United Health Group Inc., Elliott Wave Technical Analysis

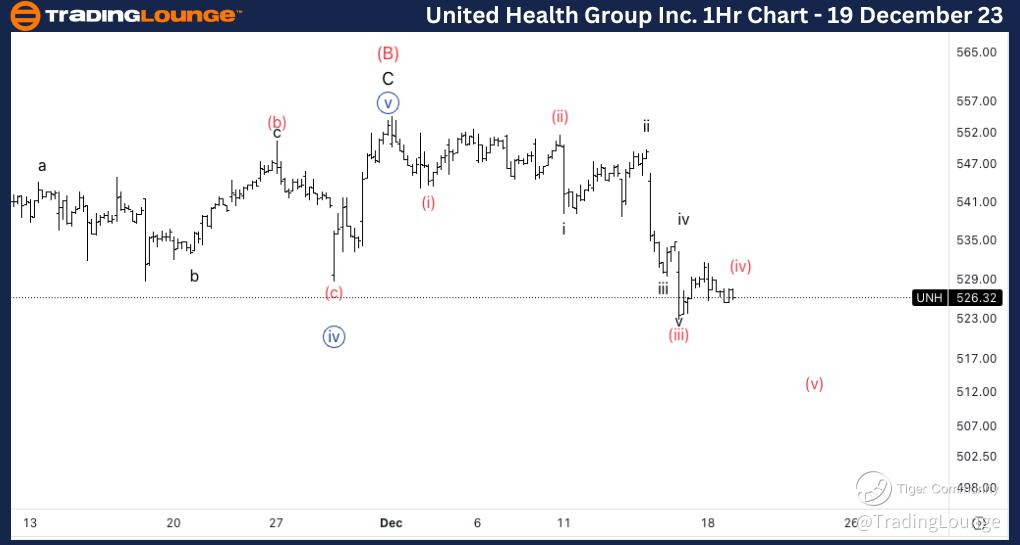

United Health Group Inc., (UNH:NYSE): 4h Chart 19 December 23

UNH Stock Market Analysis: The previous bullish count was invalidated which is why we are looking for a potential significant top in wave C of (B) and we are now looking for resumption lower.

UNH Elliott Wave Count: Wave {i} of 1.

UNH Technical Indicators: Above 200EMA.

UNH Trading Strategy: Looking for shorts after a clear five wave move off the top and a failed supported retest of 520$.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

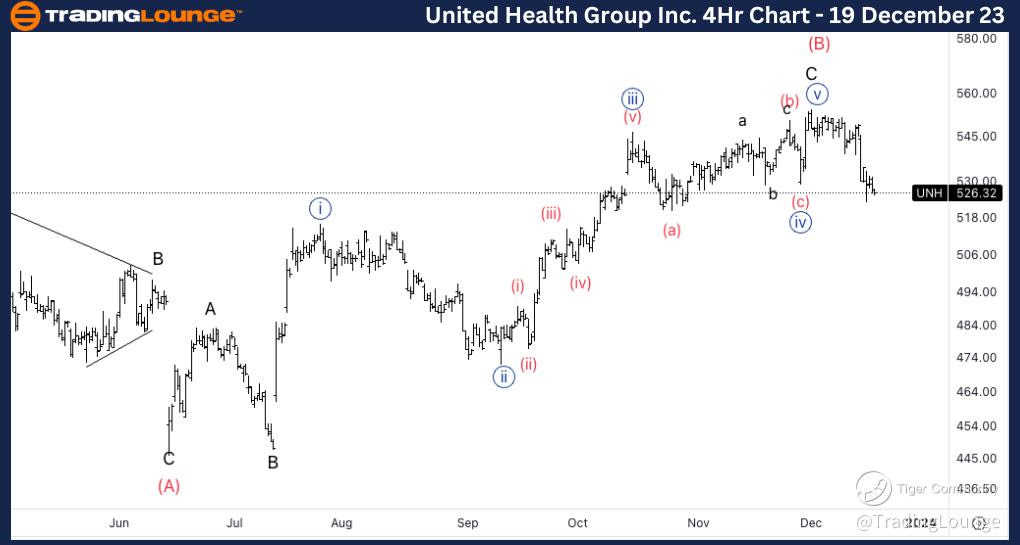

United Health Group Inc., UNH: 1-hour Chart 19 December 23

United Health Group Inc., Elliott Wave Technical Analysis

UNH Stock Market Analysis: Looking for a continuation lower into wave (v) as volume starts to weakened so we could expect a pullback higher soon.

UNH Elliott Wave count: Wave (iv) of {i}.

UNH Technical Indicators: Below all averages.

UNH Trading Strategy: Looking for shorts after a clear five wave move off the top and a failed supported retest of 520$.