ASX: Insurance Australia Group Limited (IAG) - TradingLounge Day Chart

Daily Technical Overview – IAG Stock Forecast Based on Elliott Wave Analysis

IAG Elliott Wave Technical Analysis

Hello Traders,

Today’s update focuses on ASX: Insurance Australia Group Limited (IAG) using Elliott Wave principles to forecast market direction.

Our latest analysis suggests ASX:IAG is approaching the final stage of wave B-grey, implying a potential downward shift. The current chart structure does not indicate a bullish reversal, meaning long trades could carry significant risk.

Technical Breakdown – Daily Chart (Semilog Scale)

Function: Major Trend (Minor degree, grey)

Wave Mode: Motive

Structure: Impulse

Position: Wave c)) - navy within Wave B - grey

Insights:

- Wave 3) - orange has finished forming a five-wave structure.

- Wave 4) - orange is unfolding as a Zigzag pattern (A-B-C in grey).

- Wave A - grey has concluded, while wave B - grey is evolving as an Expanded Flat.

- Wave c)) - navy is targeting the 8.772 price zone.

Key Invalidation Level: Wave b)) - navy must not fall below 7.100 for this count to hold.

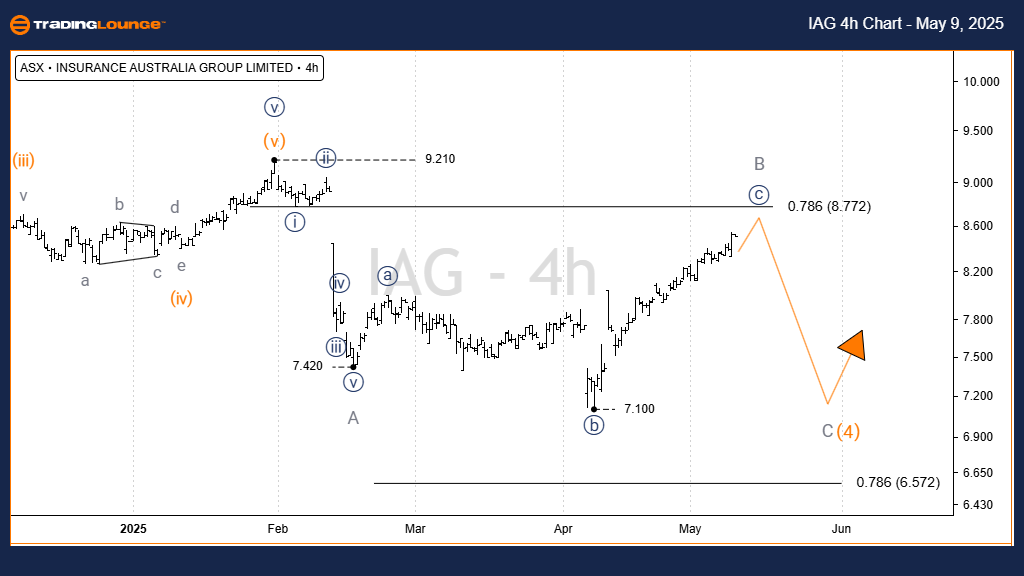

ASX: Insurance Australia Group Limited (IAG) – TradingLounge (4-Hour Chart)

ASX: Insurance Australia Group Limited – IAG Elliott Wave Technical Analysis

This 4-hour chart offers a closer examination of the IAG stock's Elliott Wave pattern, showing how wave B - grey continues forming an Expanded Flat from the 7.420 level.

Technical Breakdown – 4-Hour Chart

Function: Major Trend (Minor degree, grey)

Wave Mode: Motive

Structure: Impulse

Position: Wave c)) - navy within Wave B - grey

Insights:

- The sequence between wave a)) - navy and wave b)) - navy shows increasing complexity.

- Wave c)) - navy is gaining momentum, indicating strength versus earlier sub-waves.

- Target projection for wave c)) - navy is near 8.772, after which wave B - grey is likely to end and wave C - grey may begin its downward move.

Critical Invalidation Level: 7.100 remains a key threshold.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis for ASX: Insurance Australia Group Limited (IAG) provides both short-term insights and broader market perspective. By identifying significant wave positions and critical price levels, this forecast enhances traders' understanding of IAG’s market behavior using Elliott Wave theory. Always consider these points in line with market context and risk management.