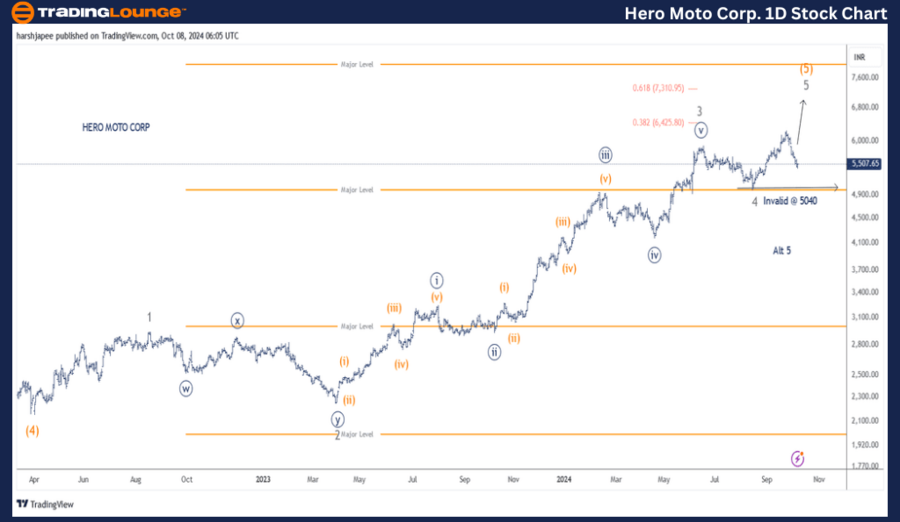

TradingLounge Hero MotoCorp Stock Analysis – HERO 1D Chart

Hero MotoCorp 1Day Technical Chart Analysis

HERO Elliott Wave Technical Analysis

Trend: Uptrend in a Larger Degree (Intermediate Degree in Orange)

Wave Mode: Motive

Wave Structure: Impulse

Current Wave Position: Minor Wave 5 (Grey)

Details: Minor Wave 5 is pushing higher, with key support at the 5040 level. Alternatively, Wave 5 might have concluded just below the 6400 level.

Invalidation Level: 5040

Hero MotoCorp Daily Chart: Elliott Wave Analysis and Key Levels

The daily chart of Hero MotoCorp suggests that Minor Wave 5 (Grey) is likely advancing toward the 7310 level. However, there's a possibility it could have finished below the 6400 level. Critical support for this analysis lies at 5040, where Minor Wave 4 (Grey) ended, acting as confirmation of a potential peak.

Since the lows of March 2022 around the 2150 mark (Intermediate Wave (4) in Orange), Hero MotoCorp has rallied in a five-wave pattern (Minor Waves 1 through 5), reaching the 6360 high. This could indicate the completion or ongoing development of Intermediate Wave (5) in Orange.

Additionally, Minor Wave 3 (Grey) extended during Minute Wave ((iii)) between the 2245 and 5921 levels. Afterward, Minor Wave 4 retraced to the 5040 level, and the bulls have since driven the stock higher, potentially completing Minor Wave 5 as part of Intermediate Wave (5) in Orange.

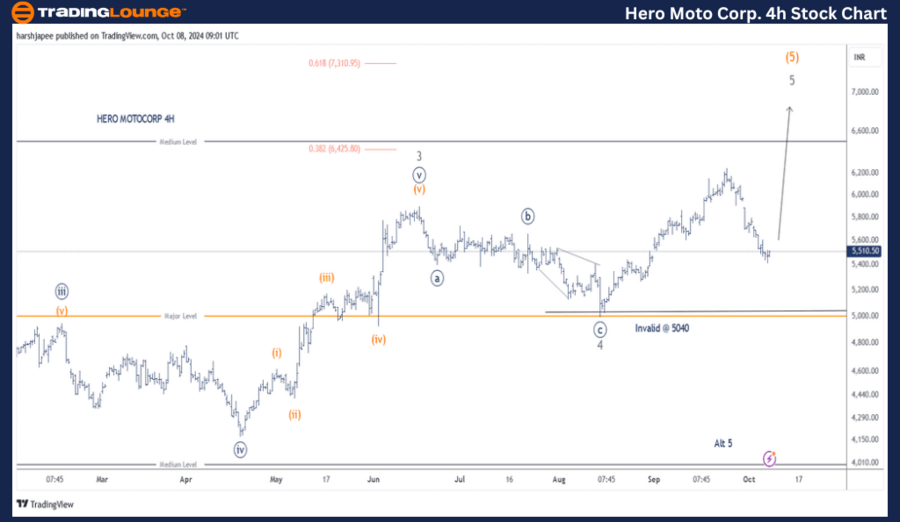

HERO MOTOCORP – HERO (4H Chart) Elliott Wave / Technical Analysis

Trend: Uptrend in a Larger Degree (Intermediate Degree in Orange)

Wave Mode: Motive

Wave Structure: Impulse

Current Wave Position: Minor Wave 5 (Grey)

Details: Minor Wave 5 is progressing, with support at the 5040 level. Alternatively, Wave 5 might have finished below 6400, as the move from 5040 to 6360 subdivides into five waves.

Invalidation Level: 5040

Hero MotoCorp 4H Chart: Elliott Wave Analysis and Internal Waves

The 4-hour chart for Hero MotoCorp highlights the internal wave structure within Minute Wave ((v)) of Minor Wave 3 and beyond. Minor Wave 4 unfolded as an ((a))-((b))-((c)) corrective wave, with Wave ((b)) forming a triangle and Wave ((c)) ending near the 5040 level as a diagonal.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BPCL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Hero MotoCorp is either continuing Minor Wave 5 of Intermediate Wave (5) in Orange, targeting 7310, or has already completed Wave 5 around the 6360 level.