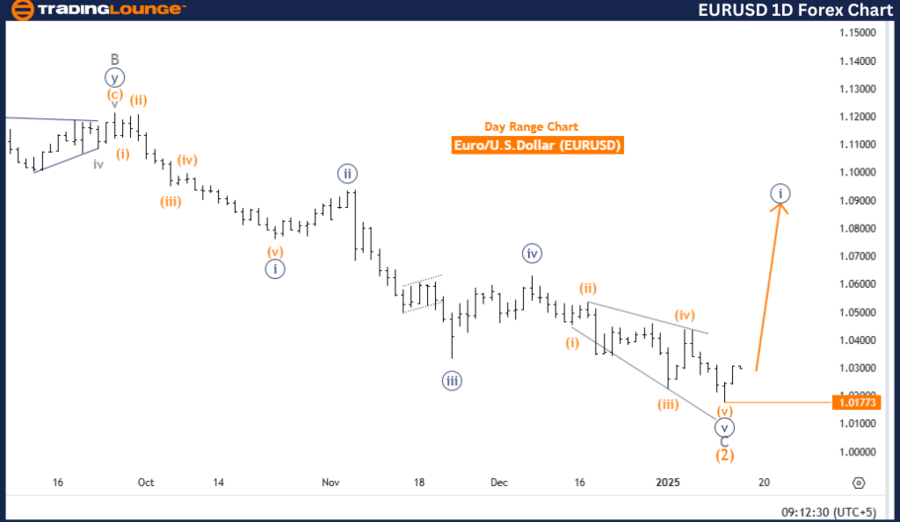

Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis - Trading Lounge Day Chart

EURUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Direction (Next Lower Degrees): Navy Blue Wave 2

Details: Navy blue wave 1 of gray wave 1 marks the start of a new bullish trend.

Wave Cancel Invalidation Level: 1.01773

The EURUSD daily chart demonstrates a bullish trend as per Elliott Wave Analysis. The market is currently in an impulsive phase, represented by navy blue wave 1, which is part of the broader gray wave 1 structure. This suggests the early stages of a new upward trend, driven by growing bullish sentiment.

Navy blue wave 1 is actively unfolding within gray wave 1, laying the foundation for subsequent upward price movements. Following the completion of navy blue wave 1, the market is expected to transition into navy blue wave 2, which will likely act as a corrective pullback within the overall bullish trend.

The invalidation level for this wave scenario is set at 1.01773. If the price moves below this point, the current Elliott Wave structure will be invalidated, prompting a reassessment of the technical outlook. This level serves as a critical reference for validating the trend and monitoring its development.

Summary

- Bullish Trend: EURUSD is in the early phase of a bullish cycle.

- Current Phase: Navy blue wave 1 of gray wave 1 is actively progressing, signaling the start of the new trend.

- Impulsive Structure: The formation of navy blue wave 1 establishes the basis for further bullish movement.

- Next Step: After the completion of navy blue wave 1, navy blue wave 2 will act as a corrective pullback.

- Invalidation Level: The 1.01773 level is crucial for confirming wave progression and structural integrity.

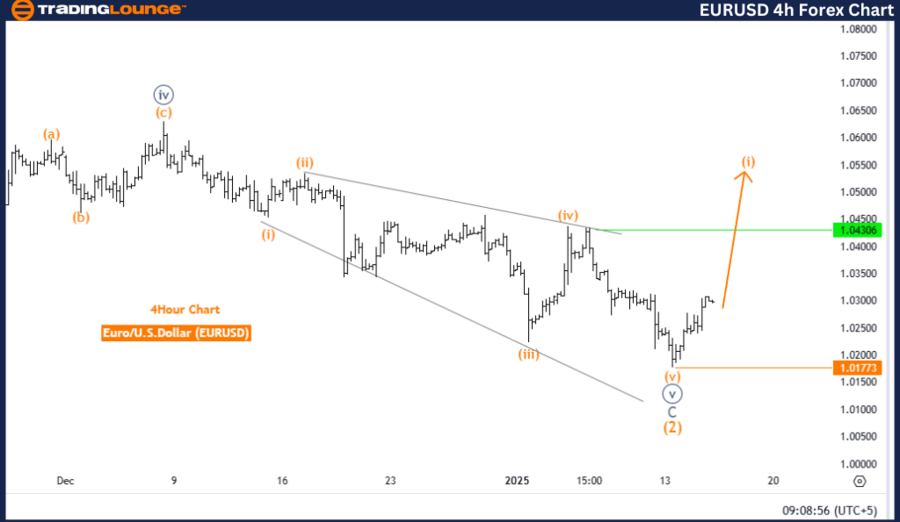

Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis - Trading Lounge 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 1

Direction (Next Lower Degrees): Orange Wave 2

Details: Orange wave 1 of navy blue wave 1 highlights the initiation of a new upward trend.

Wave Cancel Invalidation Level: 1.01773

On the 4-hour chart, the EURUSD is also exhibiting a bullish trend as per Elliott Wave Analysis. The market is in an impulsive phase, signified by orange wave 1, which is part of the larger navy blue wave 1 structure. This phase underscores the start of a new bullish cycle, reinforcing upward momentum.

Orange wave 1 is developing as the initial wave within navy blue wave 1, forming the foundation for future bullish movements. After orange wave 1 concludes, the next phase is projected to be orange wave 2, which will act as a short-term corrective pullback before the continuation of the bullish trend with orange wave 3.

The invalidation level is again set at 1.01773. A price drop below this threshold would invalidate the current wave scenario and necessitate a reevaluation of the market outlook. This benchmark plays a pivotal role in verifying the wave structure and ensuring alignment with Elliott Wave principles.

Summary

- Bullish Trend: EURUSD is in the early stages of a bullish trend.

- Current Phase: Orange wave 1 of navy blue wave 1 is actively forming, marking the start of a new bullish cycle.

- Impulsive Structure: The impulsive nature of orange wave 1 sets the foundation for the continuation of the trend.

- Next Step: Following the completion of orange wave 1, orange wave 2 is expected to serve as a corrective pullback before further bullish momentum.

- Invalidation Level: The 1.01773 level is key for monitoring wave progression and maintaining technical accuracy.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NZDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support