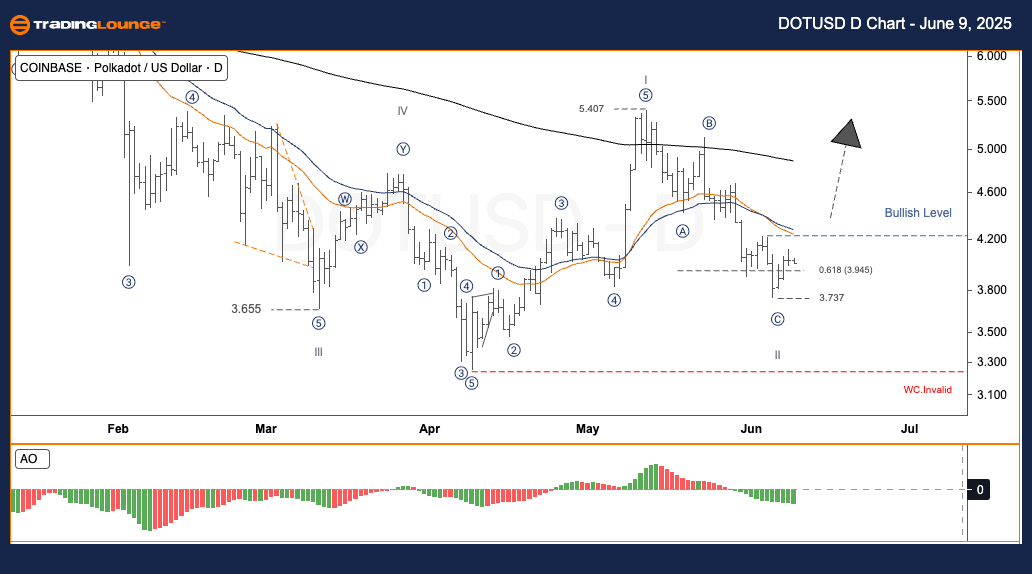

DOTUSD Elliott Wave Analysis – TradingLounge Daily Chart

Polkadot/ U.S. Dollar (DOTUSD) Daily Chart Analysis

DOTUSD Elliott Wave Technical Outlook

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave 2

Directions for Higher Degrees: Anticipating Wave 3

Invalidation Level: Critical breach under wave 2 support

Polkadot (DOTUSD) Daily Trading Strategy

DOTUSD completed its initial bullish phase (wave I) at a top of 5.407. It then corrected in a standard ABC formation during wave II. The wave C correction appears to have bottomed at 3.737, which closely aligns with the 0.618 Fibonacci retracement level calculated from wave I (3.945). This confluence suggests a likely start of wave III, often marked by strong bullish price action. A sustained move above the 4.40 resistance zone, referred to as the Bullish Confirmation Level, would confirm that wave II has ended and wave III has begun.

Trading Strategies

Strategy

✅ Swing Traders (Short-Term)

Entry: Initiate long positions upon a confirmed breakout above 4.40, confirming wave III.

Risk Management:

🟥 Stop Loss: Place below 3.30 to manage downside risk effectively.

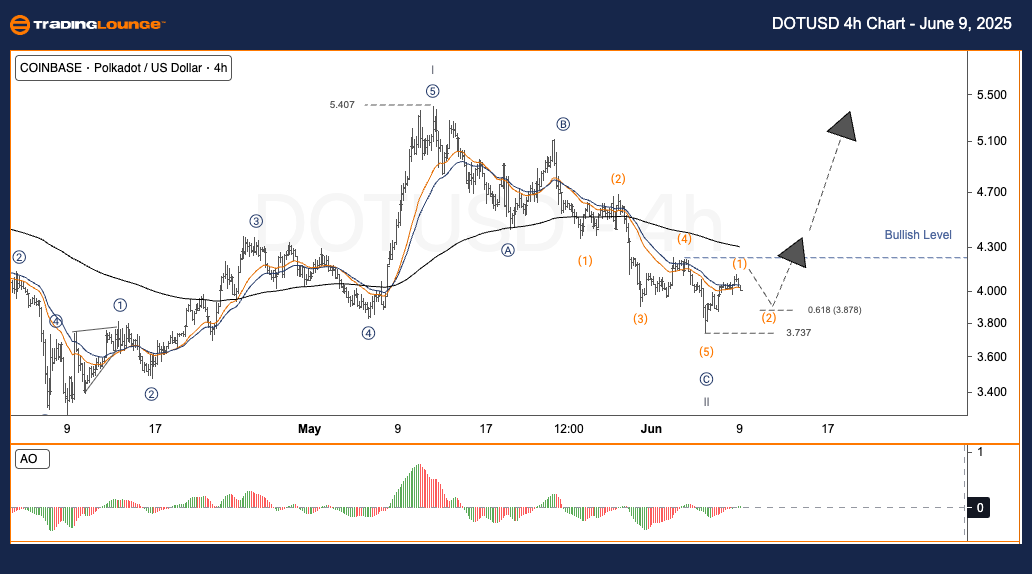

DOTUSD Elliott Wave Analysis – TradingLounge H4 Chart

Polkadot/ U.S. Dollar (DOTUSD) 4-Hour Chart Analysis

DOTUSD Elliott Wave Technical Outlook

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction for Higher Degrees: Preparing for Wave 3

Invalidation Level: Drop below wave 2 threshold

Polkadot (DOTUSD) 4-Hour Trading Strategy

DOTUSD's initial wave I surge peaked at 5.407 before reversing in a corrective ABC pattern during wave II. The final leg, wave C, likely concluded near 3.737, a level that matches the key 0.618 Fibonacci retracement of wave I at 3.945. This pattern setup suggests that the asset may now be transitioning into wave III, known for stronger price movements. A confirmed break above the 4.40 resistance mark will validate the end of wave II.

Trading Strategies

Strategy

✅ Swing Traders (Short-Term)

Entry: Only enter long trades once price action exceeds 4.40.

Risk Management:

🟥 Stop Loss: Set just below the 3.30 support level for optimal risk control.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: SEIUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support