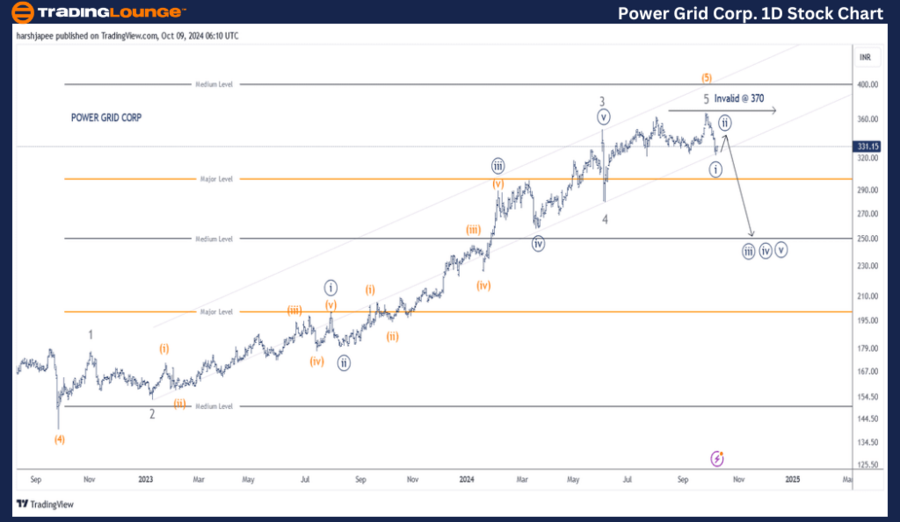

Power Grid Corp Elliott Wave Analysis | TradingLounge (1D Chart)

POWERGRIDCORP Elliott Wave Technical Analysis

Function: Counter Trend (Minute Degree, Navy)

Mode: Corrective

Structure: Potential impulse within a larger degree correction

Position: Minute Wave ((i))

Details: The structure has been updated as the price action confirms a drop below 320. Intermediate Wave (5) Orange could be complete around the 370 level as prices turn lower, likely ending Minute Wave ((i)) around 320. If this count is accurate, we can expect a rally for Minute Wave ((ii)) before bears regain control.

Invalidation Point: 370

Power Grid Corp Chart Technical Analysis and Potential Elliott Wave Counts:

Power Grid Corp’s daily chart suggests a potential structural shift over recent trading sessions, with the stock dropping below the 320 level. A possible top may have formed around 370, short of the Fibonacci projection, completing Intermediate Wave (5) Orange.

Since September 2022, the stock has been rallying after bottoming out around 140, marking the end of Intermediate Wave (4) Orange. Minor Wave 3 of Intermediate Wave (5) extended and completed around the 350 level, while Wave 4 sharply corrected below 280 on June 4, 2024.

The rally toward 370 could represent the termination of Minor Wave 5 Grey within Intermediate Wave (5) Orange, as subsequent price action breaks below the 320 support. Alternatively, the recent low could signal an expanded flat Minute Wave ((iv)) with potential for another push higher to complete the structure. This alternative count will be reassessed later.

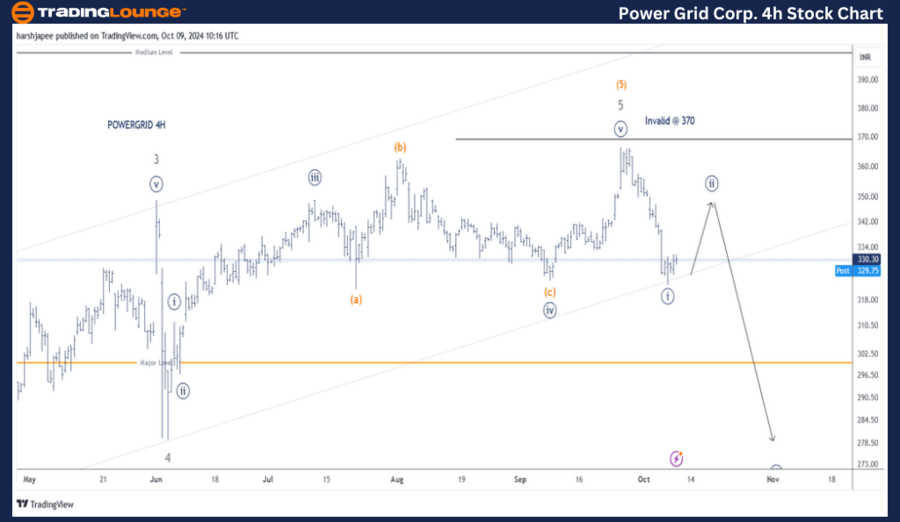

Power Grid Corp Elliott Wave Analysis | TradingLounge (4H Chart)

POWERGRIDCORP Elliott Wave Technical Analysis

Function: Counter Trend (Minute Degree, Navy)

Mode: Corrective

Structure: Potential impulse within a larger degree correction

Position: Minute Wave ((i))

Details: The proposed structure has been revised as price action confirms a decline through the 320 level. Intermediate Wave (5) Orange could now be complete near 370, with prices moving lower to end Minute Wave ((i)) around 320. If correct, expect a rally to carve out Minute Wave ((ii)) before the bears take charge again.

Invalidation Point: 370

Power Grid Corp 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4H chart of Power Grid Corp indicates a potential subdivision of Minor Wave 5 Grey. Minute Wave ((iv)) is marked as a running flat, with the internal subdivisions of Minute Wave ((v)) being unclear. However, this count suggests prices have broken below the 320 level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Hero MotoCorp Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Power Grid Corp may have topped around 370, with the bears pushing Minute Wave ((i)) below 320. A minor rally could occur to complete Minute Wave ((ii)) before the trend likely turns lower again.