this level could potentially invalidate the current wave count, suggesting a shift in the market dynamics.

In summary, the 4-hour chart for GBP/USD indicates a strong impulsive trend, with the market currently in the early stages of "red wave 3." The completion of "red wave 2" suggests that a new upward leg is underway, with a wave cancellation level providing a crucial reference point for assessing the validity of the current wave count.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Australian Dollar/U.S.Dollar (AUDUSD) Forex Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support