Elliott Wave Analysis for TLS on the Australian Stock Exchange (ASX)

Our latest Elliott Wave analysis examines TELSTRA GROUP LIMITED (TLS.ASX), highlighting potential opportunities in the current market structure. We observe that wave (2)-orange may have concluded, positioning TLS.ASX for a significant long-term upward trend with wave (3)-orange now likely unfolding.

ASX: TELSTRA GROUP LIMITED (TLS) - 1D Chart (Semilog Scale) Analysis

ASX: TELSTRA GROUP LIMITED (TLS) - Elliott Wave Technical Analysis

Key Aspects:

Trend Level: Major (Intermediate degree, orange)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave (3)-orange of Wave ((3))-navy

Details:

Evidence suggests that wave (2)-orange may have concluded, with wave (3)-orange emerging. A strong price movement upward, followed by support at $4.00, aligns with a bullish market outlook targeting higher levels, such as $5.00.

- Invalidation Point: $3.39

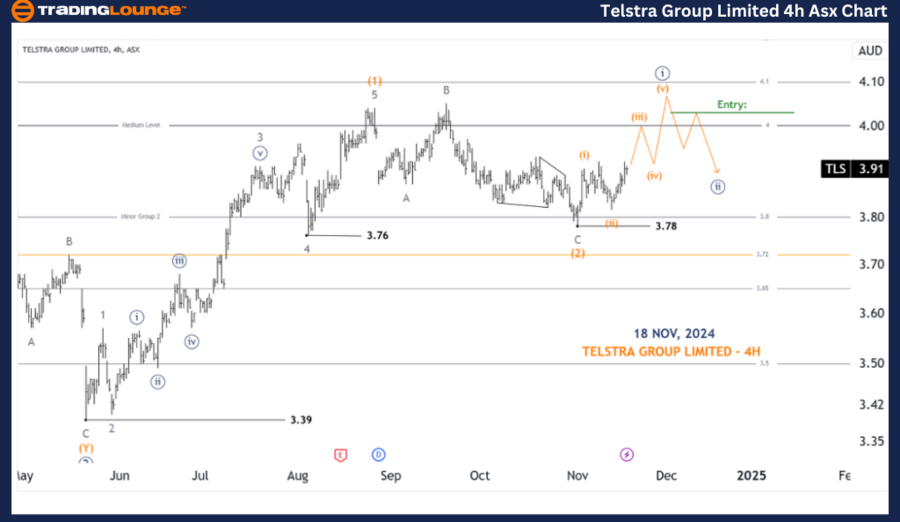

ASX: TELSTRA GROUP LIMITED (TLS) - 4-Hour Chart Analysis

Key Aspects:

Trend Level: Major (Minuette degree, navy)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave (iii)-orange of Wave ((i))-navy

Details:

Following the low at $3.78, wave (2)-orange appears to have concluded. Wave (3)-orange is advancing, with its wave ((i))-navy nearing completion. As wave ((i))-navy progresses from wave (i)-orange to wave (v)-orange, wave ((ii))-navy will likely initiate a corrective push lower before wave ((iii))-navy propels higher.

- Trading Opportunity: A long trade setup will become attractive when $4.00 is confirmed as strong support.

- Invalidation Point: $3.78

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Westpac Banking Corporation (WBC) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion: Navigating the Current Market Trends

This Elliott Wave analysis provides insights into the broader market structure and immediate opportunities for ASX: TELSTRA GROUP LIMITED (TLS). By identifying critical price points for validation and invalidation, traders can make informed decisions with increased confidence. As wave structures evolve, specific entry and exit levels will further clarify high-quality trading opportunities aligned with a bullish outlook.