ASX: Amcor PLC – AMC Elliott Wave Analysis | TradingLounge (1D Chart)

Welcome to today's Elliott Wave analysis for the Australian Stock Exchange (ASX), focusing on AMCOR PLC – AMC. Our analysis identifies AMC progressing higher within wave (iii)-orange of wave ((iii))-navy.

ASX: AMCOR PLC – AMC 1D Chart (Semilog Scale) Analysis

AMC Elliott Wave Technical Analysis

Function: Major trend (Intermediate degree)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((iii))-navy of Wave 3-grey of Wave (3)-orange

Details: After AMC reached a low of 15.53, wave ((iii))-navy began unfolding, signaling an upward push toward targets as high as 20.00. The structure has already subdivided into waves (i) and (ii)-orange, both of which are complete. Now, wave (iii)-orange is underway, driving the price higher.

Invalidation point: 15.95

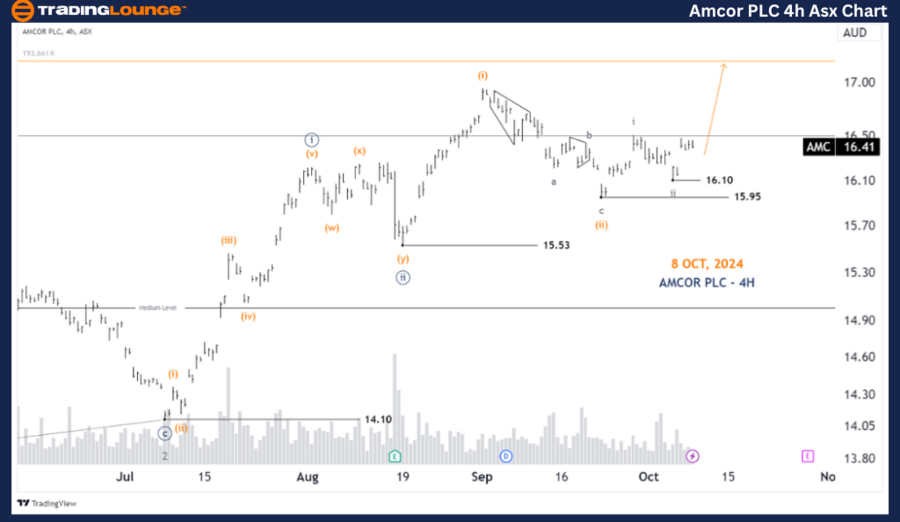

ASX: AMCOR PLC – AMC 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave iii-grey of Wave (iii)-orange of Wave ((iii))-navy

Details: Wave (ii)-orange concluded at 15.95, marked as a Zigzag pattern (a,b,c-grey). Currently, wave (iii)-orange appears to be developing, with targets ranging between 18.00 and 20.00. The price has likely completed waves i-grey and ii-grey, and wave iii-grey is now unfolding to push prices higher.

Invalidation point: 16.10

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Aristocrat Leisure Limited - ALL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our Elliott Wave analysis of ASX: AMCOR PLC – AMC provides a detailed forecast of current market trends. We outline key price levels that validate or invalidate our wave count, enabling traders to confidently navigate potential market moves. With these insights, we aim to empower traders to capitalize on AMC's ongoing trends effectively, offering a professional, objective view of the market.