Euro/British Pound (EURGBP) Elliott Wave Analysis – Trading Lounge Daily Chart

EURGBP Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 1

Direction (Next Higher Degree): Orange Wave 4

Wave Invalidation Level: 0.83572

Analysis Overview

The EURGBP Elliott Wave Analysis for the daily chart confirms a bearish trend, with strong downward momentum. The market is currently in an impulsive phase, highlighting significant selling pressure.

The wave structure indicates that Orange Wave 3 is forming within a larger Navy Blue Wave 1, reinforcing a strong downside bias.

Wave Structure Breakdown

- Orange Wave 2 (a corrective phase within Navy Blue Wave 1) has completed, leading to the emergence of Orange Wave 3.

- Orange Wave 3 is projected to continue downward, extending the bearish momentum.

- The next higher-degree wave, Orange Wave 4, suggests that after Orange Wave 3 finalizes, a corrective phase may follow.

Key Level to Watch

- Wave Invalidation Level: 0.83572

- If the price surpasses 0.83572, the bearish wave count becomes invalid, potentially signaling a trend reversal.

- Traders should monitor this level closely to confirm the strength and continuation of the downtrend.

Conclusion

- The EURGBP daily chart highlights a strong bearish trend with an impulsive market structure.

- The market remains in Orange Wave 3 within Navy Blue Wave 1, suggesting further downside potential.

- The break of Orange Wave 2 has paved the way for continued selling pressure.

- The invalid level at 0.83572 is a critical reference point for traders assessing potential trend shifts.

- Upon completion of Orange Wave 3, Orange Wave 4 is likely to bring a corrective bounce.

This Elliott Wave forecast provides a structured approach to EURGBP price action, helping traders make informed decisions.

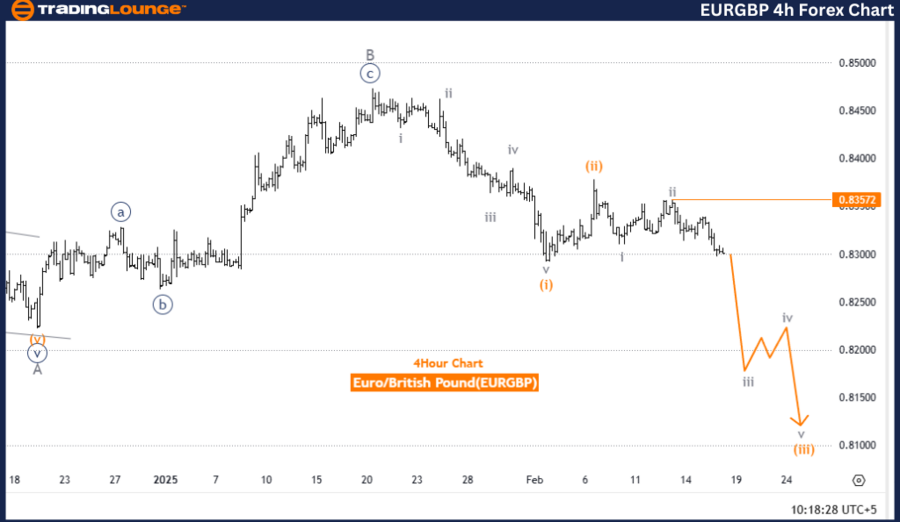

Euro/British Pound (EURGBP) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

EURGBP Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 3

Direction (Next Higher Degree): Gray Wave 3 (Developing)

Wave Invalidation Level: 0.83572

Analysis Overview

The EURGBP Elliott Wave Analysis for the 4-hour chart reaffirms the bearish trend, with strong downside movement. The market is in an impulsive phase, further emphasizing selling momentum.

The wave structure confirms that Gray Wave 3 is developing within a larger Orange Wave 3, suggesting a continuation of the bearish cycle.

Wave Structure Breakdown

- Gray Wave 2, a corrective wave within Orange Wave 3, has concluded, leading to the emergence of Gray Wave 3.

- Gray Wave 3 is expected to extend lower, pushing prices downward.

- The next higher-degree wave, Gray Wave 3, signals that selling pressure is likely to persist.

Key Level to Watch

- Wave Invalidation Level: 0.83572

- A price move above 0.83572 will invalidate the current bearish wave count, potentially altering market direction.

- Traders must closely monitor this level to confirm the strength of the downtrend.

Conclusion

- The EURGBP 4-hour chart highlights a firm bearish trend with a strong impulsive wave structure.

- The market remains in Gray Wave 3 of Orange Wave 3, reinforcing further downside potential.

- The completion of Gray Wave 2 has enabled the continuation of bearish momentum.

- The invalid level at 0.83572 serves as a crucial price marker for traders evaluating trend continuation or reversal.

- As Gray Wave 3 progresses, a deeper move lower is anticipated, strengthening the bearish outlook.

This Elliott Wave Analysis offers traders a structured framework for understanding the EURGBP market trend and future price developments.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NZDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support