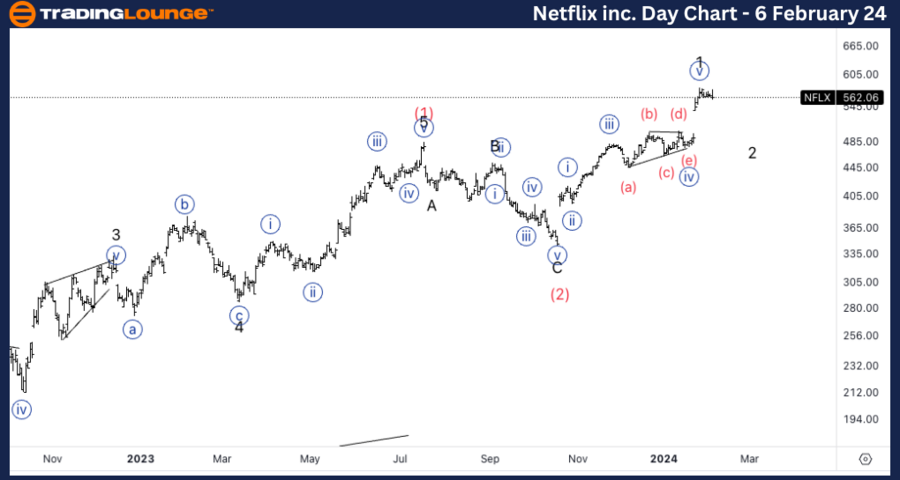

NFLX Elliott Wave Analysis Trading Lounge Daily Chart, 6 February 24

Netflix Inc., (NFLX) Daily Chart

NFLX Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Minor wave 1 of (3).

DIRECTION: Top in wave 1.

DETAILS: Considering the possibility of a top in Minor wave 1 as we can identify a clear five wave move. There is a possibility we are already in Minor wave 3 and wave 1 top stands where current wave (b) of {iv} is.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Exxon Mobil Corp.

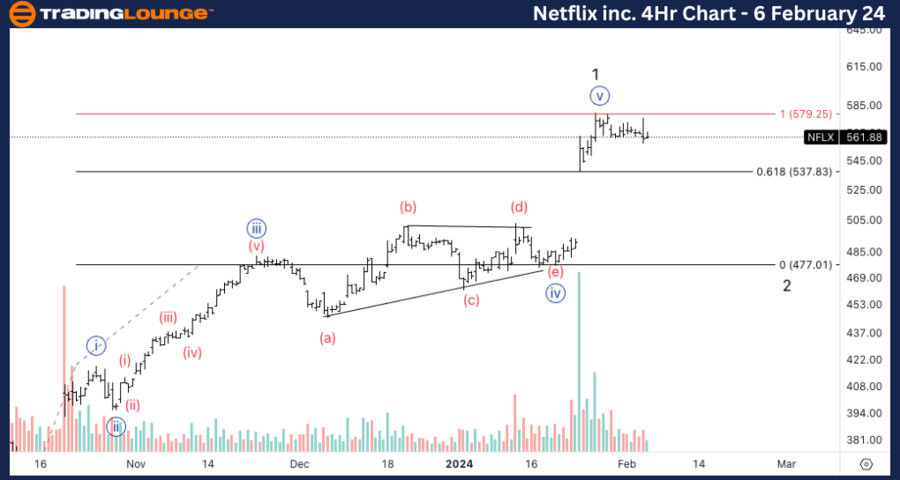

NFLX Elliott Wave Analysis Trading Lounge 4Hr Chart, 6 February 24

Netflix Inc., (NFLX) 4Hr Chart

NFLX Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Zigzag

POSITION: Wave {a} of 2.

DIRECTION: Acceleration lower into wave {a}.

DETAILS: As volume is starting to slowly increase during the last session, it appears that the move down is starting to be support by volume, suggesting bears are stepping into the market. In addition awe have reached wave {v} common target of equality with its wave {i}.

Welcome to our NFLX Elliott Wave Analysis Trading Lounge, your hub for insightful analysis of Netflix Inc. (NFLX) through Elliott Wave Technical Analysis. As of the Daily Chart on 6th February 24, we dissect significant trends in the market.

*NFLX Elliott Wave Technical Analysis – Daily Chart*

In terms of wave dynamics, we identify a dominant impulse function with a motive structure. The current position is in Minor wave 1 of (3), indicating a potential top in wave 1. We closely monitor the possibility of a top in Minor wave 1, particularly as we discern a clear five-wave move. There's also a consideration that we might already be in Minor wave 3, with the wave 1 top potentially coinciding with the current wave (b) of {iv}.

*NFLX Elliott Wave Technical Analysis – Daily Chart*

Here, the wave function adopts a counter trend approach with a corrective mode, reflecting a zigzag structure. The present position is in Wave {a} of 2, indicating an acceleration lower into wave {a}. Notably, there's a gradual increase in volume during the recent sessions, suggesting bearish momentum entering the market. Additionally, we've reached the common target of equality between wave {v} and its wave {i}.