XOM Elliott Wave Analysis Trading Lounge Daily Chart, 5 February 24

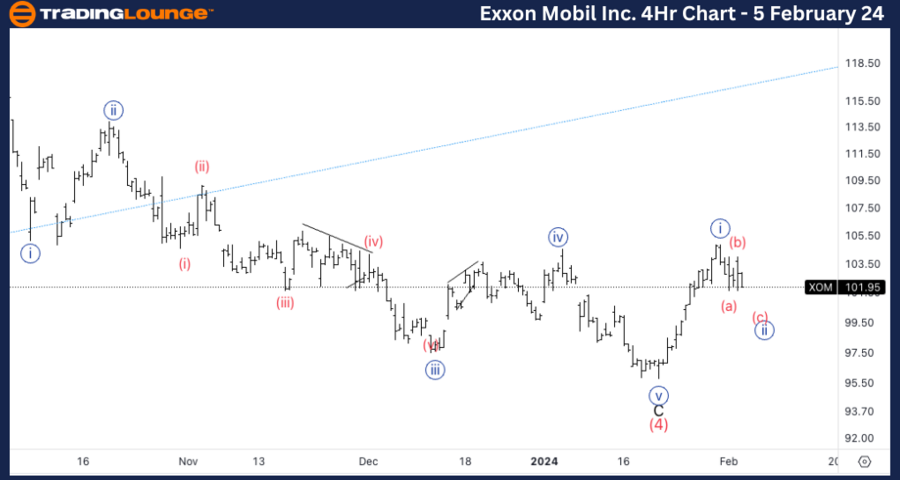

Exxon Mobil Corp., (XOM) Daily Chart

XOM Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Minute wave {ii} of 1.

DIRECTION: Bottom in wave {ii}.

DETAILS: Looking for a clear five wave move into Minor wave 1. We are finding support on top of TL 100$, which gives us additional confidence to look for further upside.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Costco Wholesale Corp. (COST)

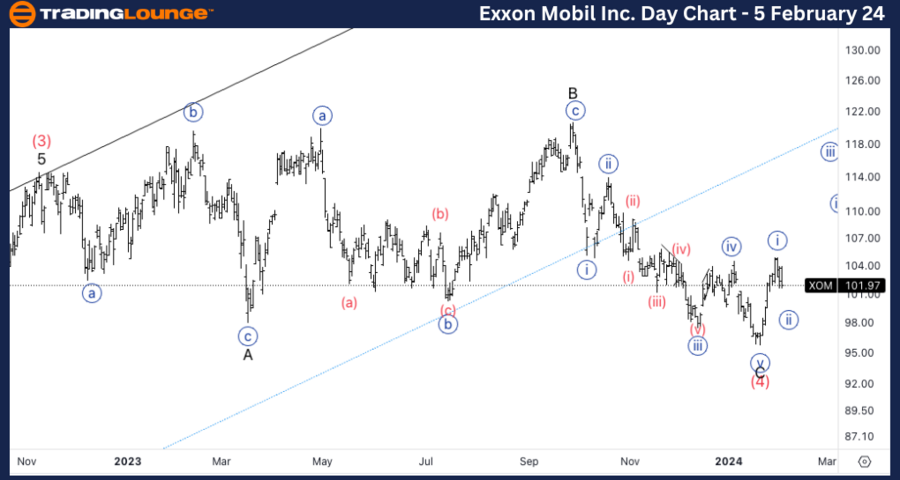

XOM Elliott Wave Analysis Trading Lounge 4Hr Chart, 5 February 24

Exxon Mobil Corp., (XOM) 4Hr Chart

XOM Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Zigzag

POSITION: Wave (c) of {ii}.

DIRECTION: Bottoming in wave (c).

DETAILS: Looking for further downside into wave (c) to complete Minute wave {ii}. Looking to find support on top of 100$ as long as we have a clear three wave move in wave {ii}.

Welcome to our XOM Elliott Wave Analysis Trading Lounge, where we navigate the waves of Exxon Mobil Corp. (XOM) through insightful Elliott Wave Technical Analysis. As of the Daily Chart on 5th February 2024, we uncover significant trends in the market.

*XOM Elliott Wave Technical Analysis – Daily Chart*

In terms of wave dynamics, we identify a prevailing impulse function with a motive structure. The present position is in Minute wave {ii} of 1, signaling a bottom in wave C. Our focus is on a clear five-wave move into Minor wave 1. The reinforcement of support on top the trendline at $100 boosts our confidence in anticipating further upside movements.

*XOM Elliott Wave Technical Analysis – Daily Chart*

Here, the wave function adopts a counter trend approach with a corrective mode, manifesting a zigzag structure. The current position is in Wave (c) of {ii}, indicating a bottoming in wave (c). Our attention is on the projected downside into wave (c) to complete Minute wave {ii}. We are actively monitoring for support, particularly above $100, ensuring clarity in the three-wave move within wave {ii}.