Avery Dennison Corp. (AVY) Elliott Wave Analysis: Daily and 1-Hour Charts

This Elliott Wave analysis of Avery Dennison Corp. (AVY) reviews both the daily and 1-hour charts to provide insight into current market trends and potential future price movements. The analysis leverages Elliott Wave Theory to forecast AVY's next potential moves.

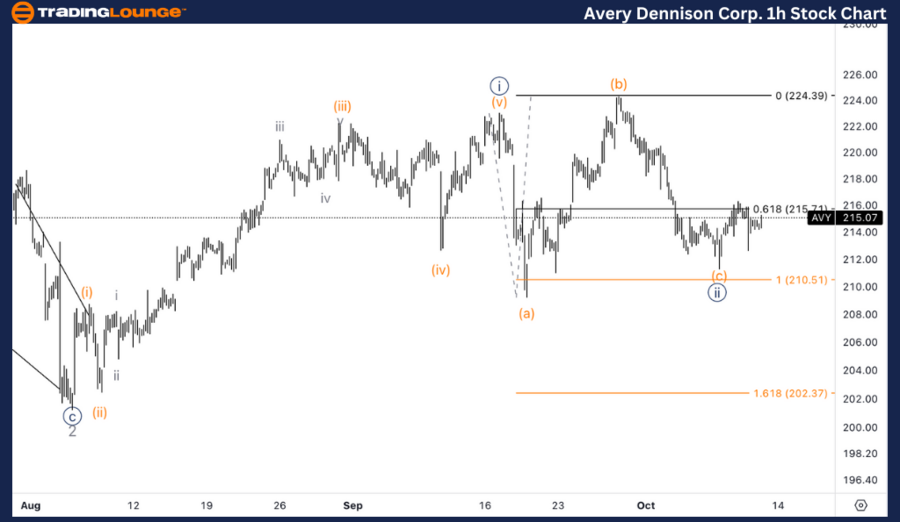

AVY Elliott Wave Analysis - TradingLounge Daily Chart

Avery Dennison Corp. (AVY) Daily Chart Overview

AVY Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3

Direction: Upside in Wave 3

Details: A bottom in Minor wave 2 appears to be in place around the $200 mark. The structure suggests another {i}-{ii} of wave 3 has completed, signaling a potential upward movement is ready to unfold.

AVY Elliott Wave Analysis – Daily Chart Breakdown

On the daily chart, Avery Dennison (AVY) seems to have completed Minor wave 2 at around $200. With the initial {i}-{ii} of wave 3 already formed, the stock looks set for a significant upward move. Wave 3 is often the strongest in an impulsive wave structure, indicating a potential rally in AVY’s price in the near term. This upward trajectory suggests a bullish outlook for the stock, driven by wave 3's impulsive behavior.

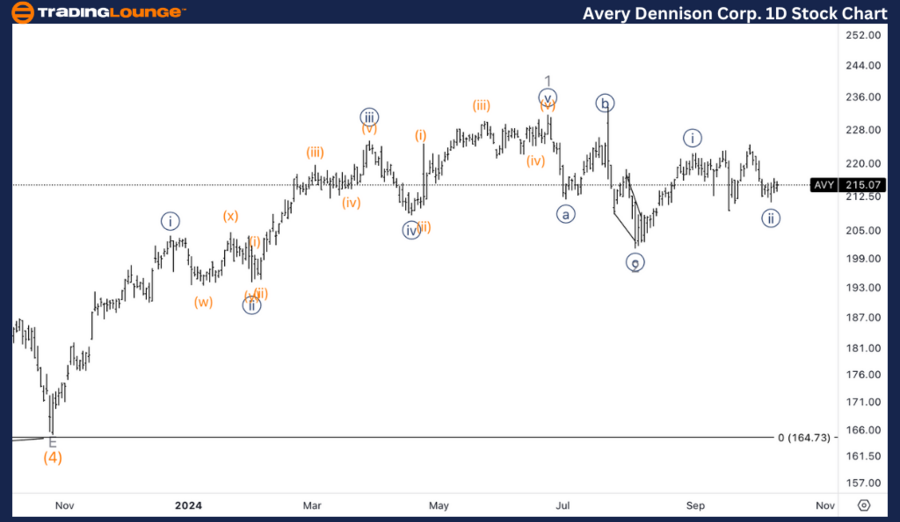

AVY Elliott Wave Analysis - TradingLounge 1-Hour Chart

Avery Dennison Corp. (AVY) 1-Hour Chart Overview

AVY Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {ii}

Direction: Bottom in Wave {ii}

Details: The stock has likely completed wave {ii}, reaching the equality of (c) vs. (a). Now, the focus shifts to wave {iii}, and the stock needs to find support above $220 to confirm the bullish momentum.

AVY Elliott Wave Analysis – 1-Hour Chart Breakdown

On the 1-hour chart, Avery Dennison (AVY) shows signs of completing wave {ii}, having reached the equality of (c) vs. (a). For the stock to continue its upward move into wave {iii}, it must hold support above $220. Maintaining this support level will likely confirm the bullish outlook, paving the way for a potential strong upward movement in wave {iii}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Boeing Company (BA) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support