Ethereum / U.S. Dollar (ETHUSD) Elliott Wave Analysis | TradingLounge Daily Chart

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next Higher Degrees: Not specified

Wave Cancel Invalid Level: Not specified

ETHUSD Daily Trading Strategy

Ethereum (ETHUSD) has finalized its Wave II correction, rebounding from a significant support level. A bullish trend initiation marks the early stage of a new upward Wave (1) sequence. At present, ETHUSD is undergoing a minor Wave (2) pullback, creating potential for a Wave 3 breakout that could surpass the $2,873 resistance mark.

Recommended Trading Strategy

For Short-Term Traders (Swing Trade):

✅ Identify long positions as ETHUSD stabilizes during the Wave (2) retracement.

🟥 Risk Management: Set stop-loss orders slightly below $2,116 to manage downside risk.

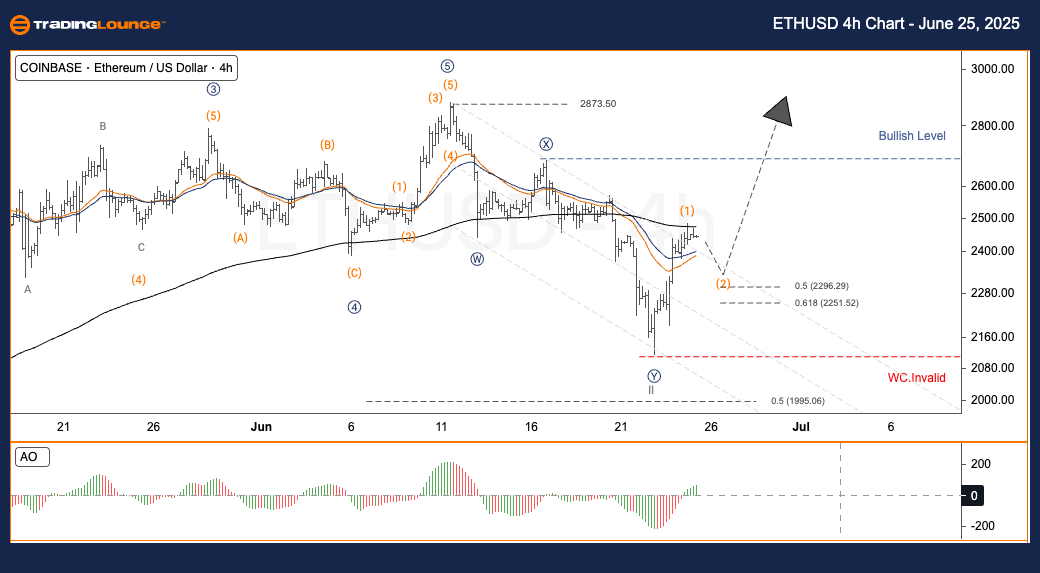

Ethereum / U.S. Dollar (ETHUSD) Elliott Wave Analysis | TradingLounge H4 Chart

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next Higher Degrees: Not specified

Wave Cancel Invalid Level: Not specified

ETHUSD H4 Trading Strategy

Ethereum (ETHUSD) completed Wave II near a crucial support zone and is currently exhibiting bullish momentum, signaling the onset of Wave (1). Presently, ETHUSD is experiencing a brief Wave (2) correction, preparing for a Wave 3 extension that may aim beyond the $2,873 resistance level.

Recommended Trading Strategy

For Short-Term Traders (Swing Trade):

✅ Monitor price action for buy signals during the ongoing Wave (2) setup.

🟥 Risk Management: Use stop-loss placements beneath the $2,116 level to protect trades.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: THETAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support