ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis Update TradingLounge Market Insights

Hello traders,

Today’s updated Elliott Wave analysis for ASX: BLOCK, INC - XYZ (SQ2) highlights a key structural move. Our assessment indicates that Wave 1) (orange) appears completed. The current downward retracement marks the beginning of Wave 2) (orange), targeting a significant support zone near 80.00 AUD. This corrective phase could set up the conditions for a strong Wave 3) (orange) bullish impulse.

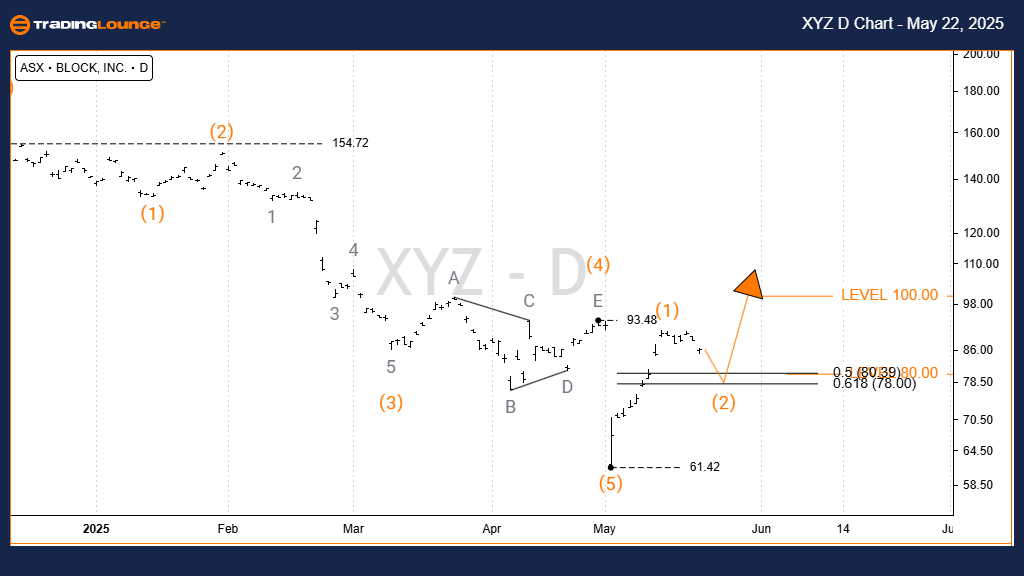

ASX: BLOCK, INC - XYZ (SQ2) Daily Chart (1D - Semilog Scale) Analysis

Function: Major Trend (Intermediate Degree - Orange)

Mode: Motive

Structure: Impulse

Wave Position: Wave 2) - Orange

Technical Summary:

- Completion of Wave 1) (orange) is likely.

- Wave 2) (orange) is unfolding downward, aligning with corrective expectations.

- Primary support at 80.00 AUD is the key level to monitor.

- Watch for reversal patterns or bullish confirmation to initiate a Wave 3) (orange) long trade setup.

Invalidation Level: 61.42 AUD – A break below this level challenges the current wave count.

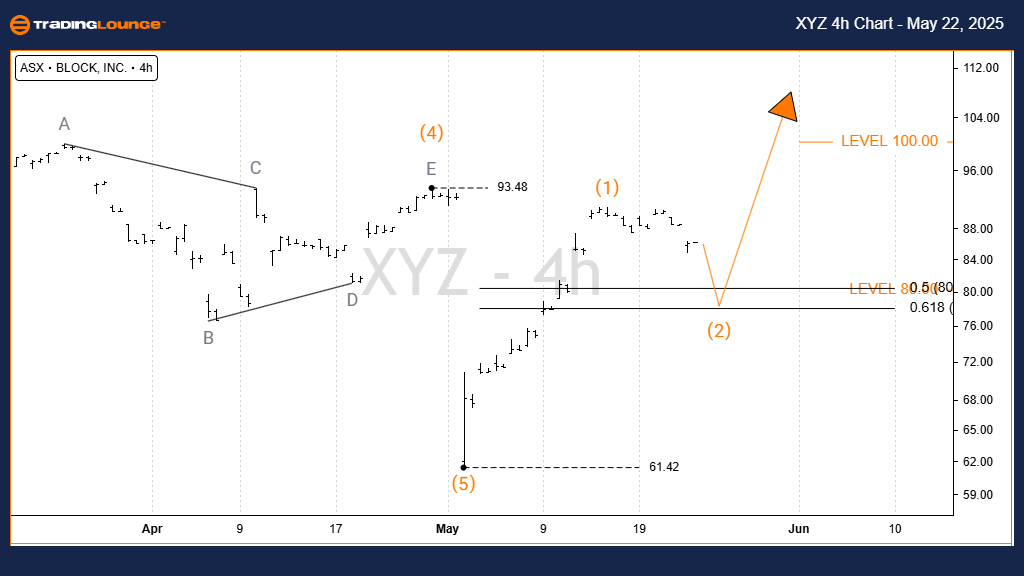

ASX: BLOCK, INC - XYZ (SQ2) 4-Hour Chart Analysis

Function: Major Trend (Intermediate Degree - Orange)

Mode: Motive

Structure: Impulse

Wave Position: Wave 2) - Orange

Technical Summary:

- The 4-hour chart confirms the broader trend seen on the daily timeframe.

- Ongoing development of Wave 2) (orange) continues to move toward the 80.00 AUD support.

- Traders should watch this zone for a potential bullish shift signaling Wave 3) (orange).

- Entry opportunities could emerge once corrective movement completes.

Invalidation Level: 61.42 AUD – Breaching this level may invalidate the current Elliott Wave scenario.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEM Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion: Elliott Wave Forecast for SQ2 on ASX

Our updated Elliott Wave forecast for ASX: BLOCK, INC - XYZ (SQ2) provides a structured view of market positioning. With Wave 2) (orange) heading toward a key support at 80.00 AUD, traders can prepare for a possible bullish turn in Wave 3) (orange). The 61.42 AUD invalidation point serves as a risk control marker to confirm or refute the wave scenario. This technical perspective aims to deliver actionable insights for strategic trade planning.